A walkout by more than 12,000 autoworkers yesterday could slow an outperforming US economy should it drag on — even risking the first monthly net drop in payroll employment in nearly three years — but is unlikely on its own to trigger a recession.

Economists see the most immediate risk to activity concentrated in the auto sector itself, which only this year got back on its feet after two years when COVID-19 pandemic-related supply chain bottlenecks hampered vehicle output. With dealer inventories restrained, sales of new cars and trucks slumped even as consumer demand remained strong.

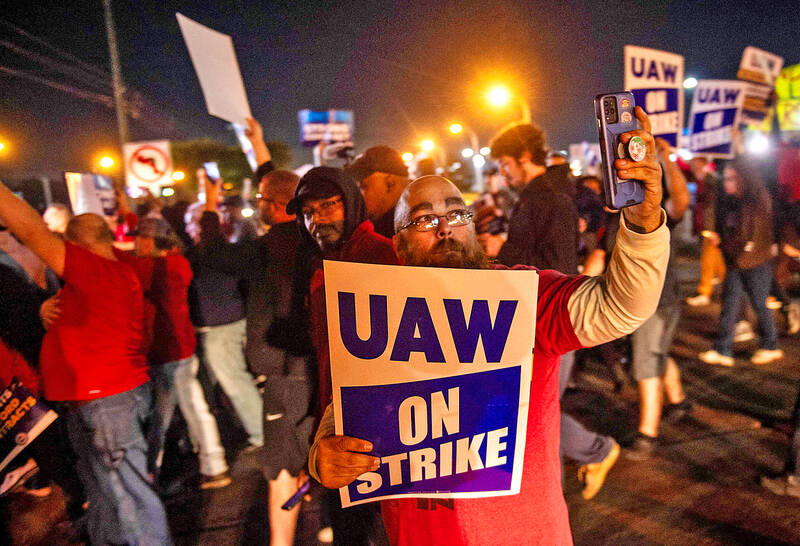

After failing to reach a deal on a new contract with Detroit’s “Big Three” automakers, General Motors, Ford and Stellantis, the United Auto Workers (UAW) union yesterday went on strike at three plants in three states. The stoppage for now affects about 12,700 hourly employees.

Photo: AFP

Should it widen in the weeks ahead to include all 146,000 UAW members at the three companies, it could become the largest automotive industry strike in a quarter century — since more than 150,000 GM workers went off the job for nearly two months in 1998.

That would put “at risk half a billion dollars per day in an economy that generates more than US$26.7 trillion in goods and services each year, or more than US$73 billion per day,” RSM chief US economist Joe Brusuelas estimated this week.

RSM estimated the US economy would suffer a modest 0.2 percent drag to annualized growth of GDP this quarter should the strike action last for a month, Brusuelas said.

“While that amount is large in nominal dollar terms, it would not be large enough to tip the economy into recession. In the end, the impact of a such a strike would be modest compared to previous generations,” Brusuelas said.

Other economists offered comparable estimates of the potential drag from a prolonged strike by the Big Three’s full union membership.

The US economy this year has dodged what was a consensus expectation for falling into recession in the face of aggressive interest rate hikes by the US Federal Reserve to rein in the highest inflation in four decades.

In fact, growth in GDP motored along at an above-trend rate of just above 2 percent annualized through the first six months of the year, and indicators of activity so far in the third quarter suggest it has accelerated further.

That said, activity in some sectors — manufacturing in particular — has recently slowed or even stalled, and a historically hot job market has cooled over the summer.

A full-blown strike “could push US payroll growth temporarily negative,” Michael Pearce, lead US economist at Oxford Economics, wrote on Wednesday.

While this was the survey week for the US Department of Labor’s monthly nonfarm payrolls report for this month, the fact that union members were on the job for most of the week ahead of the walkout means they would be counted as employed for this month’s report, Pearce said.

That means any recorded knock to employment would likely not occur until next month, should the strike last that long, and that would not be reported until early November.

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

Prices of gasoline and diesel products at domestic gas stations are to fall NT$0.2 and NT$0.1 per liter respectively this week, even though international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices continued rising last week, as the US Energy Information Administration reported a larger-than-expected drop in US commercial crude oil inventories, CPC said in a statement. Based on the company’s floating oil price formula, the cost of crude oil rose 2.38 percent last week from a week earlier, it said. News that US President Donald Trump plans a “secondary