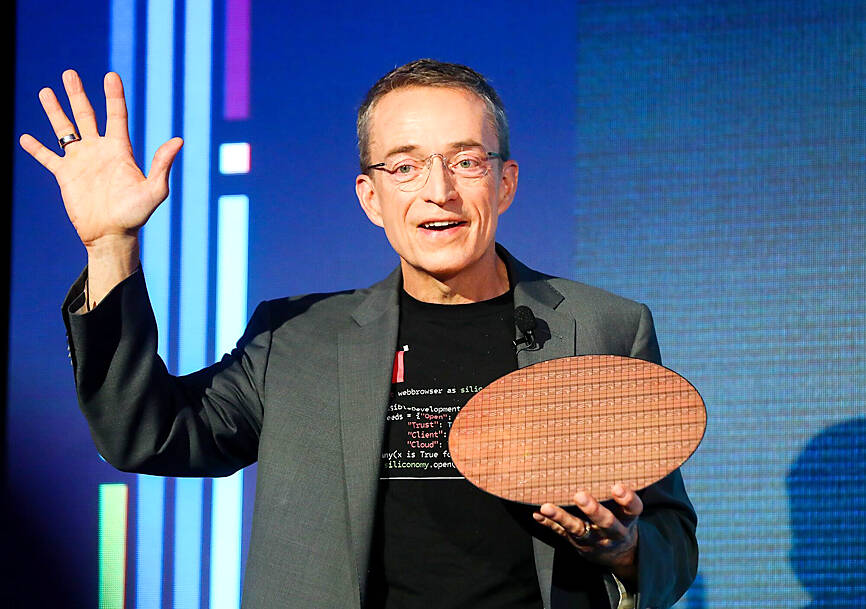

Intel Corp is expanding semiconductor capacity in the US, Europe and Asia as part of its efforts to satisfy the world’s need for a geographically balanced supply chain, while Taiwan has built itself into a foundry hub of Asia, CEO Pat Gelsinger told a media briefing in Taipei yesterday.

As a major part of its IDM2.0 (integrated device manufacturing) strategy, Intel aims to become a leading foundry service supplier to the world, Gelsinger said.

Taiwan has strong foundry companies, but Intel believes that “as the world wants a resilient geopolitical balanced supply chain, so our strategy is to align with that,” Gelsinger said. “Other than a strong Asian supply chain, with the hub built in Taiwan, there will be the need for a strong supply chain in America and Europe.”

Photo: Bloomberg

To address such needs, the US chipmaker is building a diverse manufacturing network around the world with multiple manufacturing operations in the US, Europe and Asia, he said.

In the US, Intel is building new fabs in Oregon, Arizona, New Mexico and Ohio, he said. The company also operates fabs in Israel and has unveiled major investment plans in Ireland, Poland and Germany to build leading-edge semiconductor factories, he said.

In Asia, Intel is expanding its footprint in Malaysia and Vietnam. The chipmaker is deploying wafer-level assembly and chip packaging manufacturing capabilities in Malaysia, Gelsinger said.

Intel’s investment in building geographically diversified fabs is well justified, as the global semiconductor market is expanding rapidly and is expected to reach an estimated US$1 trillion by the end of this decade from US$600 billion last year, he said.

To become a reliant foundry service provider, Gelsinger said Intel has to be “customer-obsessed,” as it has to become customers’ factories.

“No matter what, a good factory is making products that make their customers successful. Intel was never customer-oriented. We were a leadership technology provider,” Gelsinger said.

Commenting on growing competition from computers powered by ARM-based chips, Gelsinger said ARM has been unable to gain a sizeable share of the world’s PC market. At the same time, a growing number of companies are ushering into artificial-intelligence-enabled PCs, and Intel expects shipments of AI PCs to rise to 100 million units in 2025, he said.

Intel sees ARM-based chipmakers as potential customers of its foundry services, given that Intel’s OpenVINO, an open-source toolkit for optimizing and deploying AI inference, supports the ARM architecture, he said.

Gelsinger also told Intel’s local partners in Taipei that the company is confident about reaching its goal of delivering five advanced process nodes in four years. After successfully shipping the first node, the Intel 7 processor, Intel is on schedule to ramp up production of the Intel 18A, the last node of the plan, in the second half of next year.

Gelsinger took the reign of Intel in 2021.

Showing support for Intel, Asustek Computer Inc (華碩) chairman Jonney Shih (施崇棠) yesterday demonstrated the generative AI features on PCs.

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

The US Federal Reserve is expected to announce a pause in rate cuts on Wednesday, as policymakers look to continue tackling inflation under close and vocal scrutiny from US President Donald Trump. The Fed cut its key lending rate by a full percentage point in the final four months of last year and indicated it would move more cautiously going forward amid an uptick in inflation away from its long-term target of 2 percent. “I think they will do nothing, and I think they should do nothing,” Federal Reserve Bank of St Louis former president Jim Bullard said. “I think the

SUBSIDIES: The nominee for commerce secretary indicated the Trump administration wants to put its stamp on the plan, but not unravel it entirely US President Donald Trump’s pick to lead the agency in charge of a US$52 billion semiconductor subsidy program declined to give it unqualified support, raising questions about the disbursement of funds to companies like Intel Corp and Taiwan Semiconductor Manufacturing Co (台積電). “I can’t say that I can honor something I haven’t read,” Howard Lutnick, Trump’s nominee for commerce secretary, said of the binding CHIPS and Science Act awards in a confirmation hearing on Wednesday. “To the extent monies have been disbursed, I would commit to rigorously enforcing documents that have been signed by those companies to make sure we get