The IMF’s No. 2 official said that the war between Israel and Hamas could spur inflation and hamper global growth, if it turns into a wider conflict that causes a significant increase in oil prices.

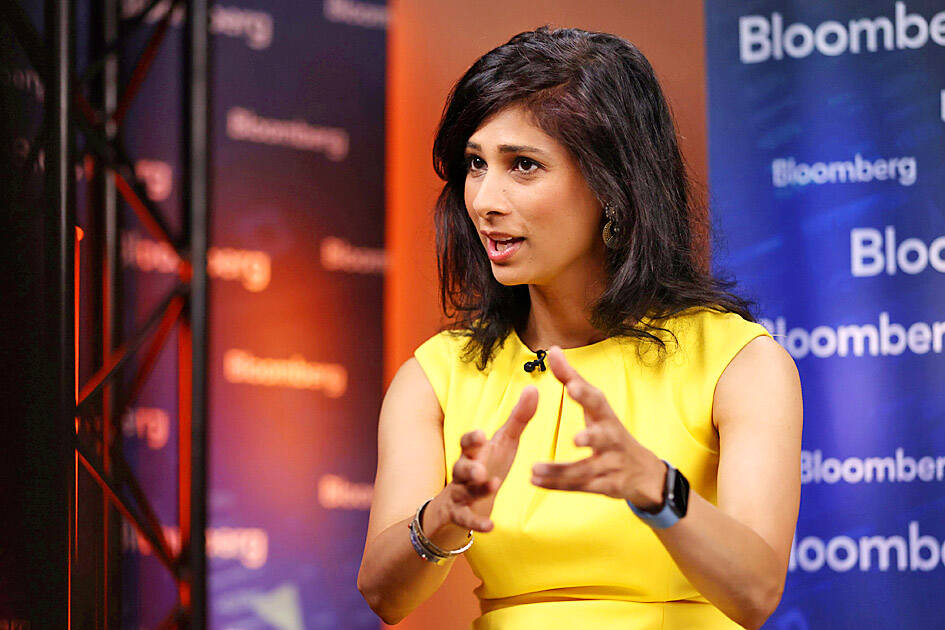

Modeling by the organization, whose mandate includes global economic surveillance, showed that a 10 percent increase in oil prices would lead to inflation being 0.4 percentage points higher a year later, IMF deputy managing director Gita Gopinath said in an interview on Bloomberg TV.

Under that scenario, global output would fall by 0.15 percentage points, which would add to an already difficult environment for inflation and growth that is challenging central banks.

Photo: Bloomberg

It is a bit early to know the full implications of the conflict, and much would depend on whether it draws in other countries, Gopinath said.

“If it turns into a wider conflict, and that causes oil prices to go up, that does have an effect on the economies,” she said. “That’s usually one of the channels through which we see that affecting global numbers.”

While nations in the Middle East are likely to be most directly affected, the impact from higher energy prices can become very widespread, Gopinath said.

More than 2,000 people have reportedly been killed since the start of the worst attack on Israel in decades. Israeli forces have since been battling to retake captured territory and signs are mounting that it is preparing for a ground invasion of Gaza.

Gopinath also spoke about China, debt restructuring issues and trade restrictions.

“[Beijing] cut interest rates, I expect that they’ll need to do more. Much more action needs to be done in terms of addressing the property sector problem,” she said.

She spoke of progress in making the debt restructuring process more efficient.

“We’ve seen low income countries that need to go through debt restructuring and it’s important to go through that in a timely manner. One goal of this week is to have a more efficient restructuring process,” Gopinath said.

Meanwhile, countries are placing more trading restrictions on each other. There were 3,000 new trade restrictions just last year.

“We really should make sure that this does not end up with all of us just turning inwards completely and a huge return to protectionism,” Gopinath said.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be