CSBC Power Technology Co (台船動力) has recently signed a letter of intent with Danish multinational engineering group Danfoss A/S as it aims to provide more efficient and cost-effective electric ship propulsion systems, while tapping into the electric ship business worth tens of billions of dollars, its parent company CSBC Corp, Taiwan (台灣國際造船) said yesterday.

“Clean energy and power have become a trend in the transportation industry. Forty-seven point six percent, or nearly half, of new European cars are electric vehicles. I believe that electric ships will also catch up with this trend,” CSBC Corp chairman Cheng Wen-lon (鄭文隆) said in a statement.

Cheng also serves as chairman of CSBC Power, which has paid-in capital of NT$75 million (US$2.4 million), of which 87 percent is held by CSBC Corp, the nation’s largest shipbuilding company, with one shipyard each in Keelung and Kaohsiung.

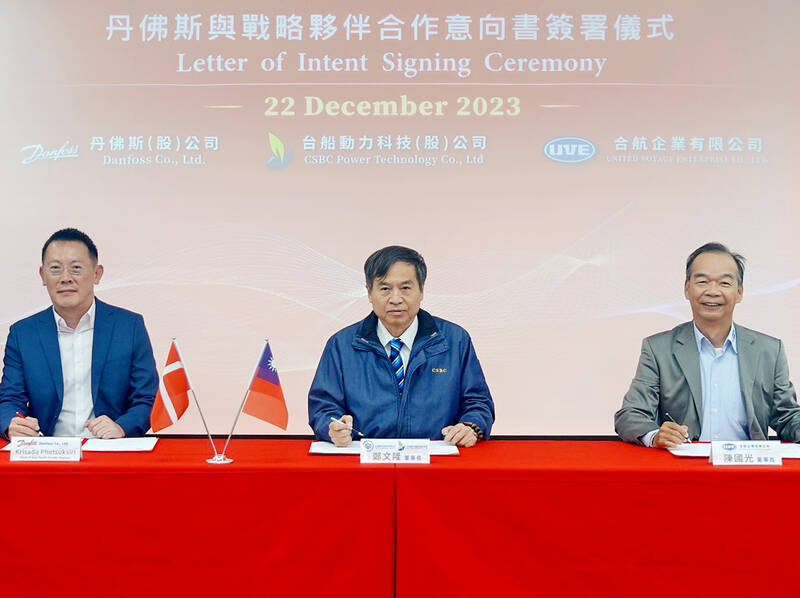

Photo courtesy of CSBC Corp, Taiwan

CSBC Power specializes in the research and development of integrated electric ship energy storage batteries and power systems. Its technical team has many years of experience in ship electrification, the firm said.

The company’s aim is to achieve the localization of megawatt-level electric vessel development in Taiwan, with advanced integrated technology, system design and assembly capabilities, it said.

Danfoss, headquartered in Nordborg, Denmark, has solid electric propulsion technology and enjoys a lead position in the global market, the statement said. The multinational company has been promoting the green transformation of the shipping industry in the past few years, it said.

Through the strategic collaboration with Danfoss, CSBC Power hopes to gradually integrate key technologies — such as electric propulsion systems, shaft generators, main and auxiliary engines and AC-DC converters — into megawatt-level electric ships, company chief executive officer Wang Shuo-ping (王碩彬) said.

The companies signed the letter at CSBC Power’s headquarters in Keelung on Dec. 22 last year with the attendance of Cheng, Danfoss Drives’ head of Asia-Pacific and India regions Krisada Phetsuksiri and United Voyage Enterprise Co (合航企業) chairman Kenneth Chen (陳國光), another strategic partner in the deal, CSBC Corp said.

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

The US Federal Reserve is expected to announce a pause in rate cuts on Wednesday, as policymakers look to continue tackling inflation under close and vocal scrutiny from US President Donald Trump. The Fed cut its key lending rate by a full percentage point in the final four months of last year and indicated it would move more cautiously going forward amid an uptick in inflation away from its long-term target of 2 percent. “I think they will do nothing, and I think they should do nothing,” Federal Reserve Bank of St Louis former president Jim Bullard said. “I think the

SUBSIDIES: The nominee for commerce secretary indicated the Trump administration wants to put its stamp on the plan, but not unravel it entirely US President Donald Trump’s pick to lead the agency in charge of a US$52 billion semiconductor subsidy program declined to give it unqualified support, raising questions about the disbursement of funds to companies like Intel Corp and Taiwan Semiconductor Manufacturing Co (台積電). “I can’t say that I can honor something I haven’t read,” Howard Lutnick, Trump’s nominee for commerce secretary, said of the binding CHIPS and Science Act awards in a confirmation hearing on Wednesday. “To the extent monies have been disbursed, I would commit to rigorously enforcing documents that have been signed by those companies to make sure we get