Aston Martin Lagonda Global Holdings PLC is tying up with Lucid Group Inc on electric vehicle (EV) technology, uniting the storied British automaker and relative newcomer both backed by Saudi Arabia’s sovereign wealth fund.

Aston Martin is to issue new shares to Lucid and make cash payments totaling US$232 million in exchange for battery-electric powertrain components, the company said in a statement yesterday.

The UK manufacturer also extended a longtime cooperation agreement with Mercedes-Benz Group AG, though it would no longer issue more shares to the German company that already owns an about 9 percent stake.

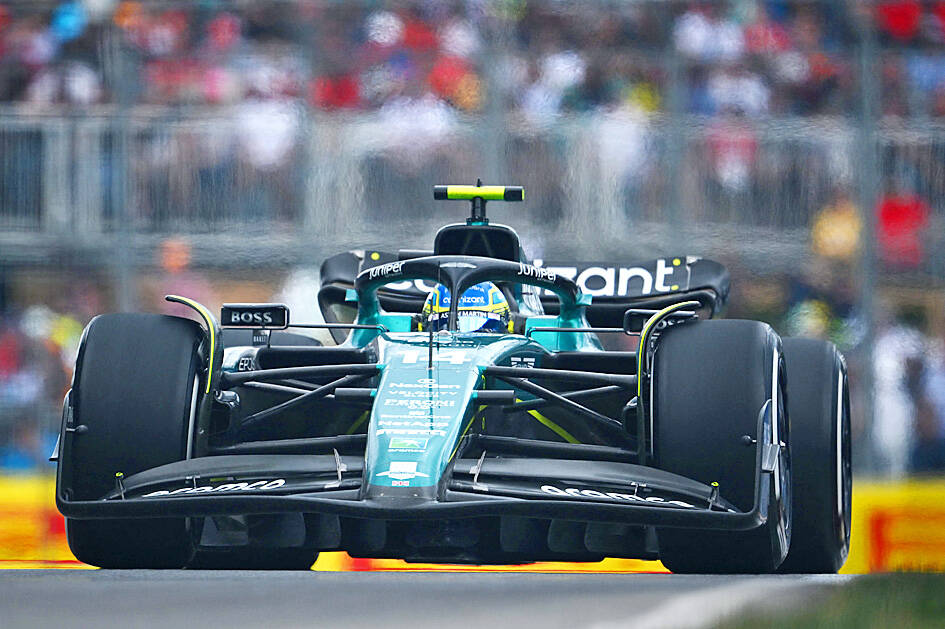

Photo: AFP

The announcements sent Aston Martin shares surging as much as 15 percent, their biggest intraday jump in more than one month.

“The proposed supply agreement with Lucid is a game changer for the future EV-led growth of Aston Martin,” chairman Lawrence Stroll said in a statement. “Based on our strategy and requirements, we selected Lucid, gaining access to the industry’s highest-performance and most innovative technologies for our future BEV products.”

Stroll, 63, is three years into an effort to turn around the British automaker with a long history of financial trouble. Aston Martin has needed several capital raises since he threw the company a lifeline in early 2020, the most recent of which have made China’s Zhejiang Geely Holding Group Co (吉利控股集團) and Saudi Arabia’s Public Investment Fund major shareholders.

The Public Investment Fund owns about 49 percent of Lucid and 18 percent of Aston Martin, according to data compiled by Bloomberg.

Aston Martin’s financial woes have made it increasingly reliant on partners for technology that other automakers consider core to their products. Models including the DBX sport utility vehicle and DB12 sports car are powered by Mercedes engines.

Going forward, Aston Martin is to discuss future access to technology from Mercedes and would pay for it in cash, scrapping plans to issue more shares to its partner over the next year.

The Lucid deal would help Aston Martin toward its ambitious electrification targets. The automaker plans to launch its first plug-in hybrid super car, the Valhalla, early next year and its first battery-electric vehicle in 2025.

Aston Martin is to make phased cash payments to Lucid totaling US$132 million and has committed to spending at least US$225 million on the EV maker’s powertrain components.

The company would also pay another US$10 million to Lucid for integrating its technology into its vehicles.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) would not produce its most advanced technologies in the US next year, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. Kuo made the comment during an appearance at the legislature, hours after the chipmaker announced that it would invest an additional US$100 billion to expand its manufacturing operations in the US. Asked by Taiwan People’s Party Legislator-at-large Chang Chi-kai (張啟楷) if TSMC would allow its most advanced technologies, the yet-to-be-released 2-nanometer and 1.6-nanometer processes, to go to the US in the near term, Kuo denied it. TSMC recently opened its first US factory, which produces 4-nanometer

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

REACTIONS: While most analysts were positive about TSMC’s investment, one said the US expansion could disrupt the company’s supply-demand balance Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) new US$100 billion investment in the US would exert a positive effect on the chipmaker’s revenue in the medium term on the back of booming artificial intelligence (AI) chip demand from US chip designers, an International Data Corp (IDC) analyst said yesterday. “This is good for TSMC in terms of business expansion, as its major clients for advanced chips are US chip designers,” IDC senior semiconductor research manager Galen Zeng (曾冠瑋) said by telephone yesterday. “Besides, those US companies all consider supply chain resilience a business imperative,” Zeng said. That meant local supply would

Servers that might contain artificial intelligence (AI)-powering Nvidia Corp chips shipped from the US to Singapore ended up in Malaysia, but their actual final destination remains a mystery, Singaporean Minister for Home Affairs and Law K Shanmugam said yesterday. The US is cracking down on exports of advanced semiconductors to China, seeking to retain a competitive edge over the technology. However, Bloomberg News reported in late January that US officials were probing whether Chinese AI firm DeepSeek (深度求索) bought advanced Nvidia semiconductors through third parties in Singapore, skirting Washington’s restrictions. Shanmugam said the route of the chips emerged in the course of an