Taiwanese hold a neutral view of the property market next quarter, as cautious sentiment lingers amid economic uncertainty, but housing prices have found support in inflation, an Evertrust Rehouse Co (永慶房屋) survey released yesterday showed.

Almost 60 percent of respondents thought it would be unwise to join the market in the next six months, while nearly 40 percent said it would be better to wait until 2025, suggesting an extended slowdown in transactions, Evertrust research manager Daniel Chen (陳賜傑) said, citing the company’s quarterly survey.

Thirty-four percent said house prices would increase, while 31 percent expected price corrections, with high inflation believed to become a new norm, Chen said.

Photo: Hsu Yi-ping, Taipei Times

Respondents were conservative even though 79 percent said that the recent introduction of favorable lending terms for first-home buyers was helpful in bolstering people’s interest in buying property, he said.

“People by-and-large need more time to digest economic signals at home and abroad,” Chen said, referring to poor exports, capital flight, monetary tightening in advanced economies and international oil price increases.

Evertrust general manager Yeh Ling-chi (葉凌棋) said that while it is difficult to make projections at this point, things could grow more fluid next quarter before Taiwan elects a new president and lawmakers in January.

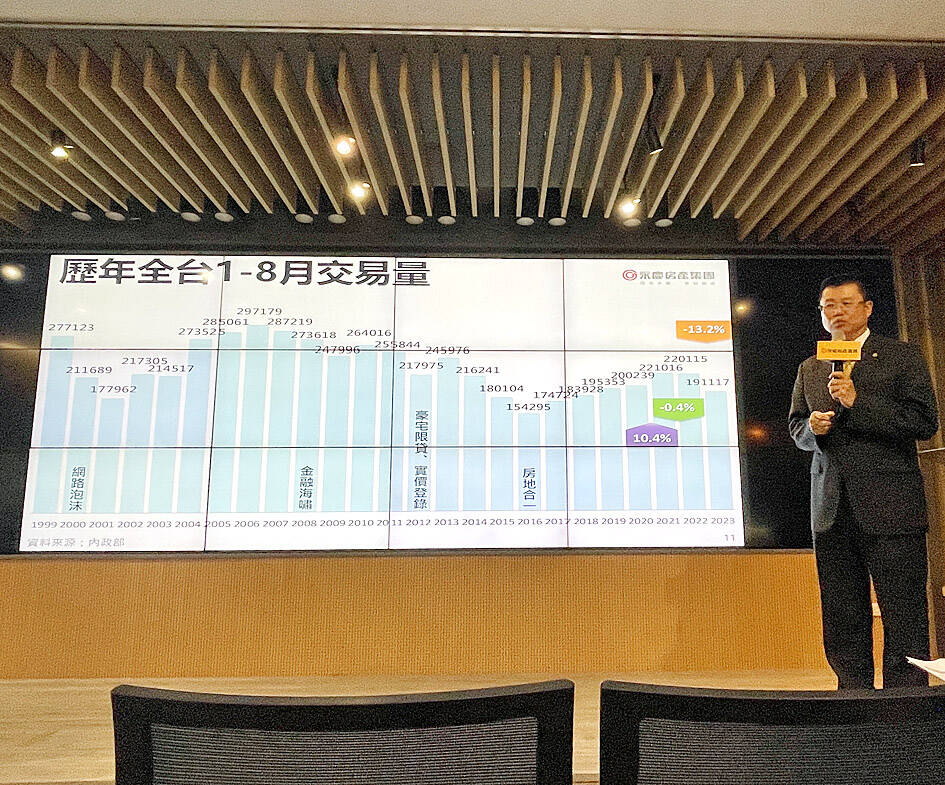

“Political uncertainty always warrants caution,” Yeh said, adding that Evertrust Rehouse, Taiwan’s largest broker by number of offices, stood by its earlier forecast that housing deals this year would shrink 8 to 11 percent to 283,000 to 293,000 units, despite a better-than-expected third quarter.

A low base accounts for the improvement in comparison values this quarter, Yeh added.

House prices grew a moderate 2 to 4.9 percent in major cities this quarter, as the mentality that real estate is the best defense against inflation supported prices, he said.

Expectations of price declines have not been realized and some buyers decided not to stay on the sidelines any longer, Yeh added.

Of the survey’s respondents, 83 percent said they supported the government’s plan to raise house taxes for people who own multiple homes next year, but they were concerned that it would prompt landlords to pass their extra tax burden on to their tenants.

Small and open, Taiwan’s economy is vulnerable to external influences, and the US’ dim economic outlook for next year would inevitably weigh on Taiwan’s exports, the nation’s main growth driver, Yeh said.

That explains why the public is generally not confident that the nation’s economy will recover next quarter, he said.

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down