Huawei Technologies Co (華為) is among a field of “very formidable” competitors to Nvidia Corp in the race to produce the best artificial intelligence (AI) chips, Nvidia chief executive officer Jensen Huang (黃仁勳) said yesterday.

Huawei, Intel Corp and an expanding group of semiconductor start-ups pose a stiff challenge to Nvidia’s dominant position in the market for AI accelerators, Huang told reporters in Singapore.

Shenzhen-based Huawei has grown into China’s chip tech champion and returned to the spotlight this year with an advanced made-in-China smartphone processor.

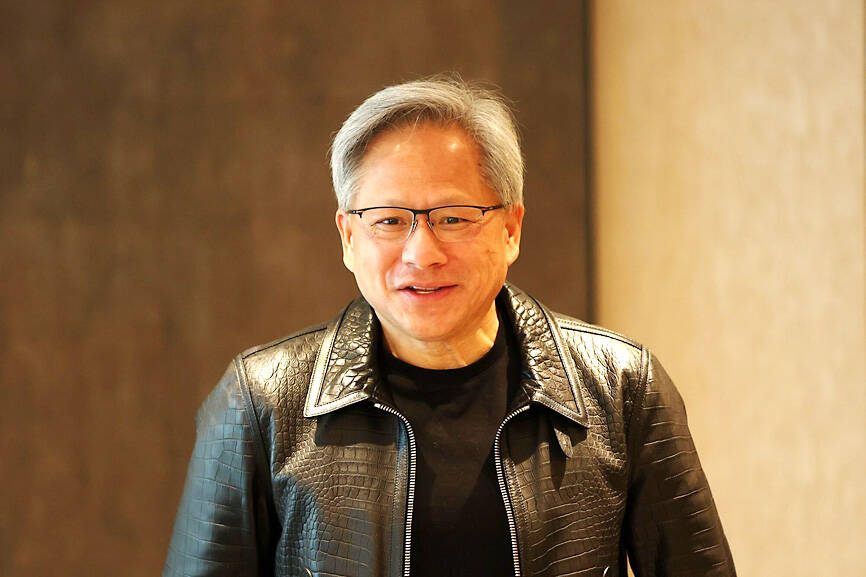

Photo: Bloomberg

“We have a lot of competitors, in China and outside China,” Huang said. “Most of our competitors don’t really care where I am. They want to compete with us everywhere we go.”

Questions about China were prominent during Huang’s visit to Singapore, where he met Singaporean Prime Minister Lee Hsien Loong (李顯龍) to discuss the city-state’s strategy to compete in the global AI race.

However, the US has raised barriers on the company’s sales to China, further tightening China’s access to Nvidia’s AI chips in the middle of October.

China has historically accounted for about 20 percent of Nvidia’s sales and the company will continue to adhere with trade regulations “perfectly,” Huang said.

The company is to deliver a new set of products for the Chinese market that is in line with the latest rules coming from Washington, the 60-year-old executive added.

Santa Clara, California-based Nvidia does serve Chinese customers in Singapore, Huang said.

Among the biggest Chinese firms with a presence there are ByteDance Ltd (字節跳動), Tencent Holdings Ltd (騰訊) and Alibaba Group Holding Ltd (阿里巴巴).

Sales to customers in the city-state, including Chinese firms, accounted for about 15 percent of Nvidia’s revenue in the three months ended in October, a regulatory filing showed.

Singapore sees the expansion of its digital economy as instrumental to stimulating broader growth. It hosts less-advanced chipmaking factories operated by GlobalFoundries Inc and other global players. Nvidia’s go-to maker of AI accelerators Taiwan Semiconductor Manufacturing Co (台積電) and NXP Semiconductors NV also run a joint venture in the country.

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

The US Federal Reserve is expected to announce a pause in rate cuts on Wednesday, as policymakers look to continue tackling inflation under close and vocal scrutiny from US President Donald Trump. The Fed cut its key lending rate by a full percentage point in the final four months of last year and indicated it would move more cautiously going forward amid an uptick in inflation away from its long-term target of 2 percent. “I think they will do nothing, and I think they should do nothing,” Federal Reserve Bank of St Louis former president Jim Bullard said. “I think the

SUBSIDIES: The nominee for commerce secretary indicated the Trump administration wants to put its stamp on the plan, but not unravel it entirely US President Donald Trump’s pick to lead the agency in charge of a US$52 billion semiconductor subsidy program declined to give it unqualified support, raising questions about the disbursement of funds to companies like Intel Corp and Taiwan Semiconductor Manufacturing Co (台積電). “I can’t say that I can honor something I haven’t read,” Howard Lutnick, Trump’s nominee for commerce secretary, said of the binding CHIPS and Science Act awards in a confirmation hearing on Wednesday. “To the extent monies have been disbursed, I would commit to rigorously enforcing documents that have been signed by those companies to make sure we get