Taiwanese stocks are likely to shrug off geopolitical concerns to mount a recovery next year, led by a resurgence in chip-sector earnings, according to the nation’s largest active equity fund manager.

Taiwan’s semiconductor companies will see earnings growth of around 30 percent next year, with 20 percent growth expected for Taiwan-listed companies as a whole, Ivy Chen (陳彥婷), general manager and head of Taiwan at Allianz Global Investors, said in an interview on Tuesday.

Escalating tensions between Taiwan, China and the US and fears of a global economic slowdown have driven foreign investors to pull US$7.4 billion from Taiwanese stocks this year, the most in Asia, according to Bloomberg-compiled data. Still, the benchmark TAIEX has gained 16 percent year to date, the second-best-performing major stock market in Asia after Japan.

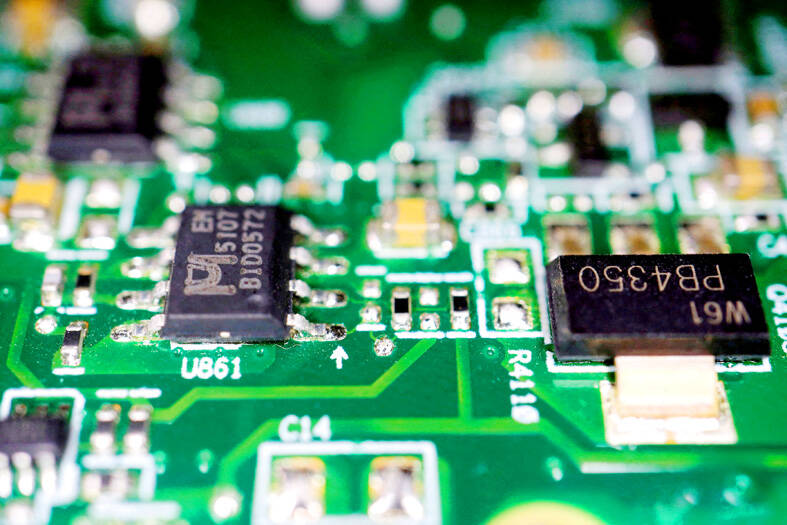

Photo: Reuters

Geopolitical risk is “not news for Taiwanese people,” Chen said, adding that similar risks could emerge anywhere in the world in the wake of the Russian-Ukraine war and the Israel-Hamas conflict. “The best way to reduce geopolitical risks is by diversifying in terms of asset class or sector.”

The main drivers of growth for Taiwan’s chip companies include improving end-consumer demand and the destocking of the sector coming to an end, Chen said, adding that demand for semiconductors related to artificial intelligence will continue to boom.

She expects Taiwanese stocks next year to top this year’s gains.

The Taipei-based Market Intelligence and Consulting Institute on Wednesday forecast that production value of Taiwan’s semiconductor industry next year would increase 13.7 percent to NT$4.29 trillion, from NT$3.77 trillion this year.

The increase in output would be driven mainly by the wafer foundry sector as chipmakers expand capacity for advanced manufacturing, the institute said in a report.

Institute consultant Sagitta Pan (潘健光) said the growth momentum of the semiconductor industry would rely on emerging applications such as innovative information services, energy and environmental protection, and technology integration.

In particular, artificial intelligence (AI), new energy and artificial intelligence of things will become the main growth momentum, Pan said.

Chen said she is confident that Taiwanese stocks will attract foreign investors again with their earnings growth. Taiwan’s manufacturers have also increasingly diversified their production base, which will help boost their competitiveness as it alleviates geopolitical concerns, she said.

Over the longer term, the firm is positive on sectors including bicycles, textiles, shoe manufacturing, machine tools and biotech.

Allianz Global Investors Taiwan manages NT$69.5 billion (US$2.15 billion) in onshore Taiwanese stock funds as of September, the most in Taiwan, according to data from the Securities Investment Trust and Consulting Association. That includes a technology fund which beat 96 percent of peers in the past year, according to Bloomberg-compiled data, with Alchip Technologies Ltd (世芯), Quanta Computer Inc (廣達) and MediaTek Inc (聯發科) among its top holdings.

Additional reporting by staff writer

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

EARLY TALKS: Measures under consideration include convincing allies to match US curbs, further restricting exports of AI chips or GPUs, and blocking Chinese investments US President Donald Trump’s administration is sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new US president plans to expand efforts that began under former US president Joe Biden to limit Beijing’s technological prowess. Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd and ASML Holding NV engineers from maintaining semiconductor gear in China, people familiar with the matter said. The aim, which was also a priority for Biden, is to see key allies match China curbs the US

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

‘SACRED MOUNTAIN’: The chipmaker can form joint ventures abroad, except in China, but like other firms, it needs government approval for large investments Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) needs government permission for any overseas joint ventures (JVs), but there are no restrictions on making the most advanced chips overseas other than for China, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. US media have said that TSMC, the world’s largest contract chipmaker and a major supplier to companies such as Apple Inc and Nvidia Corp, has been in talks for a stake in Intel Corp. Neither company has confirmed the talks, but US President Donald Trump has accused Taiwan of taking away the US’ semiconductor business and said he wants the industry back