Early signs of a strong outcome in this year’s annual wage talks have heightened the chances that the Bank of Japan (BOJ) would end its negative interest rate policy next week, three sources familiar with its thinking said.

The central bank is likely to scrutinize a preliminary survey on the wage talks’ outcome, to be released by the Japanese Trade Union Confederation tomorrow, before deciding whether conditions to phase out stimulus have fallen into place, the sources said.

This year’s annual wage talks started yesterday, with Toyota Motor Corp agreeing to give factory workers their biggest pay increase in 25 years, heightening expectations that other companies would follow suit with bumper wage increases.

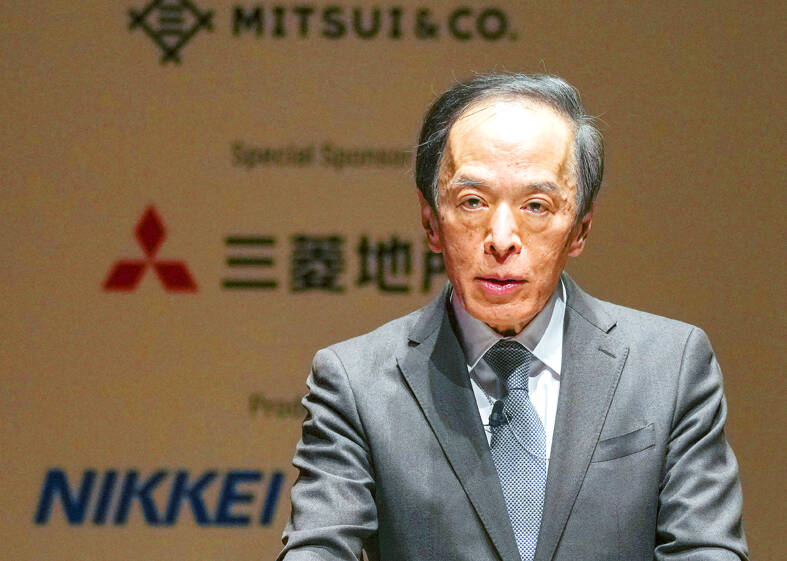

Photo: EPA-EFE

“There seem to be enough factors that justify a March policy shift,” one of the sources said.

“In the end, it will be a judgement call by the nine board members,” the source said, speaking on condition of anonymity due to the sensitivity of the matter.

BOJ Governor Kazuo Ueda signaled the bank’s readiness to phase out its massive stimulus as soon as next week, pointing to “fairly high pay demands” made by labor unions.

“The outcome of this year’s annual wage negotiation is critical” in deciding the timing of an exit from massive stimulus, Ueda told parliament yesterday.

“We’re seeing many companies make offers, including today. We hope to reach an appropriate decision looking comprehensively at these results,” as well as other data, he added.

Many market players expect the BOJ to end negative rates either at its two-day meeting concluding on Tuesday next week, or a subsequent meeting next month.

An end to negative interest rates, which have been in place since 2016, would mark a landmark shift away from the BOJ’s massive stimulus program and Japan’s first interest rate hike since 2007.

TARIFF TRADE-OFF: Machinery exports to China dropped after Beijing ended its tariff reductions in June, while potential new tariffs fueled ‘front-loaded’ orders to the US The nation’s machinery exports to the US amounted to US$7.19 billion last year, surpassing the US$6.86 billion to China to become the largest export destination for the local machinery industry, the Taiwan Association of Machinery Industry (TAMI, 台灣機械公會) said in a report on Jan. 10. It came as some manufacturers brought forward or “front-loaded” US-bound shipments as required by customers ahead of potential tariffs imposed by the new US administration, the association said. During his campaign, US president-elect Donald Trump threatened tariffs of as high as 60 percent on Chinese goods and 10 percent to 20 percent on imports from other countries.

Taiwanese manufacturers have a chance to play a key role in the humanoid robot supply chain, Tongtai Machine and Tool Co (東台精機) chairman Yen Jui-hsiung (嚴瑞雄) said yesterday. That is because Taiwanese companies are capable of making key parts needed for humanoid robots to move, such as harmonic drives and planetary gearboxes, Yen said. This ability to produce these key elements could help Taiwanese manufacturers “become part of the US supply chain,” he added. Yen made the remarks a day after Nvidia Corp cofounder and chief executive officer Jensen Huang (黃仁勳) said his company and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) are jointly

United Microelectronics Corp (UMC, 聯電) expects its addressable market to grow by a low single-digit percentage this year, lower than the overall foundry industry’s 15 percent expansion and the global semiconductor industry’s 10 percent growth, the contract chipmaker said yesterday after reporting the worst profit in four-and-a-half years in the fourth quarter of last year. Growth would be fueled by demand for artificial intelligence (AI) servers, a moderate recovery in consumer electronics and an increase in semiconductor content, UMC said. “UMC’s goal is to outgrow our addressable market while maintaining our structural profitability,” UMC copresident Jason Wang (王石) told an online earnings

MARKET SHIFTS: Exports to the US soared more than 120 percent to almost one quarter, while ASEAN has steadily increased to 18.5 percent on rising tech sales The proportion of Taiwan’s exports directed to China, including Hong Kong, declined by more than 12 percentage points last year compared with its peak in 2020, the Ministry of Finance said on Thursday last week. The decrease reflects the ongoing restructuring of global supply chains, driven by escalating trade tensions between Beijing and Washington. Data compiled by the ministry showed China and Hong Kong accounted for 31.7 percent of Taiwan’s total outbound sales last year, a drop of 12.2 percentage points from a high of 43.9 percent in 2020. In addition to increasing trade conflicts between China and the US, the ministry said