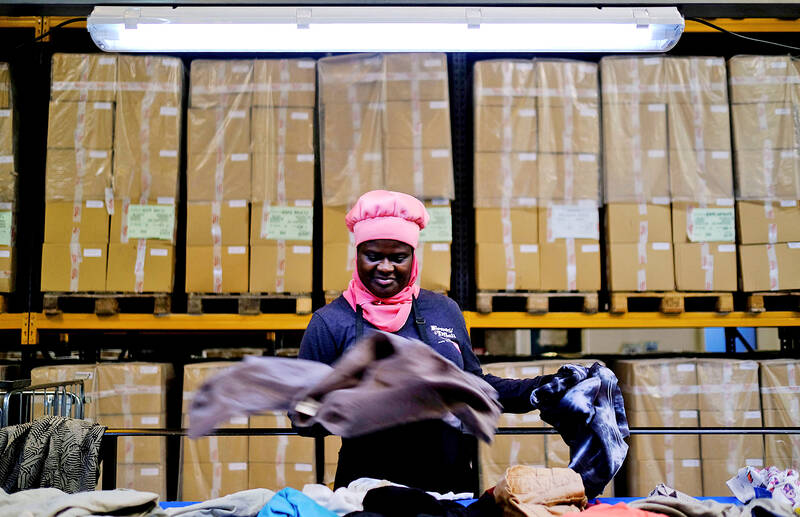

In a warehouse on the outskirts of Barcelona, Spain, women stand at conveyor belts, manually sorting T-shirts, jeans and dresses from large bales of used clothing — a small step toward tackling Europe’s towering problem of discarded fashion.

Within a year, the sorting center run by garment reuse and recycling charity Moda Re plans to double the volume it handles to 40,000 tonnes annually.

“This is just the beginning,” said Albert Alberich, director of Moda Re, which is a part of the Spanish charity Caritas Internationalis and runs Spain’s largest second-hand clothing chain. “Increasingly we are going to turn used clothes into raw material from Europe for fashion companies.”

Photo: Reuters

Partly funded by Zara owner Industria de Diseno Textil SA (Inditex), Moda Re is to expand sites in Barcelona, Bilbao and Valencia, in some of the first signs of a planned ramp-up in garment sorting, processing and recycling capacity in response to a barrage of new EU proposals to curb the fashion industry.

Also in Spain, rivals including Hennes & Mauritz AB (H&M), Mango and Inditex have created a nonprofit association to manage clothing waste, responding to an EU law requiring member states to separate textiles from other waste from January 2025.

Despite such efforts, fewer than one-quarter of Europe’s 5.2 million tonnes of clothing waste are recycled, and millions of tonnes end up as landfill every year, the European Commission said in July.

Precise data on the growth of clothing waste is scarce, but collection for recycling and reuse increased gradually in several European countries from about 2010, a 2021 EU report said.

Fast fashion, or making and selling cheap clothes with a short lifespan, is “highly unsustainable,” the commission said in July.

The textile industry is a major contributor to climate change and environmental damage, it added.

Inditex, which in March said it placed 10 percent more items of clothing on the market globally last year than in 2021, aims to use 40 percent recycled fibers in garments by 2030 as part of sustainability goals announced in July.

“The main problem that we are facing is overconsumption,” said Dijana Lind, environmental, social and governance analyst at Union Investment, a Frankfurt, Germany-based asset manager that holds shares in Adidas AG, Hugo Boss AG, Inditex and H&M.

Lind said that she had been engaging with Adidas, Hugo Boss and Inditex about the need for those companies to increase their use of recycled textiles, and for the apparel industry as a whole to increase textile recycling.

Hugo Boss said in a statement that “overproduction and overconsumption are, in general, an industry-wide problem,” adding that it was using data analysis to better adjust production to demand.

Between 6 billion and 7 billion euros (US$6.46 billion and US$7.54 billion) of investment would be needed by 2030 to create the scale of textile waste processing and recycling that the EU is aiming for, consultancy McKinsey & Co said in a report last year.

Reuters could not establish what level of investments were currently being made in the industry.

Lind said that companies had introduced some first steps, but “more needs to be done.”

Inditex said that it would invest 3.5 million euros in Moda Re over three years and had recycling containers in all its Spanish stores. It did not respond to a request for comment on the suggestion it needed to do more.

In a statement, H&M said it recognized it was “part of the problem.”

“The way fashion is produced and consumed needs to change — this is an undeniable truth,” H&M said.

The obstacles to significantly reducing clothing waste are formidable, despite the EU crackdown, industry sustainability commitments and initiatives such as the Moda Re expansion.

Hundreds of similar plants, along with investment in technology and market interventions would be needed to meet industry goals to recycle 2.5 million tonnes of textile waste by 2030, McKinsey said in the report.

