Super Micro Computer Inc’s lengthy rally came to a shuddering halt on Friday, with a selloff that derailed what had looked to be the server maker’s best week on record.

Shares fell 20 percent, their biggest one-day percentage drop since August last year. The decline comes in the wake of a nine-session run of gains, the longest such streak for the stock since 2016. However, even with the day’s selloff, the stock rose 8.5 percent for the week.

Despite Friday’s drop, recent gains show how Super Micro has become one of the hottest names in artificial intelligence (AI). The stock has risen in 18 of the past 21 sessions and remains up 183 percent this year. That follows a gain of 246 percent last year.

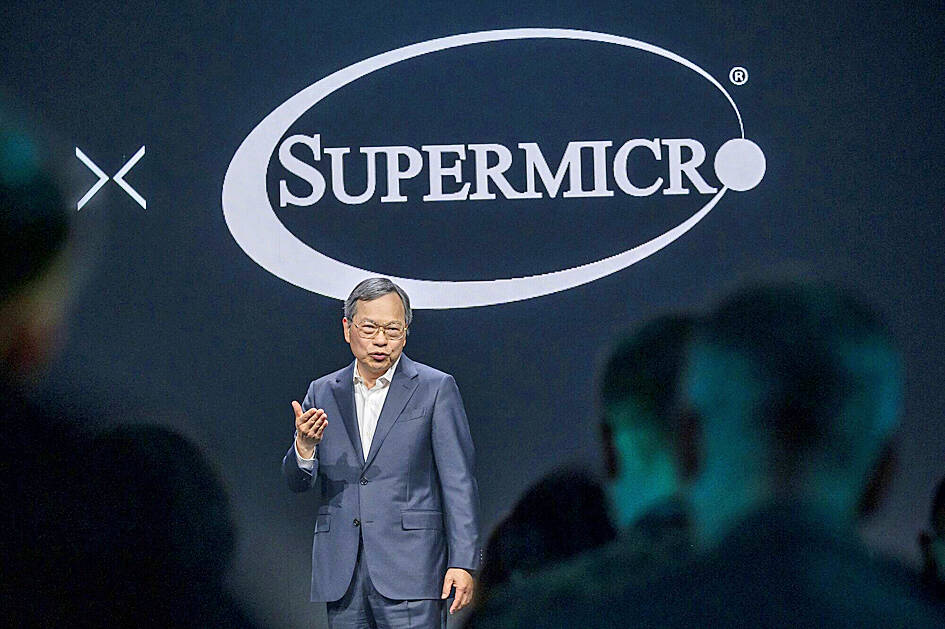

Photo: Bloomberg

Along with the rally, chief executive officer Charles Liang (梁見後) has seen his wealth quadruple this year to US$7.8 billion, making him the biggest percentage gainer on the Bloomberg Billionaires Index of the world’s 500 richest people.

“We deliver the best generative AI platform in the world,”

Liang said in an interview on Friday when asked whether the company was fairly valued. He added that the company could hit US$25 billion in revenue — if only it had enough semiconductors.

“There is a chip shortage — once we have more supply from the chip companies, from Nvidia, we can ship more to customers,” Liang said.

The company generated US$7.1 billion in revenue for the last fiscal year, and it is projected to make US$14.5 billion this fiscal year, according to data compiled by Bloomberg.

The San Jose, California-based company has become a darling for investors wanting exposure to AI and the infrastructure such as chips and servers that run AI applications.

Recent interest in the stock came after preliminary quarterly results released last month far exceeded expectations, and the company subsequently raised its revenue forecast.

The recent rally had pushed Super Micro’s market valuation to about US$45 billion, and its weighting in the Russell 2000 Index is the largest single stock weighting the index has seen going back to 1999, Bloomberg Intelligence said.

Semiconductor shares in China surged yesterday after Reuters reported the US had ordered chipmaking giant Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to halt shipments of advanced chips to Chinese customers, which investors believe could accelerate Beijing’s self-reliance efforts. TSMC yesterday started to suspend shipments of certain sophisticated chips to some Chinese clients after receiving a letter from the US Department of Commerce imposing export restrictions on those products, Reuters reported on Sunday, citing an unnamed source. The US imposed export restrictions on TSMC’s 7-nanometer or more advanced designs, Reuters reported. Investors figured that would encourage authorities to support China’s industry and bought shares

TECH WAR CONTINUES: The suspension of TSMC AI chips and GPUs would be a heavy blow to China’s chip designers and would affect its competitive edge Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, is reportedly to halt supply of artificial intelligence (AI) chips and graphics processing units (GPUs) made on 7-nanometer or more advanced process technologies from next week in order to comply with US Department of Commerce rules. TSMC has sent e-mails to its Chinese AI customers, informing them about the suspension starting on Monday, Chinese online news outlet Ijiwei.com (愛集微) reported yesterday. The US Department of Commerce has not formally unveiled further semiconductor measures against China yet. “TSMC does not comment on market rumors. TSMC is a law-abiding company and we are

FLEXIBLE: Taiwan can develop its own ground station equipment, and has highly competitive manufacturers and suppliers with diversified production, the MOEA said The Ministry of Economic Affairs (MOEA) yesterday disputed reports that suppliers to US-based Space Exploration Technologies Corp (SpaceX) had been asked to move production out of Taiwan. Reuters had reported on Tuesday last week that Elon Musk-owned SpaceX had asked their manufacturers to produce outside of Taiwan given geopolitical risks and that at least one Taiwanese supplier had been pushed to relocate production to Vietnam. SpaceX’s requests place a renewed focus on the contentious relationship Musk has had with Taiwan, especially after he said last year that Taiwan is an “integral part” of China, sparking sharp criticism from Taiwanese authorities. The ministry said

US President Joe Biden’s administration is racing to complete CHIPS and Science Act agreements with companies such as Intel Corp and Samsung Electronics Co, aiming to shore up one of its signature initiatives before US president-elect Donald Trump enters the White House. The US Department of Commerce has allocated more than 90 percent of the US$39 billion in grants under the act, a landmark law enacted in 2022 designed to rebuild the domestic chip industry. However, the agency has only announced one binding agreement so far. The next two months would prove critical for more than 20 companies still in the process