The nation’s machine tool exports fell 1.9 percent month-on-month to US$230.4 million last month as shipments in six out of the 10 biggest product categories declined, data compiled by the Taiwan Machine Tool & Accessory Builders’ Association showed yesterday.

Among all machine tool products, exports of pressing and shearing machines dropped 24 percent from the previous month to US$25.26 million, metal forming machinery slid 17.6 percent to US$31.41 million and grinding machines retreated 16.4 percent to US$17.36 million, the association said in a statement.

Bucking the trend, exports of metal-cutting machine tools edged up 1.1 percent to US$198.99 million and machine centers advanced 7.8 percent to US$79.3 million, the association said.

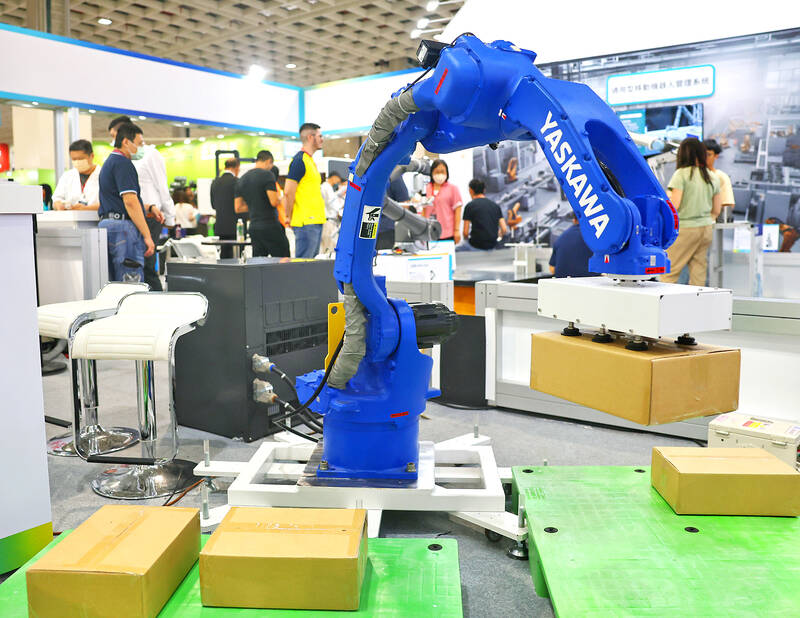

Photo: CNA

On an annual basis, machine tool exports dropped 4.5 percent last month, it said.

By destination, Taiwan’s machine tool exports last month declined nearly across the board, except for India and Turkey.

Exports to China (including Hong Kong), the sector’s main export market, fell 4.4 percent month-on-month to US$62.26 million and those to the US, the second-largest overseas market for Taiwan’s goods, dropped 3.3 percent to US$33.3 million last month, the association’s data showed.

Outbound shipments to other markets such as the Netherlands, Germany, Vietnam, Italy, Japan and Thailand registered monthly declines of 15.2 percent to 54.9 percent, the data showed.

However, exports to Turkey, the third-largest market, surged 52 percent to US$36.8 million and those to India, the fourth-largest, rose 29.1 percent to US$13.16 million, the data showed.

In the first nine months of this year, total machine tool exports fell 11.4 percent to US$1.98 billion compared with the same period last year, with metal-cutting machine tools dropping 10 percent, machine centers sinking 12.9 percent, pressing and shearing machines dipping 17 percent and metal-forming machine tools declining 19 percent, the data showed.

The Taichung-based association said that the outbreak of hostilities between Israel and Palestinian militant group Hamas, as well as the ongoing war between Ukraine and Russia, has triggered volatility in international crude oil prices, which is expected to increase global inflationary pressures and add more uncertainty to the machine tool market.

Another machinery association, the Taiwan Association of Machinery Industry (TAMI), yesterday said the Israel-Hamas conflict would have a limited impact on Taiwan’s machinery exports.

Taiwan’s machinery exports to Israel totaled US$129 million last year, accounting for a mere 0.4 percent of total outbound shipments, the Taipei-based group said.

However, the conflict in the Middle East could negatively affect Taiwan’s imports of semiconductor testing instruments and equipment from Israel, the ninth-largest importer of such goods last year, TAMI said.

Taiwan imported US$1.13 billion of semiconductor testing instruments and equipment from Israel last year, or 1.8 percent of total machinery imports, the group said.

TAMI said that the Israeli-Hamas war warrants further observation, as the Middle East, especially Turkey. is one of the major export destinations for Taiwanese machinery.

TAMI’s latest trade data, also released yesterday, showed that machinery exports — comprising inspection and testing equipment, electronic equipment and machine tools — last month fell 5.1 percent year-on-year, dropping for a 14th straight month due to the continued weakness in the global macroeconomic environment.

While the annual decline in exports was less than August’s 10.9 percent contraction, last month’s outbound shipments were still 4.9 percent lower than the previous month’s level, it said.

In the first nine months, machinery exports slid 17.1 percent year-on-year to US$22.04 billion, following an 18.4 percent fall in the first eight months, TAMI data showed.

The New Taiwan dollar is on the verge of overtaking the yuan as Asia’s best carry-trade target given its lower risk of interest-rate and currency volatility. A strategy of borrowing the New Taiwan dollar to invest in higher-yielding alternatives has generated the second-highest return over the past month among Asian currencies behind the yuan, based on the Sharpe ratio that measures risk-adjusted relative returns. The New Taiwan dollar may soon replace its Chinese peer as the region’s favored carry trade tool, analysts say, citing Beijing’s efforts to support the yuan that can create wild swings in borrowing costs. In contrast,

Nvidia Corp’s demand for advanced packaging from Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) remains strong though the kind of technology it needs is changing, Nvidia CEO Jensen Huang (黃仁勳) said yesterday, after he was asked whether the company was cutting orders. Nvidia’s most advanced artificial intelligence (AI) chip, Blackwell, consists of multiple chips glued together using a complex chip-on-wafer-on-substrate (CoWoS) advanced packaging technology offered by TSMC, Nvidia’s main contract chipmaker. “As we move into Blackwell, we will use largely CoWoS-L. Of course, we’re still manufacturing Hopper, and Hopper will use CowoS-S. We will also transition the CoWoS-S capacity to CoWos-L,” Huang said

Nvidia Corp CEO Jensen Huang (黃仁勳) is expected to miss the inauguration of US president-elect Donald Trump on Monday, bucking a trend among high-profile US technology leaders. Huang is visiting East Asia this week, as he typically does around the time of the Lunar New Year, a person familiar with the situation said. He has never previously attended a US presidential inauguration, said the person, who asked not to be identified, because the plans have not been announced. That makes Nvidia an exception among the most valuable technology companies, most of which are sending cofounders or CEOs to the event. That includes

INDUSTRY LEADER: TSMC aims to continue outperforming the industry’s growth and makes 2025 another strong growth year, chairman and CEO C.C. Wei says Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), a major chip supplier to Nvidia Corp and Apple Inc, yesterday said it aims to grow revenue by about 25 percent this year, driven by robust demand for artificial intelligence (AI) chips. That means TSMC would continue to outpace the foundry industry’s 10 percent annual growth this year based on the chipmaker’s estimate. The chipmaker expects revenue from AI-related chips to double this year, extending a three-fold increase last year. The growth would quicken over the next five years at a compound annual growth rate of 45 percent, fueled by strong demand for the high-performance computing