Fourteen textile recycling companies in Europe have plans to increase their production capacity, said Fashion For Good, a recycled fiber start-up investment company that surveyed 57 recyclers for a report released in September last year.

The EU has not set specific targets for recycled content in garments, but by 2030 aims for all textile products sold in the bloc “to a great extent” be made of recycled fibers, as well as being durable, repairable and recyclable.

To create the capacity to meet the goals, ReHubs Europe, an association set up by garment lobby group EURATEX, promotes investments in “fiber-to-fiber” recycling: processes that turn used garments into yarn to make new textiles.

EURATEX did not immediately respond to a question about the level of investments made in the technology. Fewer than 1 percent of clothes are recycled in this manner and the processes are still being developed. Challenges include separating different types of fiber into feedstock suitable for recycling.

With such techniques still in their infancy, the higher cost of recycled fabric compared to new fabric remains a barrier to widespread adoption.

At the Barcelona plant, garments arrive from more than 7,000 donation bins in supermarkets and Zara and Mango stores.

Infrared machines donated by Inditex identify the fiber makeup of garments to speed up the largely manual sorting.

About 40 percent of the clothes Moda Re receives are sent to other facilities for recycling. Of that, just one-fifth is recycled fiber-to-fiber, a share that Moda Re said it expects to grow to 70 percent over the next three to four years.

For now, most of the recycling is instead for lower grade products such as dishcloths.

Almost half the clothes donated to Moda Re are shipped for resale in African countries including Cameroon, Ghana and Senegal. Moda Re says the clothes it exports can be reused.

UN trade data showed that the EU exported 1.4 million tonnes of used textiles last year, more than twice as much as in 2000.

Not all those clothes get reused, and exports of used clothes from Europe to Africa can lead to pollution when clothes that cannot be resold end up in dumps, the EU has said.

Proposed European Commission rules seek to clamp down on unscrupulous operators that export damaged items destined for dumps, and would require countries to demonstrate their ability to manage the material sustainably.

Moda Re said it aims to reduce the volume of clothes it sends to Africa.

Only 8 percent of the donations are resold at Moda Re’s secondhand shops, the method widely seen as the more efficient way of reusing old clothes. A similar amount ends up as European landfill.

The company aims to double the amount it resells by expanding to 300 secondhand shops in Spain over the next three years from just more than 100 presently, it said.

Despite the challenges, employees at Moda Re said they felt their work was positive.

“We take the clothes that have been thrown away to make new clothes,” said Aissatou Boukoum, a young Senegalese worker, feeding garments through a machine that slices them into ribbons to be sent for recycling. “For me, it is good.”

As well as the efforts by Inditex, Puma SE has partnerships with garment collecting and sorting companies I:CO in Germany, TEXAID Textilverwertungs AG in Switzerland and Vesti Solidale in Italy.

Adidas, Bestseller AS and H&M have invested in Finnish start-up Infinited Fiber Co Oy, which manufactures fiber out of textile waste, cardboard and paper.

The European Commission’s legislative push includes rules to make retailers contribute to the cost of collecting used clothes for reuse and recycling.

Under the proposed rules, retailers would pay a fee of about 0.12 euros per item for each garment sold in the bloc, with higher rates for garments that are harder to recycle, the commission said in July.

As in Spain, textile waste associations would be set up in each country. In France this system has already been in place since 2008 under an organization called Refashion.

Reuters asked 10 leading fashion companies including Adidas, H&M and Primark Stores Ltd how the fees would affect their profitability. None provided an estimate. All said they hoped the fees would be the same across the EU.

“It’s a tsunami of legislation,” EURATEX sustainable businesses director Mauro Scalia said.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

EARLY TALKS: Measures under consideration include convincing allies to match US curbs, further restricting exports of AI chips or GPUs, and blocking Chinese investments US President Donald Trump’s administration is sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new US president plans to expand efforts that began under former US president Joe Biden to limit Beijing’s technological prowess. Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd and ASML Holding NV engineers from maintaining semiconductor gear in China, people familiar with the matter said. The aim, which was also a priority for Biden, is to see key allies match China curbs the US

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

STRUGGLING TO SURVIVE: The group is proposing a consortium of investors, with Tesla as the largest backer, and possibly a minority investment by Hon Hai Precision Nissan Motor Co shares jumped after the Financial Times reported that a high-level Japanese group has drawn up plans to seek investment from Elon Musk’s Tesla Inc to aid the struggling automaker. The group believes the electric vehicle (EV) maker is interested in acquiring Nissan’s plants in the US, the newspaper reported, citing people it did not identify. The proposal envisions a consortium of investors, with Tesla as the largest backer, but also includes the possibility of a minority investment by Hon Hai Precision Industry Co (鴻海精密) to prevent a full takeover by the Apple supplier, the report said. The group is