China’s export controls on metals — gallium and germanium — used in making semiconductors are “just a start,” an influential trade policy adviser said yesterday, as it ramped up a tech fight with the US a day before US Secretary of the Treasury Janet Yellen visits Beijing.

Germanium is used in high-speed computer chips, plastics and in military applications such as night-vision devices and satellite imagery sensors.

Gallium is used in building radars and radio communication devices, satellites and LEDs.

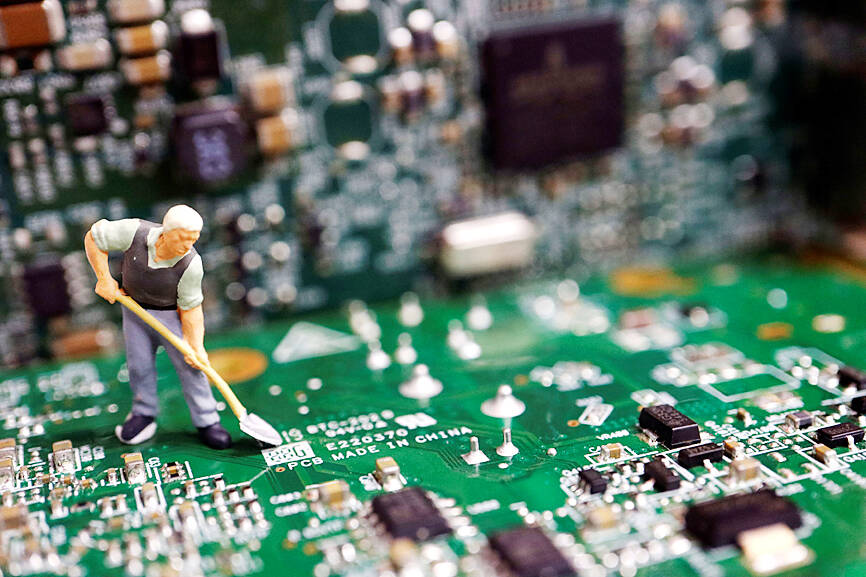

Photo: Reuters

China’s abrupt announcement of controls from Aug. 1 on exports of some gallium and germanium products, also used in electric vehicles (EVs) and fiber-optic cables, has sent companies scrambling to secure supplies and bumped up prices.

Announced on the eve of US Independence Day and just before Yellen’s planned visit to Beijing from today, analysts said it was clearly timed to send a message to US President Joe Biden’s administration, which has been targeting China’s chip sector and pushing allies such as Japan and Netherlands to follow suit.

Beijing’s move has also raised concerns on whether restrictions on rare earth exports could follow, they said, pointing to how it curbed shipments 12 years earlier in a dispute with Japan.

China is the world’s biggest producer of rare earths, a group of metals used in EVs and military equipment.

Analysts have described yesterday’s move as China’s second, and so far biggest, countermeasure in a long-running US-China tech dispute, coming after it banned some key domestic industries from purchasing from US memorychip maker Micron Technology Inc in May.

Former Chinese vice minister of commerce Wei Jianguo (魏建國) was yesterday quoted in the China Daily as saying that countries should brace for more should they continue to pressure China, describing the controls as a “well thought-out heavy punch” and “just a start.”

“If restrictions targeting China’s high-technology sector continue then countermeasures will escalate,” said Wei, who served as vice commerce minister from 2003 to 2008 and is the vice chairman of state-backed think tank the China Center for International Economic Exchanges.

The state-run Global Times, in a separate editorial published late on Tuesday, said that it was a “practical way” of telling the US and its allies that their efforts to curb China from procuring more advanced technology were a “miscalculation.”

The Chinese Ministry of Commerce did not respond to a request for further comment.

Washington is considering new restrictions on the shipment of high-tech microchips to China, following a series of curbs over the past few years.

The US and the Netherlands are also expected to further restrict sales of chipmaking equipment to China, part of efforts to prevent their technology from being used by China’s military.

A day after China unveiled the curbs, Chinese President Xi Jinping (習近平) repeated a call for “stable and smooth functioning of regional industrial and supply chains” in a virtual address to leaders attending the Shanghai Cooperation Organization summit, state media reports said.

Shares of Chinese metals companies such as Yunnan Lincang Xinyuan Germanium Industry Co (雲南臨滄鑫圓鍺業) and Yunnan Chihong Zinc & Germanium Co (雲南馳宏鋅鍺) surged for a second session yesterday, with local media reporting that a rise in germanium prices would boost revenue growth for the firms.

CHIP WAR: Tariffs on Taiwanese chips would prompt companies to move their factories, but not necessarily to the US, unleashing a ‘global cross-sector tariff war’ US President Donald Trump would “shoot himself in the foot” if he follows through on his recent pledge to impose higher tariffs on Taiwanese and other foreign semiconductors entering the US, analysts said. Trump’s plans to raise tariffs on chips manufactured in Taiwan to as high as 100 percent would backfire, macroeconomist Henry Wu (吳嘉隆) said. He would “shoot himself in the foot,” Wu said on Saturday, as such economic measures would lead Taiwanese chip suppliers to pass on additional costs to their US clients and consumers, and ultimately cause another wave of inflation. Trump has claimed that Taiwan took up to

SUPPORT: The government said it would help firms deal with supply disruptions, after Trump signed orders imposing tariffs of 25 percent on imports from Canada and Mexico The government pledged to help companies with operations in Mexico, such as iPhone assembler Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), shift production lines and investment if needed to deal with higher US tariffs. The Ministry of Economic Affairs yesterday announced measures to help local firms cope with the US tariff increases on Canada, Mexico, China and other potential areas. The ministry said that it would establish an investment and trade service center in the US to help Taiwanese firms assess the investment environment in different US states, plan supply chain relocation strategies and

WASHINGTON POLICY: Tariffs of 10 percent or more and other new costs are tipped to hit shipments of small parcels, cutting export growth by 1.3 percentage points The decision by US President Donald Trump to ban Chinese companies from using a US tariff loophole would hit tens of billions of dollars of trade and reduce China’s economic growth this year, according to new estimates by economists at Nomura Holdings Inc. According to Nomura’s estimates, last year companies such as Shein (希音) and PDD Holdings Inc’s (拼多多控股) Temu shipped US$46 billion of small parcels to the US to take advantage of the rule that allows items with a declared value under US$800 to enter the US tariff-free. Tariffs of 10 percent or more and other new costs would slash such

Hon Hai Precision Industry Co (鴻海精密) is reportedly making another pass at Nissan Motor Co, as the Japanese automaker's tie-up with Honda Motor Co falls apart. Nissan shares rose as much as 6 percent after Taiwan’s Central News Agency reported that Hon Hai chairman Young Liu (劉揚偉) instructed former Nissan executive Jun Seki to connect with French carmaker Renault SA, which holds about 36 percent of Nissan’s stock. Hon Hai, the Taiwanese iPhone-maker also known as Foxconn Technology Group (富士康科技集團), was exploring an investment or buyout of Nissan last year, but backed off in December after the Japanese carmaker penned a deal