Apple Inc is slashing production targets for its Vision Pro because manufacturers are struggling with the novel gadget’s complex design, the Financial Times reported.

Apple is preparing to make fewer than 400,000 units of the US$3,499 headset for next year, it said, citing unidentified people close to Apple and Luxshare Precision Industry Co (立訊精密), the Chinese firm that is initially assembling the device.

Two China-based suppliers of components said that Apple was only asking for enough parts for 130,000 to 150,000 units in the first year, while plans for a cheaper version have been pushed back, the newspaper reported.

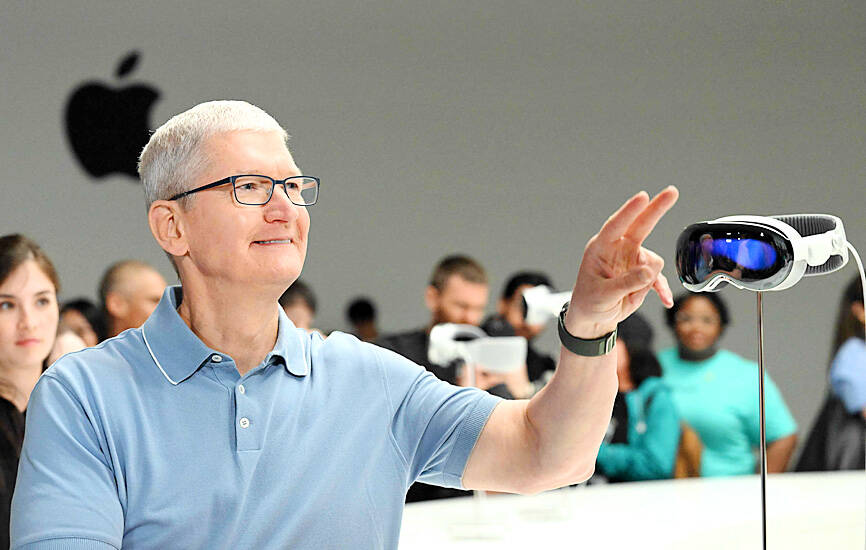

Photo: AFP

The Vision Pro, unveiled last month, is Apple’s latest move to sustain sales momentum and try to propel a mixed-reality industry that for years has struggled to make it into the mainstream. The device, which resembles high-tech ski goggles, is slated to arrive early next year in the US, followed by other regions later.

The new projections are down sharply from a previous internal sales target of 1 million units in the first 12 months, the Financial Times said.

A major hurdle is the creation of high-resolution inward displays, while projecting the wearer’s eyes to the outside world, the paper said.

Apple is also working on a more affordable version of the headset with South Korean display makers, the paper said, citing two people with direct knowledge.

The iPhone maker made Wall Street history after its market value climbed past US$3 trillion, as investors continued to pile into big tech firms.

The massive rally in Apple’s shares is forcing some fund managers to revisit a thorny dilemma: They might not own enough of the stock.

Apple’s share price has soared 49 percent so far this year. The company’s weighting in the S&P 500 has swelled to 7.6 percent, the biggest of any one stock in the history of the benchmark index, S&P Dow Jones Indices showed.

That hefty weighting means moves in Apple’s shares have an outsized influence on index performance. Yet many investors hold allocations of Apple that are smaller than its relative weighting in indices, whether it is due to the desire for portfolio flexibility, worries over owning too much of any one position and limitations imposed by the rules of their own funds.

If shares of Apple keep rallying, that could hurt the results of active fund managers, who strive to beat indices such as the S&P 500 or Russell 1000.

The issue has taken on additional urgency this year, as the market’s gains are being led primarily by a handful of megacap companies such as Apple, Microsoft Corp and Nvidia Corp, whose shares have outperformed.

“If you’re an active manager, one of the issues is it’s hard to own that much of one name. You are taking on more and more risk,” said Todd Sohn, technical strategist at Strategas Asset Management. “Because they are such heavy weights within the benchmarks, it becomes really challenging to outperform.”

Additional reporting by Reuters

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

The US Federal Reserve is expected to announce a pause in rate cuts on Wednesday, as policymakers look to continue tackling inflation under close and vocal scrutiny from US President Donald Trump. The Fed cut its key lending rate by a full percentage point in the final four months of last year and indicated it would move more cautiously going forward amid an uptick in inflation away from its long-term target of 2 percent. “I think they will do nothing, and I think they should do nothing,” Federal Reserve Bank of St Louis former president Jim Bullard said. “I think the

SUBSIDIES: The nominee for commerce secretary indicated the Trump administration wants to put its stamp on the plan, but not unravel it entirely US President Donald Trump’s pick to lead the agency in charge of a US$52 billion semiconductor subsidy program declined to give it unqualified support, raising questions about the disbursement of funds to companies like Intel Corp and Taiwan Semiconductor Manufacturing Co (台積電). “I can’t say that I can honor something I haven’t read,” Howard Lutnick, Trump’s nominee for commerce secretary, said of the binding CHIPS and Science Act awards in a confirmation hearing on Wednesday. “To the extent monies have been disbursed, I would commit to rigorously enforcing documents that have been signed by those companies to make sure we get