Taiwan Bio-Manufacturing Corp (TBMC, 臺灣生物醫藥製造), a government-initiated biotech company, on Friday staged its first public event in Taipei, during which it outlined its business model as being similar to that of contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and highlighted its strategic alliance with a US technology-focused biomanufacturing company.

The company, co-established by the Industrial Technology Research Institute (ITRI) and the Development Center for Biotechnology (DCB) last year, on Friday announced a strategic alliance with National Resilience Inc from the US, which it said would give it access to the latter’s expertise in biologics, vaccines, nucleic acids, cell therapy and gene therapy.

TBMC was started following the government’s realization during COVID-19 that Taiwan needed to have its own pharmaceutical manufacturing capabilities, Minister of National Development Kung Ming-hsin (龔明鑫) told a news conference in Taipei.

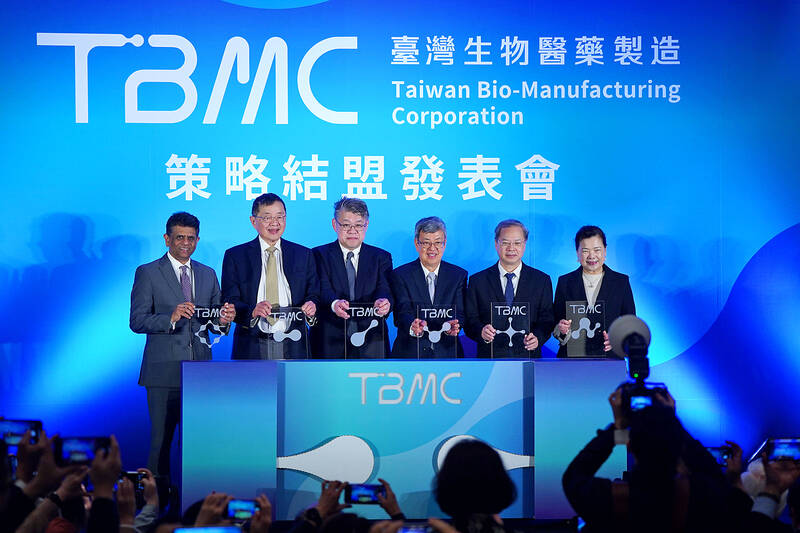

Photo courtesy of Taiwan Bio-Manufacturing Corp

“It is both a health issue and a national security issue,” he said.

The pandemic put Taiwan’s inability to mass produce mRNA vaccines under the spotlight, TBMC chairman and acting CEO Michel Chu (瞿志豪) said.

“Then-vice president Chen Chien-jen (陳建仁) and then-vice premier Shen Jong-chin (沈榮津) initiated a plan to start a company that specializes in the contract manufacturing of biologics, but can also manufacture vaccines during a pandemic,” Chu said in a video played at the news conference that introduced the company.

Chu also told the audience that the company plans to make the most of Taiwan’s advantages — abundant biotech talent and an outstanding smart manufacturing industry — to catapult the country into becoming a global market for contract development and manufacturing organizations (CDMOs).

CDMOs are companies that provide pharmaceutical companies with outsourcing options for drug development and manufacturing to lower risks and capital investment in advanced manufacturing processes.

TBMC is thus not only similar to TSMC in name, but also in its strategy of specializing in advanced contract manufacturing, Chu said.

The establishment of TBMC is based on the “successful experience” of TSMC, he added.

TBMC, like TSMC in 1986, was partly funded by the government, first employed talent from the ITRI — and also the DCB in the case of TBMC — and used foreign technologies and innovations “to secure the trust of future clients,” Chu said.

TSMC’s foreign partner back then was Royal Philips Electronics NV — which transferred some of its semiconductor patents to TSMC — while TBMC works with National Resilience.

“There are very few CDMOs in the world that out-license,” Chu said. “Many companies around the world would love for TSMC to authorize its advanced manufacturing technologies to them, but TSMC would definitely not be willing to do so.”

The reason TBMC was able to strike a deal with National Resilience was not just its special Taiwan connection — Resilience vice chairman Patrick Yang (楊育民) is Taiwanese American — but also because Taiwan has the exceptional automated and smart manufacturing capabilities that large-molecule drugs increasingly require, Chu said.

Large-molecule drugs, also known as biologics, are made from living organisms, while small-molecule drugs, which make up most of the pharmaceutical drugs on the market, are chemically synthesized.

Minister of Economic Affairs Wang Mei-hua (王美花) added that Taiwan has an edge when comes to talent, its medical system and protection of intellectual property, but “as the pharmaceutical industry is a field where big companies gain the most by remaining large, international collaboration is crucial for Taiwan’s biotech industry.”

CDMO shows great potential for biologics in Asia, Wang said, adding that TBMC has established a lab in the Taipei Bioinnovation Park and that it aims to have a Good Manufacturing Practices-grade factory in the Hsinchu Biomedical Science Park within two years.

“We’re hoping TBMC will become another ‘sacred mountain that protects the nation’ [as TSMC is referred to among Taiwanese] in the decades to come,” the minister said.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced