A top executive of Chinese property giant Evergrande Group’s (恆大集團) electric vehicle company has been detained by police in the latest sign of trouble for the world’s most heavily indebted property developer.

Evergrande New Energy Vehicle Group Ltd (恆大新能源汽車) announced the detention of Liu Yongzhuo (劉永灼), its vice chairman and an executive director, in a notice yesterday to the Hong Kong Stock Exchange.

Its shares plunged nearly 11 percent after they resumed trading later in the day.

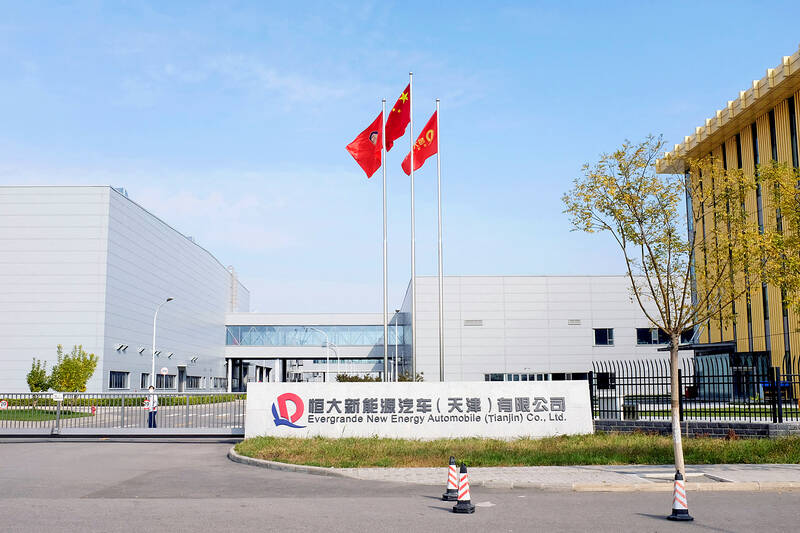

Photo: Reuters

That followed news over the weekend that Zhongzhi Enterprise Group Co (中植企業), a major shadow bank in China that has lent billions in yuan to property developers, filed for bankruptcy liquidation after it was unable to pay its debts.

Zhongzhi, one of China’s largest private asset management companies, said in November last year that its debts of up to 460 billion yuan (US$64.74 billion) were more than twice its assets of 200 billion yuan.

Soon afterwards, Beijing police said they were investigating the suspected crimes of a Chinese wealth company owned by Zhongzhi.

Evergrande has been in crisis since it defaulted on its debt obligations two years ago.

It is in the midst of a restructuring that includes selling off assets to avoid defaulting on US$340 billion in debt.

The firm confirmed in September last year that its chairman, Hui Ka Yan (許家印), had been subjected to “mandatory measures in accordance with the law due to suspicion of illegal crimes.” His status is unclear.

Evergrande New Energy Vehicle’s shares tumbled nearly 20 percent last week after it said a deal to sell shares to Dubai-based NWTN Motors had lapsed.

The brief announcement of Liu’s detention on “suspicion of illegal crimes” made no mention of that or other details.

The company has delayed its plans for beginning manufacturing after running into difficulties in attracting enough funding.

SELL-OFF: Investors expect tariff-driven volatility as the local boarse reopens today, while analysts say government support and solid fundamentals would steady sentiment Local investors are bracing for a sharp market downturn today as the nation’s financial markets resume trading following a two-day closure for national holidays before the weekend, with sentiment rattled by US President Donald Trump’s sweeping tariff announcement. Trump’s unveiling of new “reciprocal tariffs” on Wednesday triggered a sell-off in global markets, with the FTSE Taiwan Index Futures — a benchmark for Taiwanese equities traded in Singapore — tumbling 9.2 percent over the past two sessions. Meanwhile, the American depositary receipts (ADRs) of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the most heavily weighted stock on the TAIEX, plunged 13.8 percent in

A wave of stop-loss selling and panic selling hit Taiwan's stock market at its opening today, with the weighted index plunging 2,086 points — a drop of more than 9.7 percent — marking the largest intraday point and percentage loss on record. The index bottomed out at 19,212.02, while futures were locked limit-down, with more than 1,000 stocks hitting their daily drop limit. Three heavyweight stocks — Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Hon Hai Precision Industry Co (Foxconn, 鴻海精密) and MediaTek (聯發科) — hit their limit-down prices as soon as the market opened, falling to NT$848 (US$25.54), NT$138.5 and NT$1,295 respectively. TSMC's

TARIFFS: The global ‘panic atmosphere remains strong,’ and foreign investors have continued to sell their holdings since the start of the year, the Ministry of Finance said The government yesterday authorized the activation of its NT$500 billion (US$15.15 billion) National Stabilization Fund (NSF) to prop up the local stock market after two days of sharp falls in reaction to US President Donald Trump’s new import tariffs. The Ministry of Finance said in a statement after the market close that the steering committee of the fund had been given the go-ahead to intervene in the market to bolster Taiwanese shares in a time of crisis. The fund has been authorized to use its assets “to carry out market stabilization tasks as appropriate to maintain the stability of Taiwan’s

In a small town in Paraguay, a showdown is brewing between traditional producers of yerba mate, a bitter herbal tea popular across South America, and miners of a shinier treasure: gold. A rush for the precious metal is pitting mate growers and indigenous groups against the expanding operations of small-scale miners who, until recently, were their neighbors, not nemeses. “They [the miners] have destroyed everything... The canals, springs, swamps,” said Vidal Britez, president of the Yerba Mate Producers’ Association of the town of Paso Yobai, about 210km east of capital Asuncion. “You can see the pollution from the dead fish.