Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday promoted Y.J. Mii (米玉傑) and Y.P. Chyn (秦永沛) as co-chief operating officers (COO) of the world’s biggest contract chipmaker, signaling the formation of a succession team.

The latest executive reshuffle comes after TSMC chairman Mark Liu (劉德音) in December last year announced that he is to retire this year. CEO C.C. Wei (魏哲家) has been recommended as his successor while continuing to serve in his current position.

Mii and Chyn, as well as the company’s human resources, finance, legal and corporate planning units, are to report directly to Wei, a company statement released after the board of directors approved the appointment during a special board meeting yesterday said.

Photo: Grace Hung, Taipei Times

All other organizations are to report to the co-COOs. The new personnel adjustments and organizational structure take effect today, it said.

TSMC did not disclose details about the new COOs’ job responsibilities.

The company appointed Cliff Hou (侯永清), senior vice president of Europe and Asia sales and corporate research, as Chyn’s deputy, while Kevin Zhang (張曉強), senior vice president of TSMC’s business development, is to be Mii’s deputy.

Chyn is currently responsible for the operation and management of all fabs in Taiwan and overseas. He also co-leads TSMC’s Overseas Operations Office, which is responsible for supporting the company’s global expansion and accelerating the organizational effectiveness of overseas operations, information on the company’s Web site says.

Mii is in charge of the company’s research and development (R&D). He joined TSMC in 1994 as a manager at Fab 3 and then joined the R&D unit in 2001. In 2011, Mii was appointed vice president of R&D and in November 2016, he was promoted to senior vice president.

This is not the first time TSMC has adopted a co-COO management model. In 2012, the chipmaker’s board appointed three executives — Chiang Shang-yi (蔣尚義), Liu and Wei — to share the responsibilities of COO.

The three took turns taking charge of the company’s three major divisions: R&D, operations or manufacturing and business development.

In 2018, Liu was tapped as company chairman after founding chairman Morris Chang (張忠謀) retired from his post. Wei became company CEO.

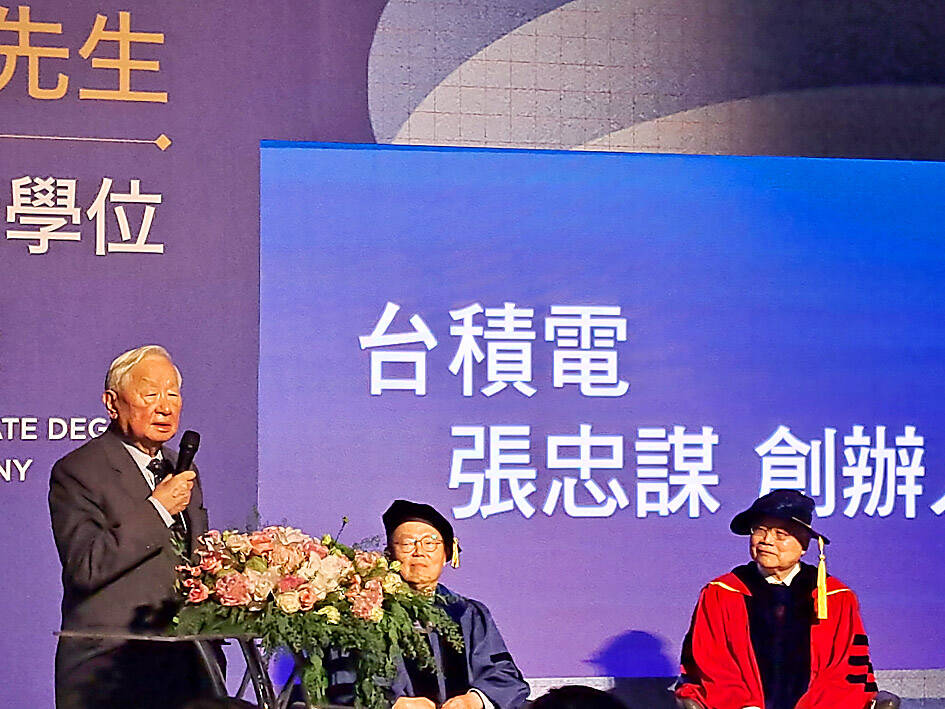

“C.C. has been on the job of CEO for six years. In fact, he is the most well-prepared CEO,” Chang said during his speech at a ceremony in which Wei was awarded an honorary doctorate by National Yang Ming Chiao Tung University in Hsinchu yesterday.

Wei is a CEO with comprehensive experiences in the company’s three key divisions, in addition to sales and marketing, Chang said.

He was appointed head of the chipmaker’s first business development division in charge of sales and marketing in 2019, Chang said.

Prior to that, Wei was responsible for managing the company’s 6-inch and 8-inch fabs. He also worked at the R&D divisions of TSMC and Texas Instruments, Chang said.

In his speech, Wei said he has learned a lot from Chang, including how to be a trusted partner of customers.

The first step in building trust with customers is not to compete with them, Wei said, adding that this is the “essence of running a foundry model.”

Moreover, it is something that TSMC’s major rivals, one from South Korea and the other from California, can never catch up with, he said.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not