The Indian government, after years of watching from the sidelines of the chips race, now has to evaluate US$21 billion of semiconductor proposals and divvy up taxpayer support between foreign chipmakers, local champions or some combination of the two.

Israel’s Tower Semiconductor Ltd is proposing a US$9 billion plant, while India’s Tata Group has put forward an US$8 billion chip fabrication unit, people familiar with the matter said. Both projects would be in Indian Prime Minister Narendra Modi’s home state of Gujarat, the people said.

Semiconductors have grown into a key geopolitical battleground, with the US, Japan and China investing heavily in developing domestic capabilities.

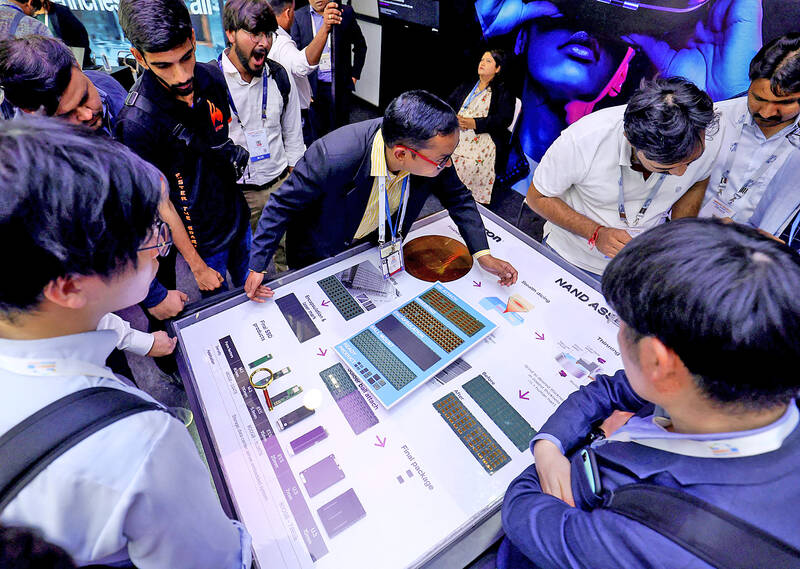

Photo: Reuters

Modi’s push to turn India into a global manufacturing hub also includes luring international chipmakers to the country — a bid to catch up in the sector to save money on expensive imports and enhance a growing smartphone assembly industry.

Under India’s chipmaking incentive plan, the government would bear half the cost of any approved project, with an initial budget of US$10 billion for the task. However, the world’s most populous country is yet to find success in this sphere, with the high-profile partnership between local firm Vedanta Resources Ltd and Taiwan’s Hon Hai Precision Industry Co (鴻海精密) collapsing after failing to find a suitable partner for chip design technology.

An India plant for manufacturing would give Tower a foothold in a key emerging market and help it move out of the shadow of its failed acquisition bid by Intel Corp. Although Tower’s sales are a fraction of giants Intel and Taiwan Semiconductor Manufacturing Co (台積電), it makes components for large customers such as Broadcom Inc and serves fast-growing sectors like electric vehicles.

Tower’s plan is to scale up a plant over a decade and eventually produce 80,000 silicon wafers per month, one of the people said. If approved, this would be the first fabrication unit in India operated by a major semiconductor company.

The Tata conglomerate is expected to partner with Taiwan’s Powerchip Semiconductor Manufacturing Corp (力積電) for its project, though it has also held talks with United Microelectronics Corp (聯電), the people said.

The US$150 billion Tata group has previously said it plans to begin construction of a chip fabrication plant in Dholera this year.

Both Tower and Tata’s facilities would produce so-called mature chips — using 40-nanometer or older technology — that are very widely used in consumer electronics, automobiles, defense systems and aircrafts, the people said.

The Tata Group is also planning to build a 250-billion-rupee (US$3 billion) chip-packaging plant in eastern India that would assemble and export chips, including for automakers such as the group-controlled Tata Motors Ltd. That would similarly require the government’s approval before proceeding.

The moves are part of Tata’s nascent push to invest billions of dollars in high-tech businesses. Tata operates India’s biggest smartphone component plant, constructed at a cost of more than US$700 million, in southern India. It also bought Apple supplier Wistron Corp’s (緯創) India factory last year and is seeking to build its own iPhone plant.

Separately, Japan’s Renesas Electronics Corp is looking to forge a venture with Murugappa Group’s CG Power and Industrial Solutions Ltd arm for a chip-packaging facility.

All of the chip proposals require the assent of Modi’s Cabinet, which could come within weeks. To qualify for state subsidies, any chip project would have to make detailed disclosures including whether it has binding agreements with a technology partner for production.

Applicants also need to disclose financing plans as well as the type of semiconductors they plan to make and their target customers.

TECH CLUSTER: The US company’s new office is in the Shalun Smart Green Energy Science City, a new AI industry base and cybersecurity hub in southern Taiwan US chip designer Advanced Micro Devices Inc (AMD) yesterday launched an office in Tainan’s Gueiren District (歸仁), marking a significant milestone in the development of southern Taiwan’s artificial intelligence (AI) industry, the Tainan City Government said in a statement. AMD Taiwan general manager Vincent Chern (陳民皓) presided over the opening ceremony for the company’s new office at the Shalun Smart Green Energy Science City (沙崙智慧綠能科學城), a new AI industry base and cybersecurity hub in southern Taiwan. Facilities in the new office include an information processing center, and a research and development (R&D) center, the Tainan Economic Development Bureau said. The Ministry

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

The Taipei International Cycle Show (Taipei Cycle) yesterday opened at the Taipei Nangang Exhibition Center, with the event’s organizer expecting a steady recovery in the industry this year following a tough last year. This year, 980 companies from 35 countries are participating in the annual bicycle trade show, showcasing technological breakthroughs and market development trends of the bicycle industry at 3,600 booths, the Taiwan External Trade Development Council (TAITRA, 外貿協會) said in a statement. Under the theme “Ride the Revolution,” the exhibition has attracted more than 3,500 international buyers from 80 countries to preregister for the four-day event, which is expected to