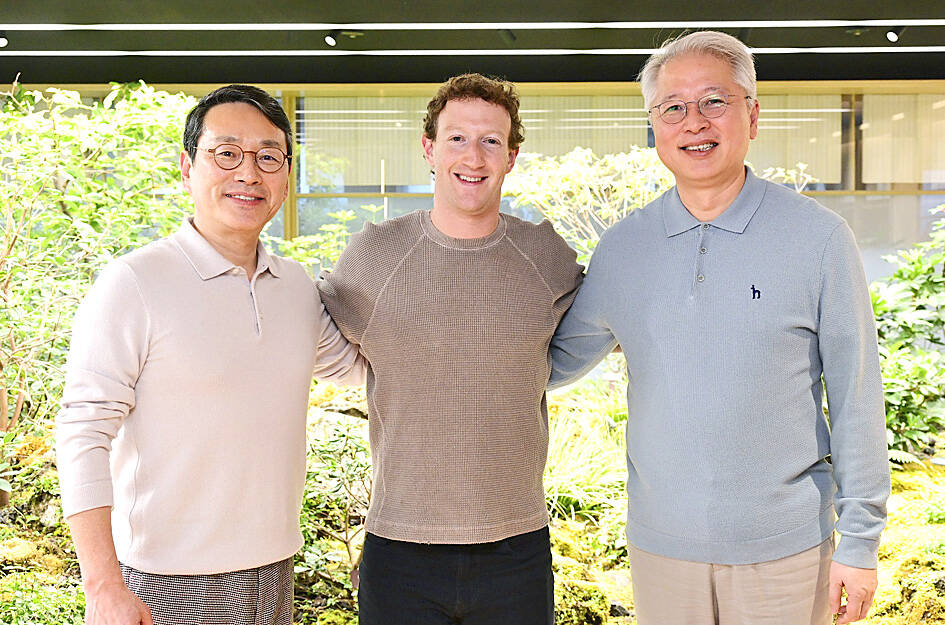

Mark Zuckerberg yesterday discussed ways to deepen Meta Platforms Inc’s strategic alliance on extended-reality (XR) technology with LG Electronics Inc, during his latest stop on a tour of Asia that has taken the billionaire founder from Tokyo to Seoul.

Zuckerberg and LG Electronics CEO William Cho spent two hours going over business strategies for XR devices, considered a next phase after early virtual and augmented reality devices such as Meta’s Quest headset.

The pair also discussed Meta’s large language models and the potential to build artificial intelligence (AI) into consumer devices, LG said in a statement.

Photo: LG Electronics via AP

The South Korean company mentioned in particular how Meta’s platform could dovetail with LG’s content and TV business to create a “distinctive ecosystem.”

Zuckerberg is in Seoul after spending several days on a ski trip with his family in Japan. The Meta CEO met Japanese Prime Minister Fumio Kishida on Tuesday and discussed a broad range of topics, including the status of AI’s technological advancement and the risk surrounding generative AI, top Japanese Chief Cabinet Secretary Yoshimasa Hayashi told reporters yesterday.

AI and Quest have featured heavily on Zuckerberg’s agenda so far, given Meta’s accelerating investment into AI and growing competition in hardware from the likes of Apple Inc’s Vision Pro. In South Korea, he is expected to meet up with Samsung Electronics Co, a longtime rival of LG that has also collaborated with Meta on virtual reality (VR).

Zuckerberg, who arrived in Seoul late on Tuesday, is attracting outsized attention during an Asian tour that has largely remained under wraps.

The billionaire is returning to the city as Meta, whose businesses range from Facebook to Instagram, races to compete in AI with powerful competitors from OpenAI and Microsoft Corp to Alphabet Inc. It is an undertaking that requires huge amounts of Nvidia Corp chips and investment to build what Zuckerberg has dubbed a “massive compute infrastructure.”

Meta remains far and away the industry leader in VR headsets — holding nearly half the market, according to Counterpoint Research — but is losing money on that venture and now has to contend with Apple’s latest device.

It is unclear if mainstream consumers would ever fully embrace the products.

Zuckerberg’s next stop is India, where he is slated to attend the prewedding celebrations of billionaire Mukesh Ambani’s youngest son. The three-day festivities, which are to start tomorrow, are expected to draw celebrities in business, technology and entertainment.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to