MediaTek Inc (聯發科) yesterday said that its flagship mobile processors would generate more than US$1 billion in revenue this year, as the world’s biggest smartphone chip supplier aims to bring its chips to edge devices and cloud-based machines with generative artificial intelligence (AI) capabilities.

That means about 7 percent of the chip supplier’s revenue this year, estimated at US$14 billion, would come from advanced 5G mobile processors.

The Hsinchu-based chip designer has added its first AI processing unit (APU) to its latest flagship mobile processor, the Dimensity 9300. MediaTek sarted building its APU technology about four to five years ago.

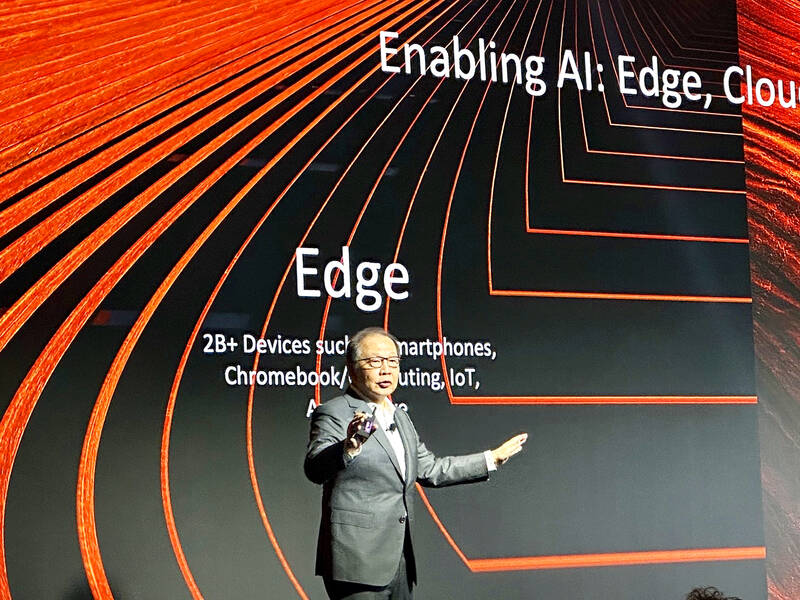

Photo courtesy of MediaTek Inc

The new advanced processor is optimized to run large language models for generative AI, the company said.

MediaTek expects smartphones powered by Dimensity 9300 — the third-generation of its flagship mobile chip — to hit the market by the end of this year. Next year, the company plans to increase the availability of AI-enabled 5G processors to a variety of smartphones.

The introduction of the Dimensity 9300 chip has boosted MediaTek’s confidence that its flagship mobile processors would “bring in more than US$1 billion in revenue for us,” company CEO Rick Tsai (蔡力行) said in his speech during the MediaTek Executive Summit 2023 in the US yesterday.

“In the next five years, I want Mediatek to enable AI either on all [devices] on edge, cloud or [anything] in between,” Tsai said.

MediaTek said the US market would play a critical role in fueling its revenue growth in the next five years, as it is diversifying its product portfolio from mobile chips and broadening its footprint beyond China.

MediaTek made a great stride yesterday by adding Meta to its US client portfolio. The company is to collaborate with Meta to develop chips for the technology giant’s new augmented reality (AR) glasses. Meta’s Reality Labs vice president Jean Boufarhat joined Tsai onstage to make the announcement.

The partnership ignited speculation that MediaTek might replace Qualcomm Inc and become the sole chip supplier for Meta’s new AR glasses.

Mediatek said that building an ecosystem is crucial for the firm to grow its revenue in the future.

The chip designer partners with Taiwan Semiconductor Manufacturing Co (台積電) to utilize its leading-edge technology, including 3-nanometer processing and advanced chip packaging technologies from chip on wafer on substrate, or CoWoS, to chiplets to manufacture its processors, Tsai said.

The company also collaborates with ARM Holdings and Nvidia Corp to broaden its business to computing and automotive areas, he said.

“We want to work with them [those partners] to optimize, to maximize capabilities, so people can enjoy edge AI,” Tsai said. “We cannot do Deep Mind things. We cannot do [what] OpenAI [does]. But, we will provide technology, chips and services to enable them to do that.”

Mediatek said it has built up its technology leadership by investing heavily in research and development. Since 2018, the company has spent about US$18 billion on research and development, it said.

During the same period, its revenue is estimated to have surged 77 percent to an estimated US$14 billion this year from US$7.9 billion, it said.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

‘SILVER LINING’: Although the news caused TSMC to fall on the local market, an analyst said that as tariffs are not set to go into effect until April, there is still time for negotiations US President Donald Trump on Tuesday said that he would likely impose tariffs on semiconductor, automobile and pharmaceutical imports of about 25 percent, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the US leader’s trade war. “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25 percent,” Trump told reporters at his Mar-a-Lago club when asked about his plan for auto tariffs. Asked about similar levies on pharmaceutical drugs and semiconductors, the president said that “it’ll be 25 percent and higher, and it’ll

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

WARNING SHOT: The US president has threatened to impose 25 percent tariffs on all imported vehicles, and similar or higher duties on pharmaceuticals and semiconductors US President Donald Trump on Wednesday suggested that a trade deal with China was “possible” — a key target in the US leader’s tariffs policy. The US in 2020 had already agreed to “a great trade deal with China” and a new deal was “possible,” Trump said. Trump said he expected Chinese President Xi Jinping (習近平) to visit the US, without giving a timeline for his trip. Trump also said that he was talking to China about TikTok, as the US seeks to broker a sale of the popular app owned by Chinese firm ByteDance Ltd (字節跳動). Trump last week said that he had