Four Taiwanese companies which are alleged to be helping Chinese telecom firm Huawei Technologies Co (華為) build “infrastructure for an under-the- radar network of chip plants” are not supplying critical technologies to the Chinese client, which has been sanctioned by the US, Minister of Economic Affairs Wang Mei-hua (王美花) said yesterday.

Speaking with reporters, Wang said Taiwan’s law bars local companies from providing key technologies to China, while investing in the Chinese market, and to her knowledge, the four companies named in a Bloomberg report earlier in the day are not supplying any key technologies or equipment to Huawei.

According to an investigation by Bloomberg, the four Taiwanese companies, which have engaged in “unusual” cooperation with US-sanctioned Huawei were a subsidiary of chip material reseller Topco Scientific Co (崇越), a subsidiary of cleanroom equipment supplier L&K Engineering Co (亞翔), a subsidiary of construction specialist United Integrated Services Co (漢唐) and chemical supply system provider Cica-Huntek Chemical Technology Taiwan Co (矽科宏晟).

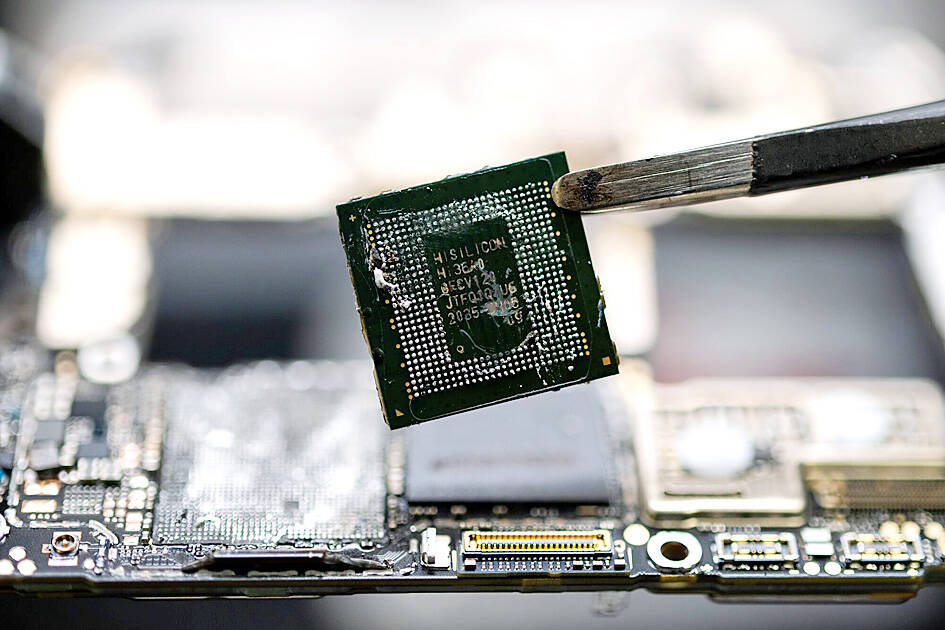

Photo: Bloomberg

“At a time when China threatens Taiwan regularly with military action for even contemplating independence, it’s unusual that members of the island’s most important industry may be helping US-sanctioned Huawei develop semiconductors to effectively break an American blockade,” the report said.

Bloomberg said the US sanctions against Huawei were called into question after the Chinese firm unveiled a smartphone in late August with an advanced made-in-China chip, which set off alarm bells in Washington with the US government urged by the US Congress to completely cut off Huawei and Shanghai-based contract chipmaker Semiconductor Manufacturing International Corp (中芯).

The report cited the Semiconductor Industry Association as saying Huawei has set up “its own shadow network of chipmakers” with the support of the Chinese government. In addition, Huawei has been relying on three little-known firms in Shenzhen -- Pengxinwei IC Manufacturing Co (鵬芯微), Pensun Technology Co (鵬新旭) and SwaySure Technology Co (昇維旭) -- to roll out chips based on its designs.

Wang said all Taiwanese investors in China should abide by not only Taiwan’s national security law but also keep a close eye on whether they violate US export control measures if the equipment they use is restricted by American rules.

Other officials said the ministry will continue to watch closely how Taiwanese firms do business with Huawei in a bid to protect their interests.

The officials reminded Taiwanese companies about the possible risks of doing business in China, adding that firms should observe US foreign direct product rules, or FDPR, which were first introduced in 1959 to control sales of US technologies.

In response to the Bloomberg report, United Integrated Services and Topco Scientific said they did not violate any laws when doing business in China.

United Integrated Services said since it was founded in 1982, all of its business and investments in China have adhered to Taiwan’s national policy.

While its subsidiary based in China’s Jiangxi Province was contracted by SwaySure Technology for construction projects in Shenzhen, United Integrated Services said the contracts were executed in accordance with law.

Topco Scientific said while it secured orders from Pensun Technology to provide environmental protection services in early last year, the project did not involve any critical technologies.

Topco Scientific emphasized that it did not provide any semiconductor raw materials or equipment to Pensun Technology, adding that the Chinese company had not been placed on the US sanctions list at the time the contracts were signed.

Topco Scientific said the contract with Pensun Technology will continue and undertook to prudently consider future cooperation with the Chinese firm.

L&K Engineering and Cica-Huntek Chemical Technology were not immediately available to comment on the Bloomberg report.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced