A California semiconductor company plans to hire hundreds of employees exclusively from local unions, a rare move in an industry historically averse to organized labor and one that could boost its bid for US funds.

Akash Systems Inc has entered formal labor agreements with the industrial division of the Communications Workers of America (CWA) and the Building and Construction Trades Council of Alameda County, covering about 250 production-line workers and dozens of construction workers who are to build a US$62 million semiconductor facility in West Oakland, California.

The company said the union agreement would allow it to more rapidly hire and train skilled workers.

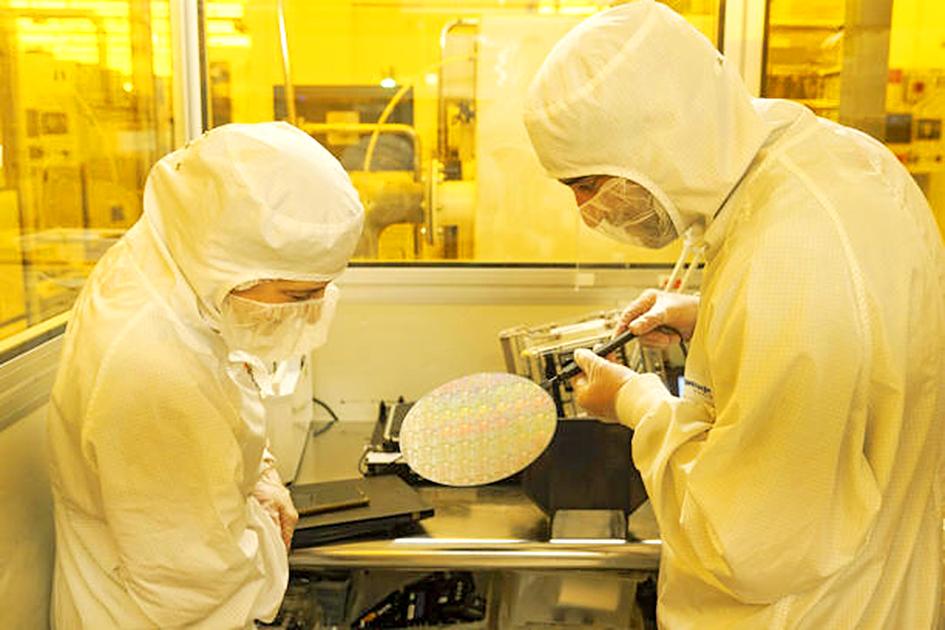

Photo: Bloomberg

However, it also has the added political benefit of appealing to US President Joe Biden, who has worked in recent months to burnish his pro-union intentions.

Akash is one of hundreds of firms vying for money from last year’s Chips Act, which set aside federal grants and loans valued at US$100 billion for chip makers and their suppliers. The law aims to bring semiconductor manufacturing back to the US and reduce reliance on Asian supply chains — while contributing to a broader manufacturing revival that Biden has promised would be a boon to organized labor.

“Historically, semiconductor tech companies in general are not excited about unions,” said Akash Systems cofounder and chief executive officer Felix Ejeckam. “We are aware that the Biden administration’s excited about this and so we’re certainly leaning into that.”

White House spokesperson Robyn Patterson said Biden and his administration “welcome partnerships between the semiconductor industry and labor unions.”

US Acting Secretary of Labor Julie Su hosted Ejeckam and several union leaders at an event Tuesday on empowering workers, according to a press release.

The US Department of Commerce declined to comment on any potential applicant, but pointed to the administration’s so-called “good jobs principles,” which include workers’ right to organize.

Those principles are part of the guidelines for applicants seeking Chips Act funds, along with a preference for labor agreements between chip makers and construction unions. Projects that receive government support are also covered by updated federal wage rules, which increase pay for more than a million construction workers.

However, labor deals are rare in the semiconductor sector. Only one US chip production facility — ON Semiconductor Corp’s plant in Mountain Top, Pennsylvania — has a unionized workforce, according to the CWA.

The tension is already playing out in the US chips push, as Arizona unions clash with the world’s leading chipmaker, Taiwan Semiconductor Manufacturing Co (台積電), over safety and management issues at their US$40 billion Phoenix site.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors