They are wriggly, they are gross and they are worth more than US$2,000 a pound. Soon, fishers might be able to catch thousands of pounds of them for years to come.

Baby eels, also called elvers, are likely the most valuable fish in the US on a per-pound basis — worth orders of magnitude more money at the docks than lobsters, scallops or salmon. That is because they are vitally important to the worldwide supply chain for Japanese food.

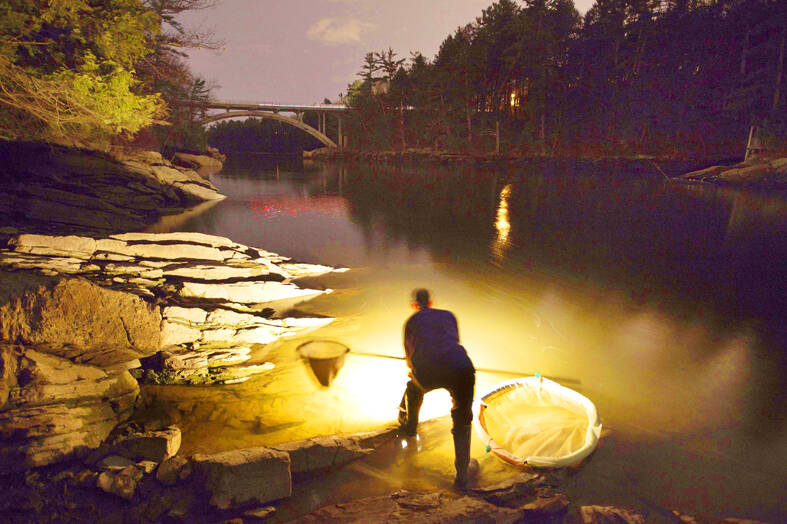

The tiny fish, which weigh only a few grams, are harvested by fishers using nets in rivers and streams. The only state in the country with a significant elver catch is Maine, where fishers have voiced concerns in the past few months about the possibility of a cut to the fishery’s strict quota system.

Photo: AP

An interstate regulatory board that controls the fishery has released a plan to potentially keep the elver quota at its current level of a little less than 10,000 pounds (4,536kg) a year with no sunset date.

Fishers who have spent years touting the sustainability of the fishery are pulling for approval, Maine Elver Fishermen Association director Darrell Young said.

“Just let ‘er go and let us fish,” Young said. “They should do that because we’ve done everything they’ve asked, above and beyond.”

Photo: AP

A board of the Atlantic States Marine Fisheries Commission is scheduled to vote on a new quota system for the eel fishery on May 1. The board could also extend the current quota for three years.

The eels are sold as seed stock to Asian aquaculture companies that raise them to maturity so they can be used as food, such as kabayaki, a dish of marinated, grilled eel. Some of the fish eventually return to the US where they are sold at sushi restaurants.

The eels were worth US$2,009 a pound last year — more than 400 times more than lobster, Maine’s signature seafood. The state has had an elver fishery for decades, but its eels became more valuable in the early 2010s, in part, because foreign sources dried up.

The International Union for Conservation of Nature lists the European eel as more critically endangered than the US eel, although some environmental groups have pushed for greater conservation in the US.

Since booming in value, elvers have become the second-most valuable fish species in Maine in terms of total value. The state has instituted numerous new controls to try to thwart poaching, which has emerged as a major concern as the eels have increased in value.

The elver quota remaining at current levels reflects “strong management measures we’ve instituted here in Maine,” Maine Department of Marine Resources Commissioner Patrick Keliher said.

A quota cut “could have been a loss of millions of dollars in income for Maine’s elver industry,” he said.

This year’s elver season starts next week. Catching the elvers is difficult and involves setting up large nets in Maine’s cold rivers and streams at predawn hours.

That has not stopped new fishers from trying their hand in the lucrative business. The state awards to right to apply for an elver license through a lottery, and this year more than 4,500 applicants applied for just 16 available licenses.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to