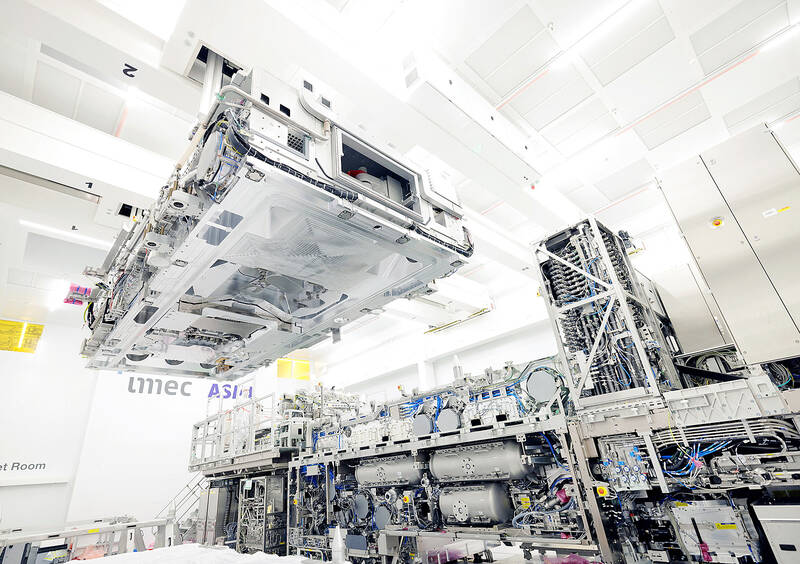

ASML Holding NV is showing off its latest chipmaking machine, a 350 million euro (US$380 million) piece of equipment that weighs as much as two Airbus A320s.

Media outlets were given a tour on Friday of the system known as High-NA extreme ultraviolet. Intel Corp has already placed orders for the machine and got the first one shipped to a factory in Oregon in late December. The company plans to start making chips with it late next year.

The machine can print lines on semiconductors 8 nanometers thick, 1.7 times smaller than the previous generation. The thinner the lines, the more transistors you can fit on a chip. And the more transistors you can fit on a chip, the higher the processing speeds and memory.

Photo: Reuters

That is why, ASML executives said, the system will prove essential for artificial intelligence (AI), a technology that is notorious for the intensity of the processing it requires.

AI will need “massive amounts of computing power and data storage. I think without ASML, without our technology, that’s not going to happen,” company chief executive officer Peter Wennink said in an interview with Bloomberg last month. “It’s going to be a big driver for our business.”

ASML is the only company that produces equipment needed to make the most sophisticated semiconductors, and demand for its products is a bellwether for the industry’s health.

The Dutch company last quarter received record orders for its top-of-the-line extreme ultraviolet (EUV) lithography machines, showing optimism among the biggest customers for the technology, including Intel, Samsung Electronics Co and Taiwan Semiconductor Manufacturing Co (台積電).

Installation of the first 150,000-kilogram system required 250 crates, 250 engineers and six months to complete, ASML spokesperson Monique Mols said during the press tour of the company headquarters in Veldhoven.

The rise of generative AI over the past year, catalyzed by OpenAI’s ChatGPT launch late 2022, has boosted expectations for semiconductor companies across the board. The so-called low-NA EUV machines, which ASML has been selling since 2018, have a price tag of 170 million euros.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced