The nation’s three major science parks posted combined revenue of NT$1.8 trillion (US$55.8 billion) for the first half of the year, down 11.95 percent year-on-year, the National Science and Technology Council said in a report yesterday.

The council attributed the decline to sluggish end-market demand and industry-wide inventory adjustments amid high global inflation and interest rates, which negatively affected the business performance of companies in the three parks.

However, the first-half figure was still the second-highest ever for the same period on record, it said.

Photo: Wu Po-hsuan, Taipei Times

From January to June, Hsinchu Science Park (新竹科學園區) reported revenue contracted by 19.01 percent annually to NT$668.4 billion and the Central Taiwan Science Park (中部科學園區) posted revenue decline of 19.72 percent to NT$458.8 billion, while the Southern Taiwan Science Park (南部科學園區) saw revenue increase 3.81 percent to NT$677 billion in the same period, the report said.

The parks exported a combined NT$1.11 trillion of goods in the first six months of the year, down 15.69 percent from a year earlier, due to sustained inventory destocking in the supply chain and a high comparison base a year earlier, the council said.

Their combined imports rose 2.45 percent to NT$880.4 billion, as companies continued to build factories and expand production while increasing purchases of precision machinery and equipment from abroad, it said.

Overall, the three parks saw two-way trade fall 8.52 percent year-on-year to NT$1.99 trillion in the first half, it added.

The three parks had a record 323,532 employees, up 3.08 percent from 313,877 last year, the council said.

“Given high inflation and interest rate hikes, and the ongoing war between Russia and Ukraine, global demand was weak during the first half, which also affected orders received by companies in the science parks,” the report said. “However, the continued expansion by major manufacturers and the support of the world’s most advanced and high-value manufacturing processes offered a buffer to the downturn.”

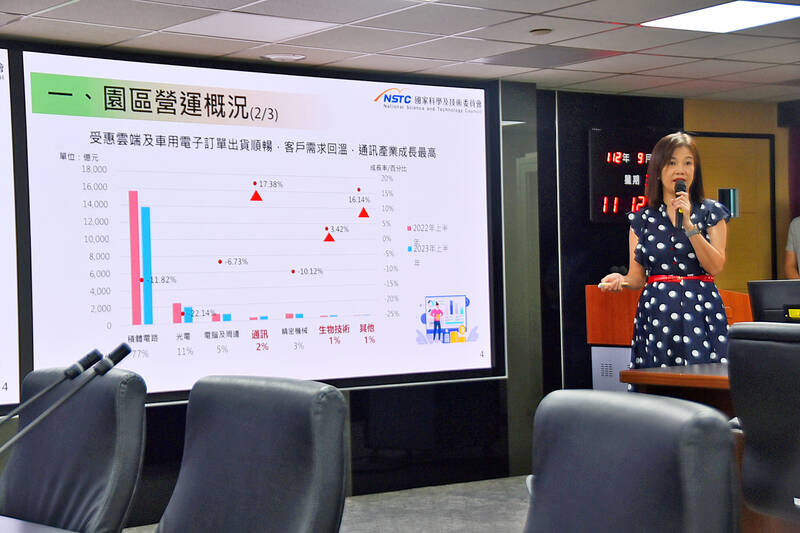

Of the six major industries in the parks, the communications industry placed first in terms of revenue growth, rising 17.38 percent year-on-year to NT$45.64 billion, followed by the biotechnology industry with an increase of 3.42 percent to NT$20.68 billion.

However, the optoelectronics industry’s revenue fell the most by 22.14 percent to NT$191.5 billion due to declining flat-panel prices, inventory adjustments and cooling demand in the end market, while the integrated circuit industry also posted revenue decline of 11.82 percent to NT$1.39 trillion, the report showed.

Meanwhile, the computer and peripherals industry’s revenue decreased 6.72 percent to NT$91.6 billion and the precision machinery industry’s sales dropped 10.12 percent to NT$59.05 billion, the report showed.

As global macroeconomic uncertainties remain in the second half of the year, the council forecast the three parks’ full-year revenue this year would fall slightly from the record number of NT$4.27 trillion last year, but it predicted communications and biotechnology industries’ revenues would continue hitting new highs.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) would not produce its most advanced technologies in the US next year, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. Kuo made the comment during an appearance at the legislature, hours after the chipmaker announced that it would invest an additional US$100 billion to expand its manufacturing operations in the US. Asked by Taiwan People’s Party Legislator-at-large Chang Chi-kai (張啟楷) if TSMC would allow its most advanced technologies, the yet-to-be-released 2-nanometer and 1.6-nanometer processes, to go to the US in the near term, Kuo denied it. TSMC recently opened its first US factory, which produces 4-nanometer

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

REACTIONS: While most analysts were positive about TSMC’s investment, one said the US expansion could disrupt the company’s supply-demand balance Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) new US$100 billion investment in the US would exert a positive effect on the chipmaker’s revenue in the medium term on the back of booming artificial intelligence (AI) chip demand from US chip designers, an International Data Corp (IDC) analyst said yesterday. “This is good for TSMC in terms of business expansion, as its major clients for advanced chips are US chip designers,” IDC senior semiconductor research manager Galen Zeng (曾冠瑋) said by telephone yesterday. “Besides, those US companies all consider supply chain resilience a business imperative,” Zeng said. That meant local supply would

Servers that might contain artificial intelligence (AI)-powering Nvidia Corp chips shipped from the US to Singapore ended up in Malaysia, but their actual final destination remains a mystery, Singaporean Minister for Home Affairs and Law K Shanmugam said yesterday. The US is cracking down on exports of advanced semiconductors to China, seeking to retain a competitive edge over the technology. However, Bloomberg News reported in late January that US officials were probing whether Chinese AI firm DeepSeek (深度求索) bought advanced Nvidia semiconductors through third parties in Singapore, skirting Washington’s restrictions. Shanmugam said the route of the chips emerged in the course of an