GlobalWafers Co (環球晶圓), the world’s No. 3 silicon wafer supplier, on Tuesday offered a lukewarm outlook for this quarter and next after revenue last quarter fell 2.9 percent to NT$17.38 billion (US$538.95 million) from the previous quarter as customers digested inventory and were cautious about wafer restocking.

Revenue this quarter would be slightly lower than last quarter and revenue momentum next quarter would remain weak, GlobalWafers chairwoman Doris Hsu (徐秀蘭) told investors.

A pickup in demand is likely in the second quarter of next year, when customers’ inventories fall, Hsu said.

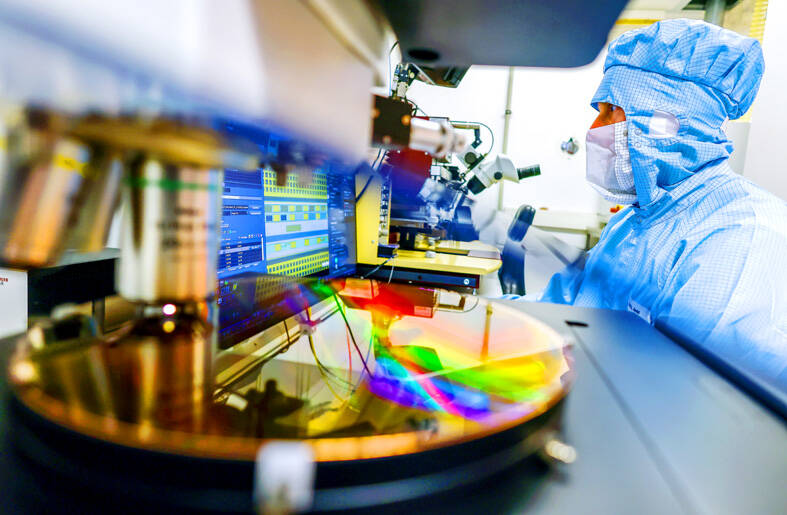

Photo: EPA-EFE

GlobalWafers factories making smaller-diameter wafers suffered the most, with a capacity utilization rate of 60 to 65 percent, while its 8-inch factory usage dropped to 80 to 90 percent as demand started trending down last quarter, she said.

Its 12-inch factories fared better, with a utilization rate of 90 to 100 percent, she added.

A couple of months ago, GlobalWafers saw that demand from some integrated device manufacturing (IDM) customers was soft, particularly for automotive components and applications, Hsu said.

The company now sees the slowdown as a short-term phenomenon, as those customers are striving to deplete inventories, she said.

Despite the inventory pressure, GlobalWafers has secured more long-term supply agreements (LTA) and most customers are honoring them, the company said.

The company expects average selling prices for LTA customers to climb next year, given higher depreciation costs and improving demand, it said.

Capital spending this year would fall short of the firm’s target of NT$40 billion, as it has pushed out deliveries of construction materials and manufacturing tools to cope with sagging demand, it said.

However, next year would be the peak of capital spending for GlobalWafers, it said, adding that the construction of its new US fab is on track.

Separately, contract chipmaker Vanguard International Semiconductor Corp (世界先進) on Tuesday warned of weakening revenue growth this quarter, as it faces challenges from softening demand for auto chips.

Wafer shipments this quarter are expected to contract by 8 to 10 percent from last quarter, Vanguard said.

Average selling prices would be little changed, or down 2 percent sequentially, due to soft demand and intensifying competition from Chinese peers, it said.

Gross margin would be between 22 and 24 percent this quarter, down from 26.5 percent last quarter, it said.

Factory utilization is to deteriorate to between 55 and 65 percent this quarter, it added.

“Overall, market demand remains soft,” Vanguard vice president Claire Chen (陳姿鈞) said. “We are seeing a recovery in large display driver ICs for TVs, while demand for notebook computers is stabilizing. The automotive and industrial segments are still under inventory correction.”

To cope with the challenging environment, Vanguard is exploring new business opportunities in emerging applications such as artificial intelligence (AI) servers, AI PCs, electric vehicles and high-performance computing devices, company president John Wei (尉濟時) said.

Hopefully, the efforts would yield significant results next year, he said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) last week recorded an increase in the number of shareholders to the highest in almost eight months, despite its share price falling 3.38 percent from the previous week, Taiwan Stock Exchange data released on Saturday showed. As of Friday, TSMC had 1.88 million shareholders, the most since the week of April 25 and an increase of 31,870 from the previous week, the data showed. The number of shareholders jumped despite a drop of NT$50 (US$1.59), or 3.38 percent, in TSMC’s share price from a week earlier to NT$1,430, as investors took profits from their earlier gains

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be