A Nobel Prize-winning labor market economist has cautioned young people against piling into science, technology, engineering and mathematics (STEM) subjects, saying “empathetic” and creative skills might thrive in a world dominated by artificial intelligence (AI).

Christopher Pissarides, professor of economics at the London School of Economics, said that workers in certain information technology (IT) jobs risk sowing their “own seeds of self-destruction” by advancing AI that would eventually take the same jobs.

While Pissarides said he is an optimist on AI’s overall effect on the jobs market, he raised concerns for those taking STEM subjects hoping to ride the coattails of the technological advances.

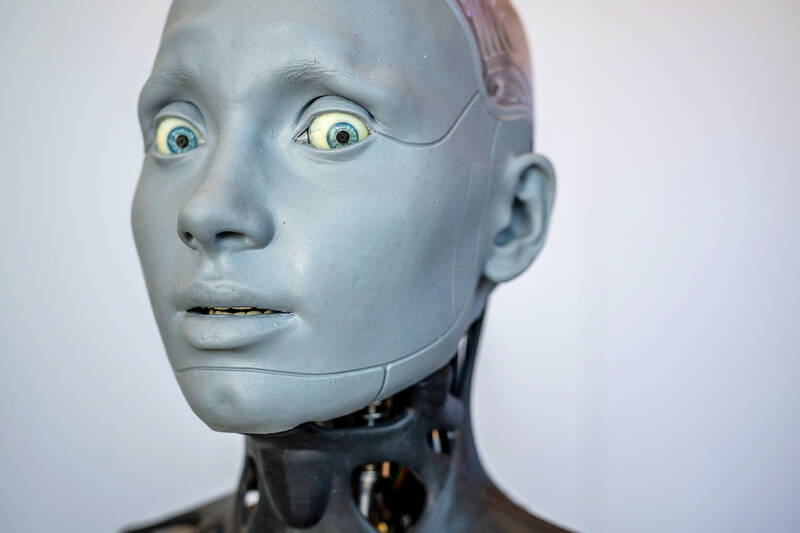

Photo: AFP

Despite rapid growth in the demand for STEM proficiency, jobs requiring more traditional face-to-face skills, such as in hospitality and healthcare, would still dominate the jobs market, he said.

“The skills that are needed now — to collect the data, collate it, develop it and use it to develop the next phase of AI, or, more to the point, make AI more applicable for jobs — will make the skills that are needed now obsolete because it will be doing the job,” he said in an interview. “Despite the fact that you see growth, they’re still not as numerous as might be required to have jobs for all those graduates coming out with STEM because that’s what they want to do.”

“This demand for these new IT skills, they contain their own seeds of self destruction,” he added.

The popularity of STEM subjects has boomed in the past few years as students seek to make themselves more employable, but The rapid rise of AI could transform the labor market, making some tasks and roles obsolete.

However, in the long-term, managerial, creative and empathetic skills, including communications, customer services and healthcare, would likely remain high in demand as they are less replaceable by technology, particularly AI.

“When you say the majority of jobs will be jobs that will involve personal care, communication, good social relationships, people might say: ‘Oh, God, is that what we have to look forward to in the future?’” Pissarides said. “We shouldn’t be looking down at these jobs. They’re better than the jobs that school leavers used to do.”

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said second-quarter revenue is expected to surpass the first quarter, which rose 30 percent year-on-year to NT$118.92 billion (US$3.71 billion). Revenue this quarter is likely to grow, as US clients have front-loaded orders ahead of US President Donald Trump’s planned tariffs on Taiwanese goods, Delta chairman Ping Cheng (鄭平) said at an earnings conference in Taipei, referring to the 90-day pause in tariff implementation Trump announced on April 9. While situations in the third and fourth quarters remain unclear, “We will not halt our long-term deployments and do not plan to

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar