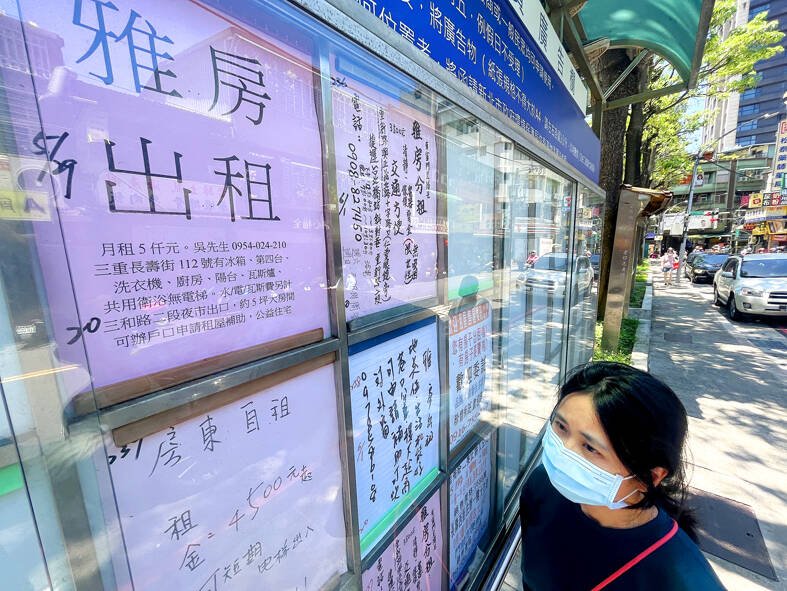

The nation’s rent index last month climbed another 1.98 percent to a record 103.66, as landlords passed on rising holding costs to tenants, Sinyi Realty Inc (信義房屋) said yesterday.

It was the first time in 12 months the pace of gains slowed below the 2 percent mark, but it remained a key factor in bolstering housing prices, Sinyi research manager Tseng Ching-der (曾進德) said.

The rent reading, tracked by the Directorate-General of Budget, Accounting and Statistics (DGBAS), has made noticeable advances for two years, as soaring house prices in the past few years prompted people to rent rather than buy their own home, the analyst said.

Photo: CNA

An ongoing economic weakness, interest rate hikes and unfavorable policy measures also curbed buying interest, Tseng said.

Nonethelesss, housing prices held firm, as developers refused to concede, buoyed by rising land, labor and building material prices, as well as the belief that real-estate properties are a proven bulwark against inflation.

Rent in central Taiwan reported the steepest gain of 2.59 percent, followed by rent in eastern Taiwan at 2.55 percent, southern Taiwan at 2.11 percent and northern Taiwan at 1.74 percent, Sinyi said, citing DGBAS figures.

Tseng said it was too early to tell whether the government’s plan to raise the cap on house taxes from 3.6 percent to 4.8 percent on multiple homes would spur another round of rent hikes.

The proposed tax adjustments still need to clear the legislature and would not affect landlords’ holding costs until they are implemented in July next year at the earliest, Tseng said, adding that a healthy job market has lent support to rental rates.

In related developments, new housing and presale projects in the first six months of the year surged 26.75 percent from a year earlier to NT$695.64 billion (US$22.52 billion) in northern Taiwan, as developers introduced more office buildings to meet robust demand, a report by property researcher My Housing Monthly said.

The value represented a new high since 2012, as developers sought to take advantage of the low vacancy rate for upscale offices in popular locations, the publication said.

Vacancy rates last quarter stood unchanged at 2.7 percent for Grade-A offices in Taipei, while rent inched up 1.3 percent, despite an economic slowdown, property consultancy Jones Lang LaSalle (JLL) Taiwan said.

That explained why presale and new housing projects in Taipei surged more than twofold to NT$323.02 billion in the first half of this year, but shrank in New Taipei City, Keelung and Taoyuan, My Housing Monthly said.

Urban renewal projects also made sizable contributions to new and presale house projects, as they are not subject to lending restrictions by the central bank to curb property speculation, it said.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors