Exports by Taiwanese machine tool manufacturers are expected to remain flat or grow slightly this year after outbound shipments fell 14 percent annually to US$2.6 billion last year amid a slowing global economy and geopolitical tensions, the Taiwan Machine Tool and Accessory Builders’ Association said yesterday.

The industry’s production value is expected to increase to US$3.37 billion this year from US$3.31 billion the previous year as end-market demand recovers and inventories return to healthy levels, the Taichung-based association said.

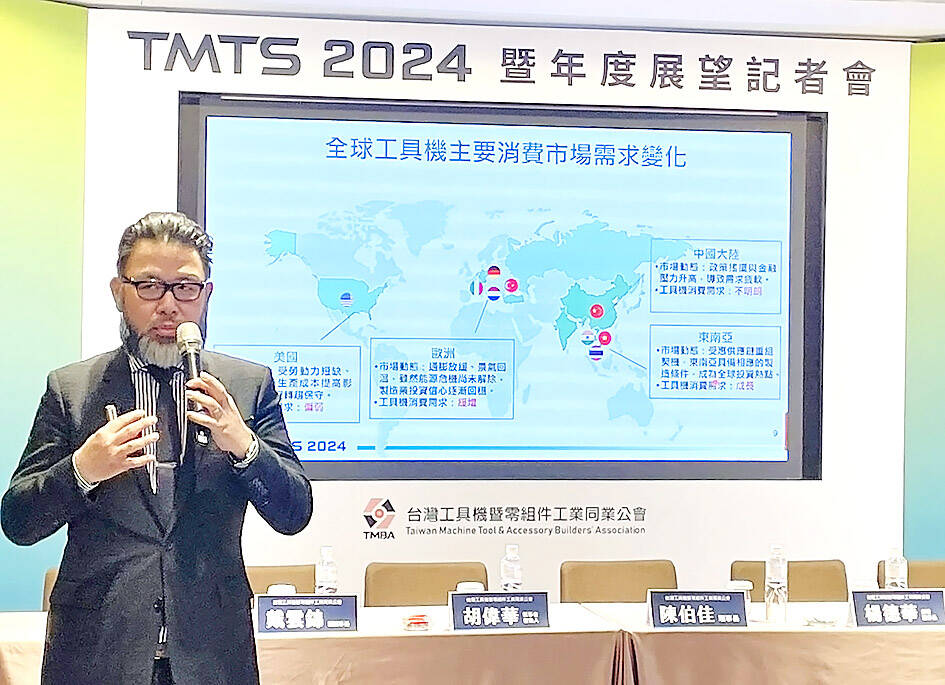

“The business climate for the machine tool industry this year is similar to that of last year, with the industry’s global output estimated to increase to US$78.04 billion from US$74.32 billion,” association chairman Patrick Chen (陳伯佳) told a news conference in Taipei.

Photo: CNA

However, the nation’s machine tool and components manufacturers this year still face challenges stemming from global geopolitics, inflation, carbon reduction requirements and demographic changes, as well as national elections around the world, including the US presidential election, and China’s weakening economy and real-estate bubble, Chen said.

“The machine tool industry has a four-year business cycle, with the bottom in 2022 and 2023, so local manufacturers are expected to see early signs of recovery at the end of the second quarter or in the third quarter,” he said.

Machine tool exports last year declined across the board, with metal-cutting tools dropping 13.3 percent from the previous year to US$2.2 billion, metal-forming machinery sliding 17.7 percent to US$395.32 million and machine centers retreating 16.5 percent to US$871.64 million, association data showed.

Exports to China, including Hong Kong, the local industry’s main export market, fell 11.9 percent year-on-year to US$711.93 million, while those to the US, the second-largest overseas market for Taiwan’s goods, dropped 15.1 percent to US$377.82 million, the data showed.

Shipments to Turkey, the third-largest market, rose 13.9 percent to US$289.79 million and those to India, the fourth-largest, rose 29.1 percent to US$120.69 million, the data showed.

Shipments to other markets such as the Netherlands, Germany, Vietnam, Italy, Japan and Thailand registered annual declines of 1.2 percent to 39 percent, the data showed.

The association has high hopes for the Taiwan International Machine Tool Show, which is scheduled to take place at Taipei Nangang Exhibition Center’s Hall 1 and 2 from March 27 to 31.

The association, which organizes the trade fair, expects the event to help local firms secure orders and bolster their presence in the global market, Chen said.

Goodway Machine Corp (程泰機械) chairman Edward Yang (楊德華), the association’s founding chairman, said that the trade show should be watched, despite the expected headwinds.

With the global economy this year not expected to be worse than last year and with inventory adjustments in the supply chain almost at an end, Goodway is targeting business growth of double-digit percentage points this year, Yang told the news conference.

Tongtai Machine and Tool Co (東台精機) also expects a recovery this year, company vice president Lulu Yen (嚴璐) said, adding that it has a special focus on aerospace, electric vehicle and semiconductor applications this year.

Tongtai is targeting the Southeast Asian market as demand for energy applications recovers, Yen said.

Representatives from Fair Friend Enterprise Group (友嘉集團) and Taiwan Takisawa Technology Co (台灣瀧澤) said they are cautiously optimistic about the industry’s prospects this year on the back of a recovery in orders from Europe, Southeast Asia and India.

The New Taiwan dollar is on the verge of overtaking the yuan as Asia’s best carry-trade target given its lower risk of interest-rate and currency volatility. A strategy of borrowing the New Taiwan dollar to invest in higher-yielding alternatives has generated the second-highest return over the past month among Asian currencies behind the yuan, based on the Sharpe ratio that measures risk-adjusted relative returns. The New Taiwan dollar may soon replace its Chinese peer as the region’s favored carry trade tool, analysts say, citing Beijing’s efforts to support the yuan that can create wild swings in borrowing costs. In contrast,

Nvidia Corp’s demand for advanced packaging from Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) remains strong though the kind of technology it needs is changing, Nvidia CEO Jensen Huang (黃仁勳) said yesterday, after he was asked whether the company was cutting orders. Nvidia’s most advanced artificial intelligence (AI) chip, Blackwell, consists of multiple chips glued together using a complex chip-on-wafer-on-substrate (CoWoS) advanced packaging technology offered by TSMC, Nvidia’s main contract chipmaker. “As we move into Blackwell, we will use largely CoWoS-L. Of course, we’re still manufacturing Hopper, and Hopper will use CowoS-S. We will also transition the CoWoS-S capacity to CoWos-L,” Huang said

Nvidia Corp CEO Jensen Huang (黃仁勳) is expected to miss the inauguration of US president-elect Donald Trump on Monday, bucking a trend among high-profile US technology leaders. Huang is visiting East Asia this week, as he typically does around the time of the Lunar New Year, a person familiar with the situation said. He has never previously attended a US presidential inauguration, said the person, who asked not to be identified, because the plans have not been announced. That makes Nvidia an exception among the most valuable technology companies, most of which are sending cofounders or CEOs to the event. That includes

INDUSTRY LEADER: TSMC aims to continue outperforming the industry’s growth and makes 2025 another strong growth year, chairman and CEO C.C. Wei says Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), a major chip supplier to Nvidia Corp and Apple Inc, yesterday said it aims to grow revenue by about 25 percent this year, driven by robust demand for artificial intelligence (AI) chips. That means TSMC would continue to outpace the foundry industry’s 10 percent annual growth this year based on the chipmaker’s estimate. The chipmaker expects revenue from AI-related chips to double this year, extending a three-fold increase last year. The growth would quicken over the next five years at a compound annual growth rate of 45 percent, fueled by strong demand for the high-performance computing