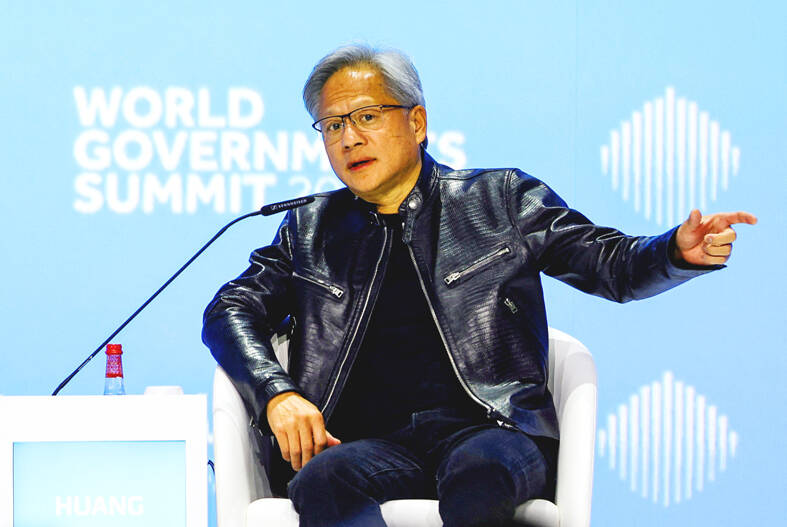

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) said yesterday that every country needs to have its own artificial intelligence (AI) infrastructure to take advantage of the economic potential while protecting its own culture.

“You cannot allow that to be done by other people,” Huang said at the World Government Summit in Dubai.

Huang, whose firm has catapulted to a US$1.73 trillion stock market value due to its dominance of the market for high-end AI chips, said his company is “democratizing” access to AI due to swift efficiency gains in AI computing.

Photo: Reuters

“The rest of it is really up to you to take initiative, activate your industry, build the infrastructure, as fast as you can,” he said.

He said that fears about the dangers of AI are overblown, adding that other new technologies and industries such as cars and aviation have been successfully regulated.

“There are some interests to scare people about this new technology, to mystify this technology, to encourage other people to not do anything about that technology and rely on them to do it. And I think that’s a mistake,” Huang said.

Huang anticipates advances in computing over the next few years will keep the cost of developing AI well below the US$7 trillion that Sam Altman is said to be fundraising.

“You can’t assume just that you will buy more computers. You have to also assume that the computers are going to become faster and therefore the total amount that you need is not as much,” Huang told the summit.

The 60-year-old’s company makes the most sought-after AI accelerators and he’s confident the chip industry will drive down the cost of AI, as those parts are made “faster and faster and faster.”

Huang was responding to a report in the Wall Street Journal that OpenAI CEO Sam Altman is seeking to raise US$7 trillion from investors in the Middle East, including the United Arab Emirates, for a semiconductor initiative to power AI projects that would rival Nvidia.

Altman and other AI developers are seeking ways to diversify their hardware options, including by exploring chipmaking ventures of their own. For Altman to have a realistic chance of making a dent in their lead, he would need to spend lavishly on research, development, facilities and expert personnel, but Huang’s view would suggest that better, more cost-efficient chips will make that unnecessary.

Still, the Nvidia CEO doesn’t see an end to the increase in AI spending anytime soon. In his remarks, Huang estimated that the global cost of data centers powering AI will double in the next five years.

“We’re at the beginning of this new era. There’s about a trillion dollars’ worth of installed base of data centers. Over the course of the next four or five years, we’ll have US$2 trillion worth of data centers that will be powering software around the world,” he said.

Separately, Australia is lagging international peers on the adoption of AI and other advanced technologies, according to the Productivity Commission.

We are “pretty much toward the bottom of the pack of OECD nations,” Danielle Wood, chair of the commission, said at the AFR Workforce Summit yesterday, referring to Australia’s rich-world counterparts in the Organisation for Economic Co-operation and Development.

“So there is a really important question, not just how does the government get the policy settings right and there’s a huge amount to be done there, but how do we shift closer to that frontier when it comes to technological adoption?” Wood said.

A government report last year predicted that Australia’s productivity growth would be 1.2 percent annually in the long term, down from 1.5 percent in the same report two years earlier. The 0.3 percentage point drop in productivity would cut estimated real GDP over the next 40 years by almost 10 percent.

Wood said she was optimistic about the overall impact on productivity from AI adoption in fields such as healthcare, education and retail and “less concerned about some of the negative workforce fallouts.”

“On the jobs piece, we have been through these kind of waves of technological changes before,” Wood said. “It may be that this time is different to history, but certainly what history, at least to date has shown is every time we get one of these waves of change, net job creation is greater than job destruction.”

Micron Memory Taiwan Co (台灣美光), a subsidiary of US memorychip maker Micron Technology Inc, has been granted a NT$4.7 billion (US$149.5 million) subsidy under the Ministry of Economic Affairs A+ Corporate Innovation and R&D Enhancement program, the ministry said yesterday. The US memorychip maker’s program aims to back the development of high-performance and high-bandwidth memory chips with a total budget of NT$11.75 billion, the ministry said. Aside from the government funding, Micron is to inject the remaining investment of NT$7.06 billion as the company applied to participate the government’s Global Innovation Partnership Program to deepen technology cooperation, a ministry official told the

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s leading advanced chipmaker, officially began volume production of its 2-nanometer chips in the fourth quarter of this year, according to a recent update on the company’s Web site. The low-key announcement confirms that TSMC, the go-to chipmaker for artificial intelligence (AI) hardware providers Nvidia Corp and iPhone maker Apple Inc, met its original roadmap for the next-generation technology. Production is currently centered at Fab 22 in Kaohsiung, utilizing the company’s first-generation nanosheet transistor technology. The new architecture achieves “full-node strides in performance and power consumption,” TSMC said. The company described the 2nm process as

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,

H200 CHIPS: A source said that Nvidia has asked the Taiwanese company to begin production of additional chips and work is expected to start in the second quarter Nvidia Corp is scrambling to meet demand for its H200 artificial intelligence (AI) chips from Chinese technology companies and has approached contract manufacturer Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to ramp up production, sources said. Chinese technology companies have placed orders for more than 2 million H200 chips for this year, while Nvidia holds just 700,000 units in stock, two of the people said. The exact additional volume Nvidia intends to order from TSMC remains unclear, they said. A third source said that Nvidia has asked TSMC to begin production of the additional chips and work is expected to start in the second