China Steel Corp (中鋼), the largest steelmaker in Taiwan, yesterday raised steel prices by a moderate NT$300 per tonne for domestic deliveries next month to reflect higher manufacturing costs as customers are experiencing a nascent demand recovery amid an improving world economy.

End customers are also rebuilding inventory as a prolonged Red Sea shipping crisis has raised concern about supply chain disruptions and upended world trade, the Kaohsiung-based steelmaker said in a statement. Most shippers have avoided Red Sea routes amid Houthi attacks.

That was the third straight month of price hikes, reinforcing the company’s optimism about this year’s revival from the industry’s one-and-a-half-year slump.

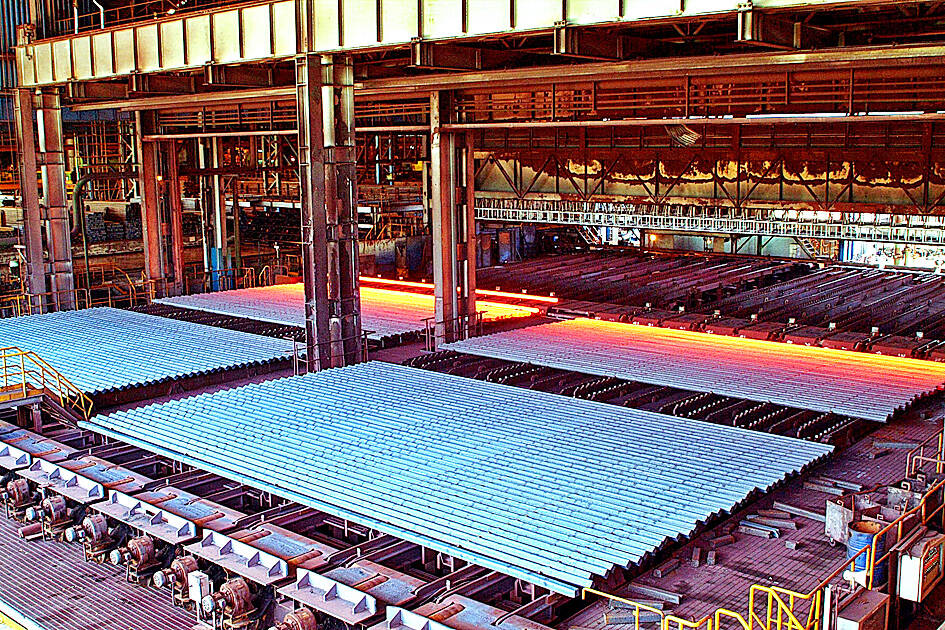

Photo courtesy of China Steel Corp

To seize growth opportunities, China Steel aims to boost its shipments of higher-margin advanced premium steel this year to 9.5 percent of total shipments, from 7.6 percent last year, company chairman Wong Chao-tung (翁朝棟) told investors last month.

Advanced steel is used in electric car motors, new-generation vehicles and military applications, it said.

“Overall, global steel prices are on the rise,” China Steel said.

In the US, economic stimulus such as stepping up public infrastructure and reviving the housing and auto sectors should serve as catalysts, the steelmaker said.

In China and Taiwan, steel demand was fueled by robust vehicle sales, China Steel said.

New vehicle sales in China exceeded 30 million units last year, while Taiwan experienced the best new car sales in 18 years with 476,987 units, it said.

World crude steel supply had shrunk for nine consecutive months to 150 million tonnes in November last year, China Steel said, citing figures from the World Steel Association.

That would further propel the steel industry’s uptrend, the company added.

China Steel said it increased steel prices at a slower pace compared with its global peers due to rising manufacturing costs.

US and European steelmakers Cleveland-Cliffs Inc and ArcelorMittal SA hiked prices by US$55 per tonne this month, while South Korean steelmakers raised prices by US$38 per tonne this month and warned about further hikes next month, China Steel said.

The price of iron ore has jumped to US$145 per tonne, hitting the highest in about one-and-a-half years, it said.

The price of coking coal is also hovering at a high of US$330 and US$340 per tonne, the company said.

China Steel increased prices for most steel products from cold-rolled to hot-rolled steel by NT$300 per tonne, except for electrical steel coils and electro-galvanized steel coils, with prices holding steady.

Nvidia Corp CEO Jensen Huang (黃仁勳) is expected to miss the inauguration of US president-elect Donald Trump on Monday, bucking a trend among high-profile US technology leaders. Huang is visiting East Asia this week, as he typically does around the time of the Lunar New Year, a person familiar with the situation said. He has never previously attended a US presidential inauguration, said the person, who asked not to be identified, because the plans have not been announced. That makes Nvidia an exception among the most valuable technology companies, most of which are sending cofounders or CEOs to the event. That includes

TARIFF TRADE-OFF: Machinery exports to China dropped after Beijing ended its tariff reductions in June, while potential new tariffs fueled ‘front-loaded’ orders to the US The nation’s machinery exports to the US amounted to US$7.19 billion last year, surpassing the US$6.86 billion to China to become the largest export destination for the local machinery industry, the Taiwan Association of Machinery Industry (TAMI, 台灣機械公會) said in a report on Jan. 10. It came as some manufacturers brought forward or “front-loaded” US-bound shipments as required by customers ahead of potential tariffs imposed by the new US administration, the association said. During his campaign, US president-elect Donald Trump threatened tariffs of as high as 60 percent on Chinese goods and 10 percent to 20 percent on imports from other countries.

Taiwanese manufacturers have a chance to play a key role in the humanoid robot supply chain, Tongtai Machine and Tool Co (東台精機) chairman Yen Jui-hsiung (嚴瑞雄) said yesterday. That is because Taiwanese companies are capable of making key parts needed for humanoid robots to move, such as harmonic drives and planetary gearboxes, Yen said. This ability to produce these key elements could help Taiwanese manufacturers “become part of the US supply chain,” he added. Yen made the remarks a day after Nvidia Corp cofounder and chief executive officer Jensen Huang (黃仁勳) said his company and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) are jointly

MARKET SHIFTS: Exports to the US soared more than 120 percent to almost one quarter, while ASEAN has steadily increased to 18.5 percent on rising tech sales The proportion of Taiwan’s exports directed to China, including Hong Kong, declined by more than 12 percentage points last year compared with its peak in 2020, the Ministry of Finance said on Thursday last week. The decrease reflects the ongoing restructuring of global supply chains, driven by escalating trade tensions between Beijing and Washington. Data compiled by the ministry showed China and Hong Kong accounted for 31.7 percent of Taiwan’s total outbound sales last year, a drop of 12.2 percentage points from a high of 43.9 percent in 2020. In addition to increasing trade conflicts between China and the US, the ministry said