The central bank yesterday kept its policy rate unchanged for the second straight quarter, saying that a rate pause would help support the economy, as consumer prices have moderated and would return to the 2 percent target next year.

“The board gave unanimous support to a policy hold, although some members voiced concern over lingering inflationary pressures and called for close monitoring,” central bank Governor Yang Chin-long (楊金龍) told a media briefing after its quarterly board meeting.

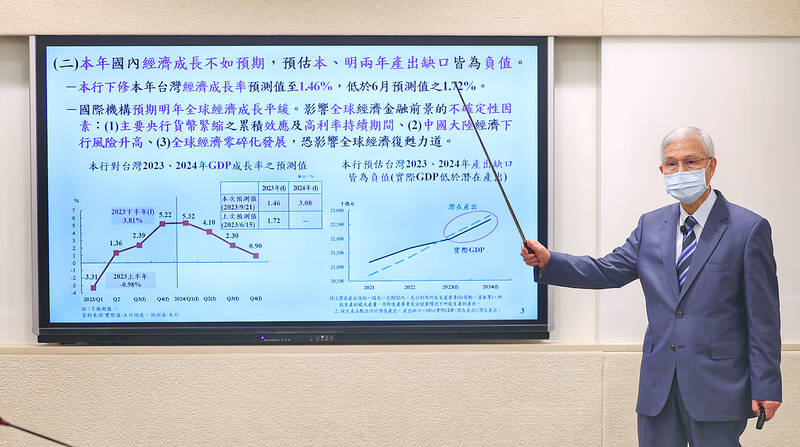

The consumer price index (CPI) would grow 1.83 percent next year, while core CPI after stripping out volatile items would advance a milder 1.73 percent, giving the central bank room to handle Taiwan’s negative output gaps or the lag between actual GDP and potential GDP.

Photo: CNA

However, Yang refused to equate the monetary policy decision as going loose, saying it would lean toward a tight stance for longer, taking cues from the US Federal Reserve’s hawkish rhetoric overnight.

The central bank again cut its forecast for the nation’s GDP growth this year from 1.72 percent to 1.46 percent, saying it is difficult to make projections due to dense economic uncertainties.

Ongoing restrictive monetary policy in the West curbs demand for goods and prolongs inventory adjustments, Yang said, adding that people in the post-COVID-19-pandemic era have shifted their resources away from purchases of technology products and assign more importance to in-person experiences.

The trend explains why prices for services picked up steeply at home and abroad, and are to blame for bolstering inflationary pressures, the top monetary official said.

“Demand for services will remain healthy ahead, but high comparison bases will weaken its ability to be the main CPI driver,” Yang said.

By contrast, inventory corrections, though turning out worse and longer than expected, are coming to an end, allowing Taiwan to breathe a sigh of relief and embark on a course of recovery from next quarter onward, the governor said.

GDP growth next year would improve to 3.08 percent, aided by a recovery in exports and private investment, its report showed.

Consumer spending would also continue to be the major growth driver, meaning the pace of improvement for exports would be limited.

The central bank did not introduce new credit controls for the property market, saying previous measures had borne fruit judging by a slowdown in property transactions and house prices, as well as house and construction loans.

“Credit controls are intended to prevent funds from overflowing to the property sector, create real-estate bubbles and threaten the stability of financial markets,” Yang said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) would not produce its most advanced technologies in the US next year, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. Kuo made the comment during an appearance at the legislature, hours after the chipmaker announced that it would invest an additional US$100 billion to expand its manufacturing operations in the US. Asked by Taiwan People’s Party Legislator-at-large Chang Chi-kai (張啟楷) if TSMC would allow its most advanced technologies, the yet-to-be-released 2-nanometer and 1.6-nanometer processes, to go to the US in the near term, Kuo denied it. TSMC recently opened its first US factory, which produces 4-nanometer

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

REACTIONS: While most analysts were positive about TSMC’s investment, one said the US expansion could disrupt the company’s supply-demand balance Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) new US$100 billion investment in the US would exert a positive effect on the chipmaker’s revenue in the medium term on the back of booming artificial intelligence (AI) chip demand from US chip designers, an International Data Corp (IDC) analyst said yesterday. “This is good for TSMC in terms of business expansion, as its major clients for advanced chips are US chip designers,” IDC senior semiconductor research manager Galen Zeng (曾冠瑋) said by telephone yesterday. “Besides, those US companies all consider supply chain resilience a business imperative,” Zeng said. That meant local supply would

Servers that might contain artificial intelligence (AI)-powering Nvidia Corp chips shipped from the US to Singapore ended up in Malaysia, but their actual final destination remains a mystery, Singaporean Minister for Home Affairs and Law K Shanmugam said yesterday. The US is cracking down on exports of advanced semiconductors to China, seeking to retain a competitive edge over the technology. However, Bloomberg News reported in late January that US officials were probing whether Chinese AI firm DeepSeek (深度求索) bought advanced Nvidia semiconductors through third parties in Singapore, skirting Washington’s restrictions. Shanmugam said the route of the chips emerged in the course of an