Hong Kong is betting free alcohol and longer shopping hours can revive the territor’s once-bustling nightlife.

The government has been in discussions with major property groups to encourage them to roll out measures to boost the nighttime economy, including extending mall operating hours, said Allan Zeman, a nightclub baron and adviser to Hong Kong Chief Executive John Lee (李家超).

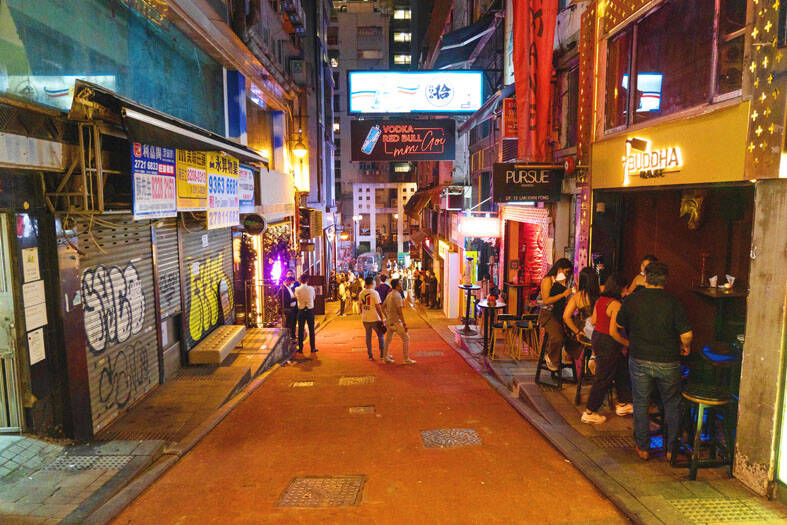

Lan Kwai Fong Holdings Ltd (蘭桂坊集團), which owns the bulk of Hong Kong’s largest party district, plans to offer flash discounts on some weekday evenings next month and set up street performances by DJs, Zeman said.

Photo: Bloomberg

Other property firms say they are going to distribute drink and shopping vouchers, and hold nighttime events in the push to reignite sluggish tourism and consumer sectors hurt by COVID-19.

This year was meant to herald Hong Kong’s grand reopening to the world after final virus curbs were scrapped and cross-border travel with China fully resumed.

However, officials’ “Hello Hong Kong” campaign to entice tourists is falling flat, and instead of throngs of shoppers and club-goers, the territory’s best-known retail and nightlife districts are a shadow of their former selves.

Domestic pressures are also mounting. Harsh COVID-19 controls and the National Security Law have sparked a wave of emigration since 2020, and residents are flocking to holiday hotspots such as Thailand and Japan or splashing their cash on day trips to Shenzhen.

“The vanished night economy is a symptom of a deeper problem that Hong Kong is facing,” Natixis SA senior economist Gary Ng (吳卓殷) said.

While “regional peers focused on improving tourism quality in the past two years, Hong Kong was busy thinking and spending resources on how to restrict mobility,” meaning the territory might find it hard to regain its competitiveness, he said.

Hong Kong’s tourist arrivals in the first half of this year were about 37 percent of pre-COVID-19 levels, compared with 57 percent for the neighboring casino hub of Macau, official statistics showed.

Yet there are signs of an uptick, with Hong Kong hitting 53 percent of 2019 levels in June and Macau reaching 71 percent.

Still, about 80 percent of Hong Kong’s arrivals come from China and those visitors are grappling with a worsening economic outlook and a weak yuan that is eroding their consumer confidence, according to Michael Cheng (鄭煥然), China and Hong Kong consumer markets leader for PwC Asia Pacific.

Some venues are managing to weather the downturn.

Zeman said his group’s business, which is largely concentrated on bars and restaurants in tourist areas of Hong Kong, has been recovering well, and some tenants are seeing year-to-date sales that exceed pre-COVID-19 levels by as much as 20 percent.

Yet many others, particularly those operating outside of the central areas popular with visitors, are struggling. Castelo Concepts shut nine of its 14 Hong Kong restaurants in July as it entered liquidation.

Louie Chung (鍾思朗), owner of Lubuds, which operates more than 40 restaurants across Hong Kong including in more residential neighborhoods, said that revenue last month registered a double-digit drop from a year earlier.

“The evening business in July and August is the quietest in my 17 years in the food and drinks industry,” Chung said.

For the territory as a whole, sales from restaurants’ evening dine-in operations last month and this month plunged an average of 30 percent year-on-year, partly due to more residents heading to Chinese cities for weekend visits or even just after-work shopping and eating, Hong Kong Federation of Restaurants and Related Trades president Simon Wong (黃家和) said.

That is spurring the effort to get people into bars, restaurants and shopping malls. Chinachem Group (華懋集團) is hosting a three-day music festival at Central Market, a historic building near the heart of the financial district that was reopened in 2021 as a cultural and retail hub. The venue, which usually closes at 10pm, is to ask bars to stay open until midnight for the event.

Meanwhile, Robert Ng’s (黃志祥) Sino Land Co (信和置業) is planning to distribute 10,000 vouchers for free drinks for people who spend a certain amount of money at its malls after 8pm. Henry Cheng’s (鄭家純) New World Development Co (新世界發展) is also considering extending its malls’ operating hours and hosting events at night to attract customers, while Lee Shau-Kee’s (李兆基) Henderson Land Development Co (恆基地產) plans to give out shopping vouchers.

However, those efforts, however, are unlikely to be enough to address the core hurdle Hong Kong’s retail and food and beverage industries face, Ng said.

“The night economy is demand-driven,” he said. “If there is no demand, no measure the government is taking right now can boost it.”

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

The US Federal Reserve is expected to announce a pause in rate cuts on Wednesday, as policymakers look to continue tackling inflation under close and vocal scrutiny from US President Donald Trump. The Fed cut its key lending rate by a full percentage point in the final four months of last year and indicated it would move more cautiously going forward amid an uptick in inflation away from its long-term target of 2 percent. “I think they will do nothing, and I think they should do nothing,” Federal Reserve Bank of St Louis former president Jim Bullard said. “I think the

SUBSIDIES: The nominee for commerce secretary indicated the Trump administration wants to put its stamp on the plan, but not unravel it entirely US President Donald Trump’s pick to lead the agency in charge of a US$52 billion semiconductor subsidy program declined to give it unqualified support, raising questions about the disbursement of funds to companies like Intel Corp and Taiwan Semiconductor Manufacturing Co (台積電). “I can’t say that I can honor something I haven’t read,” Howard Lutnick, Trump’s nominee for commerce secretary, said of the binding CHIPS and Science Act awards in a confirmation hearing on Wednesday. “To the extent monies have been disbursed, I would commit to rigorously enforcing documents that have been signed by those companies to make sure we get