As it seeks to pull off what could the largest initial public offering (IPO) of the year, Arm Holdings Ltd spent more than 3,500 words explaining the risks it faces in China, a critical market that accounts for about one-quarter of its revenue.

In a chunky section of the IPO filing’s 330-page prospectus, the British designer of chips detailed a litany of challenges in the nation: a concentration of business in the People’s Republic of China (PRC) that “makes us particularly susceptible to economic and political risks affecting the PRC”; a downward spiral in Asia’s biggest economy; rising political tensions with the US and the UK, and the potential complete loss of control over its pivotal Chinese subsidiary.

Arm runs most of its China business through an independent unit, called Arm Technology (China) Co (安謀科技中國), which is its single largest customer and accounted for about 24 percent of its sales in the year that ended in March, but Arm and its parent, Japan’s Softbank Group Corp, do not control that business.

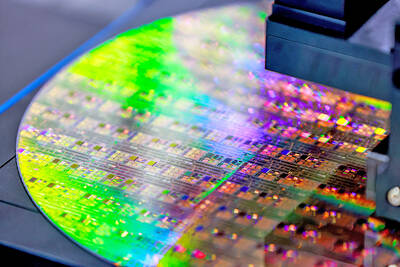

Photo: Reuters

Instead, Softbank owns approximately 48 percent of Arm China, with the majority held by local investors, including entities affiliated with Allen Wu (吳雄昂), Arm China’s former chief executive officer who was fired over allegations of conflicts of interest in 2020. The prolonged power struggle still leaves open the risk of leadership changes and affects regional operations.

“We depend on our commercial relationship with Arm China to access the PRC market,” the filing says. “If that commercial relationship no longer existed or deteriorates, our ability to compete in the PRC market could be materially and adversely affected.”

More immediately, a slowdown in the world’s biggest smartphone market and manufacturing hub, as well as steps by the US and its allies to limit China’s access to leading-edge technology, are eating into sales. Arm had to sell architecture for lower-performance chips in China, the company said.

Arm’s royalty revenue growth in China slowed in the last fiscal year, and the company warned that royalty revenue and licensing revenue could take further hits.

Arm’s biggest customers include Apple Inc, which relies on China for close to 20 percent of its revenue every year, with its major hardware lines all powered by Arm-based processors. Leading mobile chipmakers Qualcomm Inc and MediaTek Inc (聯發科) sell the bulk of their chips, built on Arm designs, to Chinese smartphone makers.

The Cambridge-based company depends on a handful of companies for a majority of its sales. Five entities, including Arm China, accounted for a combined 57 percent of Arm’s total revenue for the fiscal year that ended on March 31, the filing says.

“A significant portion of our total revenue comes from a limited number of customers, which exposes us to greater risks than if our customer base were more diversified,” the filing says.

Arm is expected to target a valuation of US$60 billion to US$70 billion in its IPO, Bloomberg News has reported.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September