In September, the fertility start-up Kindbody gathered its doctors at a weekend retreat in a Los Angeles hotel. They bonded over morning yoga and swapped best practices for helping women conceive babies.

However, an announcement by Kindbody executives cast a pall over the event. The company was burning through cash. If it was going to turn a profit and go public, the 32 reproductive endocrinologists would need to raise the number of monthly egg retrieval attempts they perform by 12, said physicians who received performance plans reviewed by Bloomberg.

For some, this meant doubling procedures.

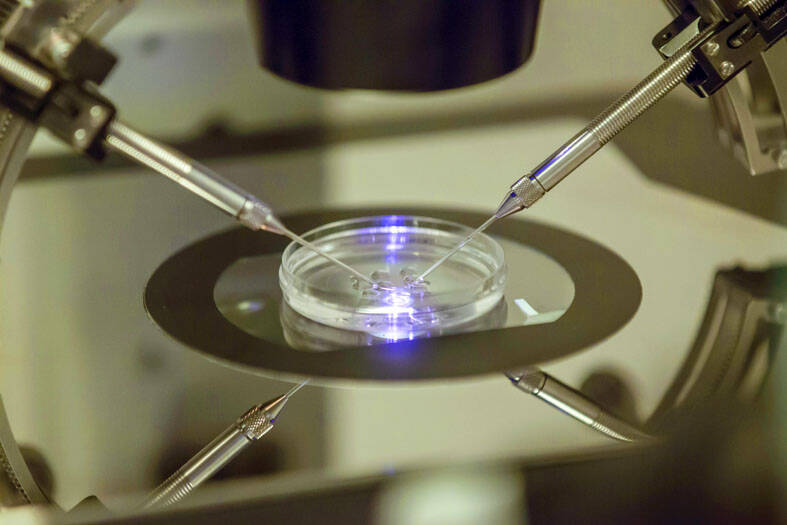

Photo: AP

At the retreat and in the days following it, several physicians pushed back vocally, calling the targets unreasonable and warning they could incentivize physicians to encourage intrusive, expensive treatments to patients who do not necessarily need them, said people familiar with the talks, who asked not to be identified to discuss internal matters.

The week after the retreat, Kindbody presented a plan to its board of directors, including investors from Perceptive Advisors, RRE Ventures and JPMorgan Chase & Co’s healthcare venture arm. The report ranked all of its doctors only by the average number of egg retrieval attempts they were performing.

Those who fell beneath a benchmark average of 23 were labeled as falling “below expectations,” documents showed.

This target would be raised by 43 percent to 33 per month in a direct bid to bolster finances, the company said in the presentation.

Kindbody said in a statement that it had set individual targets for doctors at the retreat to help the company reach a goal of getting 4,500 people pregnant.

The company disputed that it sets “a blanket target” for retrievals, and said that doctors are assessed by more than just retrieval numbers.

They are also judged on patient satisfaction, feedback and the success of their treatments, it said.

“Our guiding metric is the patient experience,” the company said.

A spokesperson did not comment on why doctors were ranked solely based on retrievals in the board presentation.

In-vitro fertilization (IVF), which Kindbody offers at its 33 clinics alongside other fertility services such as egg freezing, can cost patients upward of US$13,800, not including medications. Egg retrieval involves an often emotionally and physically taxing regimen of blood tests, ultrasounds and hormone injections, with potential side effects ranging from bloating to internal bleeding.

It is also the most lucrative procedure Kindbody offers, comprising about half of the revenue collected from an IVF cycle, said current and former Kindbody doctors, speaking on condition of anonymity as the information is not public.

Bundled packages are offered for US$27,000 and US$32,000, which cover two and three retrievals respectively.

IVF treatment in the US is also largely an out-of-pocket expense, with an estimated 56 percent of patients not covered by insurance, the resource and clinic review site FertilityIQ said.

Linking revenue to doctors’ productivity highlights an ongoing debate among academics and medical experts over the ethics behind for-profit companies in the business of reproductive health.

Kindbody — which has raised more than US$300 million from companies including Alphabet Inc and gained the backing of celebrities such as Gwyneth Paltrow — has directly connected the push for retrievals to its efforts to take the company public, according to six current and former Kindbody doctors, as well as documents reviewed by Bloomberg.

It is common practice for fertility clinics to measure their success by the number of babies born from IVF treatments. They are required by law to report live birthrates. While other fertility services providers track egg retrievals, one Kindbody rival says it does not set targets.

Kindbody said that the practice of tying monthly egg retrieval targets to doctors’ compensation and revenue forecasts is an industry standard, and it views egg retrievals as “a critical point of success” in the company’s efforts to increase access to fertility treatments.

“It is inaccurate and irresponsible to reduce fertility care — a highly technical, specific and individualized practice — to a single metric or portray it as driven solely by profit,” Kindbody said in its statement. “At Kindbody, patient care and maximizing the chances of patient success are paramount — not profit.”

At the same time Kindbody was giving its presentation to the board, multiple patients of one of the doctors ranked as falling below expectations received an e-mail saying that the physician would “transition out of” the clinic she directed, the time stamps on e-mails reviewed by Bloomberg showed.

Two other doctors Kindbody listed in the presentation as falling below the target have also since left the company, four current employees said.

The circumstances surrounding their departures are not clear. Kindbody said it hired four new doctors since September.

Perceptive and RRE, which have representatives on Kindbody’s board, did not respond to requests for comment on the presentation. Investor JP Morgan declined to comment.

“Having metrics is not a bad thing. The question is what determines those targets?” said Zev Williams, head of reproductive endocrinology and infertility at Columbia University Irving Medical Center.

“Patient needs, not profit calculations, should always come first,” he said.

Families might want to explore less invasive methods of becoming pregnant first, Williams said.

Not every fertility patient is seeking services that require an egg retrieval, he said.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

‘SILVER LINING’: Although the news caused TSMC to fall on the local market, an analyst said that as tariffs are not set to go into effect until April, there is still time for negotiations US President Donald Trump on Tuesday said that he would likely impose tariffs on semiconductor, automobile and pharmaceutical imports of about 25 percent, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the US leader’s trade war. “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25 percent,” Trump told reporters at his Mar-a-Lago club when asked about his plan for auto tariffs. Asked about similar levies on pharmaceutical drugs and semiconductors, the president said that “it’ll be 25 percent and higher, and it’ll

CHIP BOOM: Revenue for the semiconductor industry is set to reach US$1 trillion by 2032, opening up opportunities for the chip pacakging and testing company, it said ASE Technology Holding Co (日月光投控), the world’s largest provider of outsourced semiconductor assembly and test (OSAT) services, yesterday launched a new advanced manufacturing facility in Penang, Malaysia, aiming to meet growing demand for emerging technologies such as generative artificial intelligence (AI) applications. The US$300 million facility is a critical step in expanding ASE’s global footprint, offering an alternative for customers from the US, Europe, Japan, South Korea and China to assemble and test chips outside of Taiwan amid efforts to diversify supply chains. The plant, the company’s fifth in Malaysia, is part of a strategic expansion plan that would more than triple

Taiwanese artificial intelligence (AI) server makers are expected to make major investments in Texas in May after US President Donald Trump’s first 100 days in office and amid his rising tariff threats, Taiwan Electrical and Electronic Manufacturers’ Association (TEEMA, 台灣電子電機公會) chairman Richard Lee (李詩欽) said yesterday. The association led a delegation of seven AI server manufacturers to Washington, as well as the US states of California, Texas and New Mexico, to discuss land and tax issues, as Taiwanese firms speed up their production plans in the US with many of them seeing Texas as their top option for investment, Lee said. The