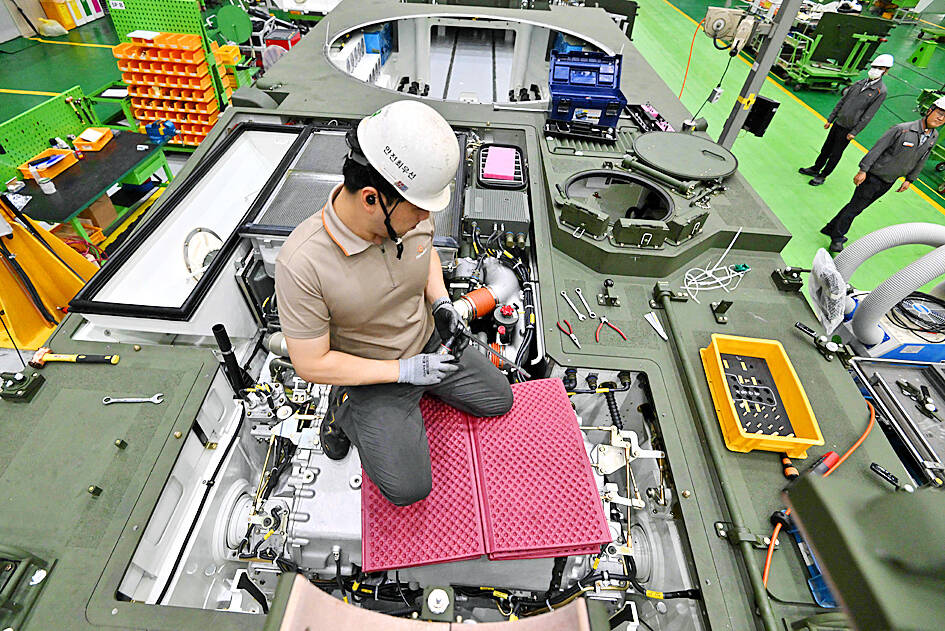

At a sprawling South Korean arms factory on Friday, a high-tech production line of robots and super-skilled workers were rapidly churning out weapons that could, eventually, play a role in Ukraine.

Since the Russian invasion last year, the Hanwha Aerospace factory in the southern city of Changwon has expanded production capacity three times, workers told reporters, as South Korea ramps up arms exports while traditional behemoths like the US struggle with production shortages.

Longstanding domestic policy bars Seoul from selling weapons into active conflicts, but even so it signed deals worth US$17.3 billion last year, including a US$12.7 billion agreement with NATO member and key Kyiv ally Poland, for K9 howitzers, K2 tanks and more.

Photo: AFP

And with North Korean leader Kim Jong-un in Russia touring space centers and weapons factories, experts say the South might be forced to review its careful balancing act on the Ukraine war — which Seoul has condemned, even as it resists calls to supply weapons directly to Kyiv.

On the assembly line were rows of Warsaw-bound howitzers, an artillery weapon a bit like a super-mobile cannon.

Hanwha Aerospace, South Korea’s largest defense contractor, is racing to meet delivery targets for the 14-wheeled, 47-tonne K9 howitzers, which have a firing a range of 40km — much longer than a tank, although the K9 needs to be stationary to shoot.

Photo: AFP

Poland ordered 212 K9s last year and Seoul has already delivered 48 of them — a pace “no one else can achieve,” said Lee Kyoung-hun, Hanwha’s production leader.

QUICK DELIVERY

“We are capable of delivering products in the shortest time frame possible,” Lee said, adding that it took between three and four months to build one howitzer from scratch.

Seoul has long harbored ambitions to join the ranks of the world’s top arms exporters — aiming to be the fourth-largest, behind the US, Russia and France — something that is now possible, industry research indicates.

It has already sold artillery shells to Washington — but with a “final user” agreement in place meaning the US would be the military that uses the munitions.

Experts have said this allows the US to then provide their own shells to Kyiv.

‘READY FOR WAR’

South Korea’s arms industry has one key advantage over others globally: It has always been “ready for war,” said Choi Dong-bin, Hanwha Aerospace’s senior vice president.

Hostilities in the 1950 to 1953 Korean War ended with an armistice, not a peace treaty, and Seoul remains technically at war with nuclear-armed Pyongyang.

This gives the country an advantage globally in weapons production, Choi said, as Seoul has the capacity to mass-produce quickly and easily whenever it gets an order.

“The fact that we’re maintaining production line is another boon. At this moment we’re receiving many orders from overseas and we are able to respond quickly to their demands and deliver products in a short period of time,” he said.

Seoul’s weapons are also well tested.

“These are deployed on the ground,” on one of the world’s most heavily fortified borders, Choi said. “Because they are deployed [in South Korea], it has the capacity to perform in any part of the world.”

Heavily sanctioned North Korea lacks Seoul’s high-tech weaponry, but it does have stockpiles of outdated Soviet-era munitions.

Kim met Russian President Vladimir Putin on Wednesday, and experts have warned that the internationally isolated pair might have agreed to a deal involving Pyongyang supplying artillery shells and anti-tank missiles in exchange for satellite technology from Moscow.

Any such deal could change Seoul’s calculations, experts say, as although South Korea has condemned Russia’s invasions of Ukraine, it has resisted calls to step up support to Kyiv, in part as it has long called on Moscow to help manage Kim.

However, if Moscow starts buying weapons from Pyongyang — something that would violate rafts of UN sanctions — it could change the course of the Ukraine war and force Seoul’s hand, said Choi Gi-il, a professor of military studies at Sangji University in Wonju, South Korea.

“If that were to happen, I think it will be more than 50-50 probability that South Korea-manufactured weapons exported to Poland would be deployed to help Ukraine fend off the Russians,” Choi said.

‘GREAT VALUE’

The export of South Korean weaponry, especially the K9 howitzers, would be “of great value to Kyiv,” he said.

“It’s always better to have more howitzers in war and both Russia and Ukraine don’t have enough of them,” he said, adding that Ukraine was mostly using Soviet-era outdated weapons.

“But K9s stand out as among the most recent, overwhelming conventional weapons,” he added. “It will mean so much for Kiev to have them on the frontlines.”

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his