Following the closure of its intervention in the local stock market in mid-April, Taiwan’s National Financial Stabilization Fund reported that it had pocketed more than NT$6 billion (US$186 billion) in profit from its investments as of the end of last month, the Ministry of Finance (MOF) said yesterday.

The stabilization fund, which aims to mitigate market volatility, released the updated financial results in a fund committee meeting held earlier yesterday.

The committee said it had sold about 60 percent of the stocks bought during the intervention period that started on July 13 last year and ended on April 13 this year, and had posted a total of NT$5.33 billion in gains and received about NT$1.35 billion in cash dividends from its investments.

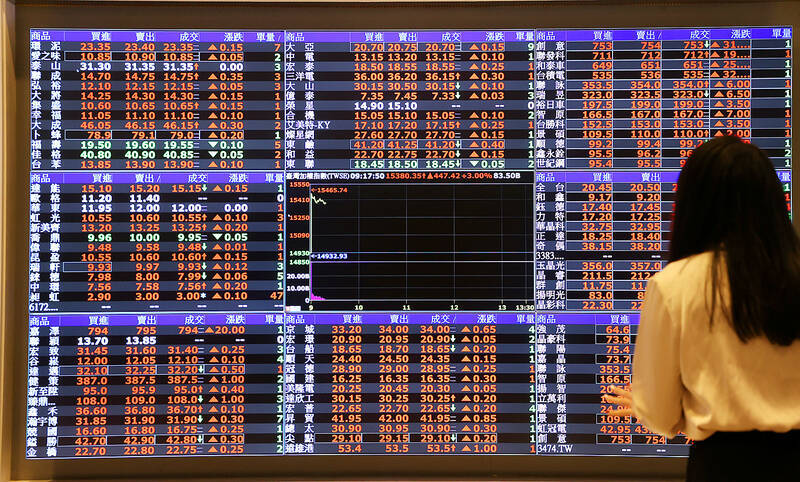

Photo: CNA

Net income as of the end of last month stood at NT$6.18 billion with a return rate of 19.63 percent, according to the ministry.

That intervention, the eighth ever, marked the stabilization fund’s longest market presence, a total of 275 days, including 181 trading sessions.

The intervention came after the TAIEX dipped below 14,000 points on July 12 last year amid escalating fears over rising interest rates in the US which were sending global financial markets into a tailspin.

During the intervention, the stabilization fund injected about NT$54.51 billion into the market to bolster share prices, the third-highest injection ever by the fund, the ministry said.

During that time, the TAIEX rose 13.29 percent, outperforming many foreign counterparts, it said.

Since the withdrawal from the local stock market, the TAIEX has risen 867.27 points, or 5.49 percent, ending at 16,672.03 yesterday, indicating that local shares have stayed stable despite the stabilization fund not currently intervening, the ministry said.

With Taiwan’s exports returning to a growth pattern last month, solid domestic demand and government measures to encourage investment, the local stock market is expected to stay stable, it said.

However, the ministry warned of the potential negative impacts of geopolitical risks and high inflation in the global markets, saying that the stabilization fund would continue to monitor the stock market closely and would make a prompt response if necessary.

The government set up the NT$500 billion stabilization fund in 2000 to serve as a buffer against unexpected external factors that might disrupt the local bourse.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to