Global index provider MSCI yesterday announced that it is to trim Taiwan’s weighting in two of its indices after the trading session ends on Aug. 31.

It is to reduce Taiwan’s position in the MSCI Emerging Markets Index by 0.12 percentage points, to 15.4 percent from 15.52 percent, while lowering its rating in the MSCI All-Country Asia ex-Japan Index by 0.21 percentage points, to 17.67 percent from 17.88 percent, it said on its Web site.

Taiwan’s score on the MSCI Global Standard Indexes would hold steady at 1.65 percent following its latest quarterly review, it said.

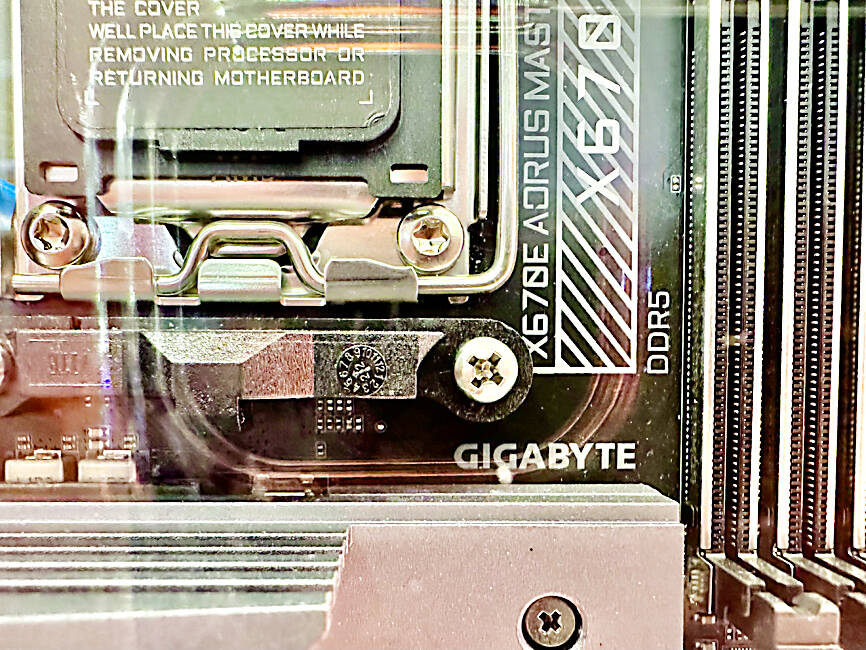

Photo: Fang Wei-chieh, Taipei Times

MSCI reviews its portfolio in February, May, August and November each year, with the moves closely watched by the investment community because many mutual funds and exchange-traded funds use the indices as benchmarks.

Meanwhile, MSCI is to add Gigabyte Technology Co (技嘉), a leading graphics card vendor for artificial intelligence (AI) applications, to the global standard indices and ditch Win Semiconductors Corp (穩懋半導體), the world’s largest pure-play gallium arsenide foundry, MSCI said.

Win Semiconductors would join the MSCI Global Small Cap Indexes, it said.

The switches were widely expected, as Gigabyte’s shares have more than doubled in the past few months on the back of an AI craze, despite lackluster revenue.

The New Taipei City-based company’s sales last month fell 9.9 percent from a month earlier to NT$8.69 billion (US$273.29 million), but rose 16.9 percent from a year earlier, a company stock filing showed.

Gigabyte chairman Dandy Yeh (葉培城) said that the company is upbeat about its server business this year, but is cautious about personal computers and peripheral products.

Demand for servers would be more evident in the second half, Yeh said.

Gigabyte’s weighting would climb to 0.48 percent as a result of adjustments that would heighten volatility for underlying assets and trading sessions, the Taiwan Stock Exchange said yesterday.

The MSCI Taiwan Index would retain a list of 90, with modest changes for the weightings of 21 firms, MSCI said.

MSCI would add 16 Taiwanese stocks to the MSCI Global Small Cap Indexes, including smartphone camera lens supplier Ability Opto-Electronics Technology Co (先進光電), clean room engineering service provider Acter Group Corp (聖暉), The Ambassador Hotel Ltd (國賓), Central Reinsurance Corp (中央再保險) and power management solution supplier Channel Well Technology Co (僑威科技), it said.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors