US President Joe Biden is planning to sign an executive order to limit critical US technology investments in China by the middle of next month, according to people familiar with the internal deliberations.

The order focuses on semiconductors, artificial intelligence and quantum computing. It would not affect any existing investments and would only prohibit certain transactions. Other deals would have to be disclosed to the government.

The timing for the order, slated for the second week of next month, has slipped many times before, and there is no guarantee it would not be delayed again, but internal discussions have already shifted from the substance of the measures to rolling out the order and accompanying rule, said the sources, who spoke on condition of anonymity.

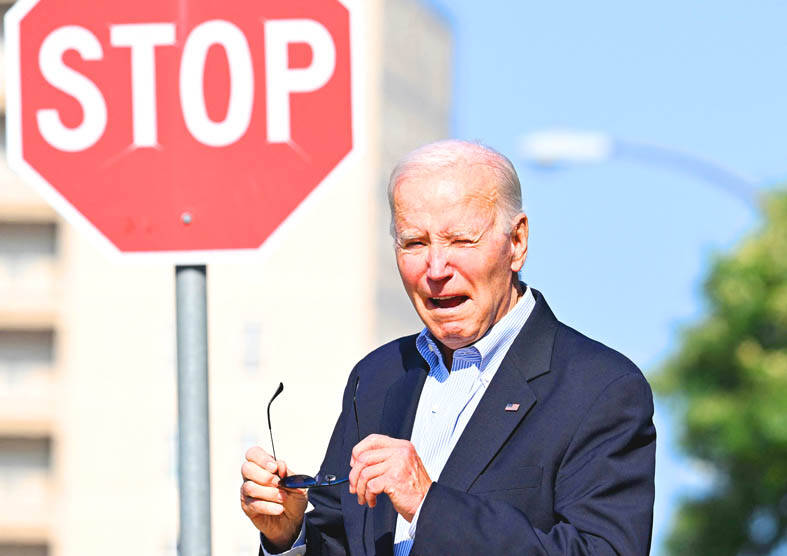

Photo: AFP

The restrictions would not take effect until next year, and their scope would be laid out in a rulemaking process, involving a comment period so stakeholders can weigh in on the final version.

A spokeswoman for the National Security Council declined to comment.

The investment controls are part of a broader White House effort to limit China’s capabilities to develop the next-generation technologies expected to dominate national and economic security. The effort has complicated the Biden administration’s already fraught relations with China, which sees the restrictions as an effort to contain and isolate the country.

China’s envoy in Washington said earlier this month that Beijing would retaliate if the US imposes new limits on technology or capital flows but did not detail what actions the country could take.

US Secretary of the Treasury Janet Yellen has sought to calm Chinese anger over the curbs, saying they would not significantly damage the ability to attract US investment and were narrowly tailored.

“These would not be broad controls that would affect US investment broadly in China, or in my opinion, have a fundamental impact on affecting the investment climate for China,” Yellen said in an interview with Bloomberg Television earlier this month.

Yellen emphasized the restrictions as well as existing export controls were not in retaliation for any specific actions from China or intended to curtail its growth.

US National Security Adviser Jake Sullivan first publicly discussed the concept in July 2021. China hawks in the US are eager for tougher and faster action. Lawmakers from both parties have also shown interest in legislating on the matter, although a bill has not yet made it to Biden’s desk.

The Senate last week passed an amendment to the national defense policy bill that would require firms to notify the government about certain investments in China and other countries of concern, although they would not be subject to review or possible prohibition.

TECH CLUSTER: The US company’s new office is in the Shalun Smart Green Energy Science City, a new AI industry base and cybersecurity hub in southern Taiwan US chip designer Advanced Micro Devices Inc (AMD) yesterday launched an office in Tainan’s Gueiren District (歸仁), marking a significant milestone in the development of southern Taiwan’s artificial intelligence (AI) industry, the Tainan City Government said in a statement. AMD Taiwan general manager Vincent Chern (陳民皓) presided over the opening ceremony for the company’s new office at the Shalun Smart Green Energy Science City (沙崙智慧綠能科學城), a new AI industry base and cybersecurity hub in southern Taiwan. Facilities in the new office include an information processing center, and a research and development (R&D) center, the Tainan Economic Development Bureau said. The Ministry

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

The Taipei International Cycle Show (Taipei Cycle) yesterday opened at the Taipei Nangang Exhibition Center, with the event’s organizer expecting a steady recovery in the industry this year following a tough last year. This year, 980 companies from 35 countries are participating in the annual bicycle trade show, showcasing technological breakthroughs and market development trends of the bicycle industry at 3,600 booths, the Taiwan External Trade Development Council (TAITRA, 外貿協會) said in a statement. Under the theme “Ride the Revolution,” the exhibition has attracted more than 3,500 international buyers from 80 countries to preregister for the four-day event, which is expected to