Nvidia Corp on Monday unveiled its latest family of chips for powering artificial intelligence (AI) as it seeks to consolidate its position as the major supplier to an AI frenzy.

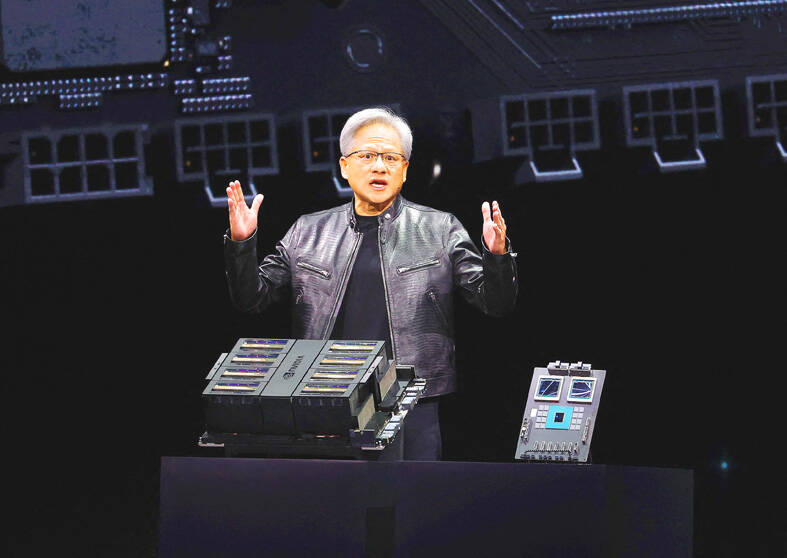

“We need bigger GPUs. So ladies and gentlemen, I would like to introduce you to a very, very big GPU,” Nvidia chief executive officer Jensen Huang (黃仁勳) said at a developers’ conference in California, referring to the graphics processors that are vital in the creation of generative AI.

The event, dubbed the “AI Woodstock” by Wedbush Securities Inc analyst Dan Ives, has become a cannot-miss date on big tech’s calendar due to Nvidia’s singular role in the AI revolution that has taken the world by storm since the introduction of ChatGPT in late 2022.

Photo: AFP

“I hope you realize this is not a concert, this is a developers’ conference,” Huang joked as he took the stage in a packed arena usually reserved for ice hockey games and concerts.

Nvidia’s powerful GPU chips and software are an integral ingredient in the creation of generative AI, with rivals like Advanced Micro Devices Inc (AMD) or Intel Corp still struggling to match the power and efficiency of the company’s blockbuster H100 product, launched in 2022.

Not letting up, Nvidia told the audience of developers and tech executives it was releasing an even more powerful processor and accompanying software, on a platform called Blackwell — named after David Blackwell, the first black academic inducted into the US National Academy of Science.

Blackwell GPUs were AI “superchips” four times as fast as the previous generation when training AI models, Nvidia said.

“The rate at which computing is advancing is insane,” Huang said.

They would also deliver 25 times the energy efficiency, Nvidia said, a key claim when the creation of AI is criticized for its ravenous needs for energy and natural resources compared with more conventional computing.

Unlike its rivals Intel, Micron Technology Inc and Texas Instruments Inc, Nvidia, like AMD, does not manufacture its own chips, but uses subcontractors, mainly Taiwan Semiconductor Manufacturing Co (台積電).

Given the geopolitical concerns with Taiwan and China, this could be a potential weak spot. The US has banned Nvidia from sending its most powerful chips to Chinese firms.

Nvidia announced other AI developments on Monday, including a platform for training humanoid robots named Project Gr00t.

Gr00t-powered robots would be designed to understand what people say and mimic their movements, learning from experience how to interact with the world, it said.

Nvidia said it was also working with Apple Inc to put AI capabilities into the newly released Vision Pro spatial computing gear.

The company also unveiled the Earth-2 cloud platform for predicting climate change, using simulation by AI supercomputers.

In addition, Nvidia announced a major expansion of its collaboration with BYD Co (比亞迪) and other Chinese electric vehicle makers.

BYD is the latest Chinese vehicle manufacturer to use Nvidia’s DRIVE Thor, an all-in-one vehicle control system that is bolstered by powerful generative AI features.

“DRIVE Thor is poised to revolutionize the automotive landscape, ushering in an era where generative AI defines the driving experience,” Nvidia said.

Thor is expected to roll out for production vehicles as early as next year, it said.

SEEKING CLARITY: Washington should not adopt measures that create uncertainties for ‘existing semiconductor investments,’ TSMC said referring to its US$165 billion in the US Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) told the US that any future tariffs on Taiwanese semiconductors could reduce demand for chips and derail its pledge to increase its investment in Arizona. “New import restrictions could jeopardize current US leadership in the competitive technology industry and create uncertainties for many committed semiconductor capital projects in the US, including TSMC Arizona’s significant investment plan in Phoenix,” the chipmaker wrote in a letter to the US Department of Commerce. TSMC issued the warning in response to a solicitation for comments by the department on a possible tariff on semiconductor imports by US President Donald Trump’s

The government has launched a three-pronged strategy to attract local and international talent, aiming to position Taiwan as a new global hub following Nvidia Corp’s announcement that it has chosen Taipei as the site of its Taiwan headquarters. Nvidia cofounder and CEO Jensen Huang (黃仁勳) on Monday last week announced during his keynote speech at the Computex trade show in Taipei that the Nvidia Constellation, the company’s planned Taiwan headquarters, would be located in the Beitou-Shilin Technology Park (北投士林科技園區) in Taipei. Huang’s decision to establish a base in Taiwan is “primarily due to Taiwan’s talent pool and its strength in the semiconductor

Industrial production expanded 22.31 percent annually last month to 107.51, as increases in demand for high-performance computing (HPC) and artificial intelligence (AI) applications drove demand for locally-made chips and components. The manufacturing production index climbed 23.68 percent year-on-year to 108.37, marking the 14th consecutive month of increase, the Ministry of Economic Affairs said. In the first four months of this year, industrial and manufacturing production indices expanded 14.31 percent and 15.22 percent year-on-year, ministry data showed. The growth momentum is to extend into this month, with the manufacturing production index expected to rise between 11 percent and 15.1 percent annually, Department of Statistics

An earnings report from semiconductor giant and artificial intelligence (AI) bellwether Nvidia Corp takes center stage for Wall Street this week, as stocks hit a speed bump of worries over US federal deficits driving up Treasury yields. US equities pulled back last week after a torrid rally, as investors turned their attention to tax and spending legislation poised to swell the US government’s US$36 trillion in debt. Long-dated US Treasury yields rose amid the fiscal worries, with the 30-year yield topping 5 percent and hitting its highest level since late 2023. Stocks were dealt another blow on Friday when US President Donald