Yageo Corp (國巨), the world’s third-largest supplier of multilayer ceramic capacitors, yesterday forecast its second-quarter revenue to stabilize, snapping a three-quarter losing streak.

Consolidated revenue last month was flat at NT$9 billion (US$293 million), compared with the previous month, but declined 14.5 percent from a year earlier, the company said.

Cumulative revenue in the first five months dipped 13.2 percent year-on-year to NT$44.11 billion, as customers scaled back orders amid inventory digestion, it said.

Photo: CNA

It would take at least two quarters for the passive-components sector to work through an excessive inventory of standard parts, it said.

Nevertheless, Yageo said it was better equipped than its peers to weather the inventory correction cycle, given that it supplies premium passive components used in vehicles, and industrial and medical devices.

“From our perspective, the market is likely to recover gradually like an L shape, rather than as a V-shape rebound,” Yageo chairman Pierre Chen (陳泰銘) told reporters on Tuesday following the company’s annual general meeting in Taipei.

As Yageo has been diversifying its product lineups to niche and high-end products, the company would be able to sustain growth, Chen said.

Through mergers, acquisitions and product adjustments, the company has expanded its high-end product revenue contribution to about 80 percent, he said.

Among premium products, passive components used in vehicles registered slight revenue growth, helping the segment’s revenue contribution exceed its 20 percent share target in the first quarter of this year, Chen said.

“We have broken into the first-tier automakers of Japan,” he said.

A decline in passive components used in consumer electronics was also a factor, he added.

The company also sees the industrial, medical and aerospace sectors as key growth areas, he said.

Yageo has tapped into sensor businesses through merger-and-acquisition deals with Heraeus Holding GmbH and Schneider Electric SE, he said.

Those sensors are used in industrial devices and vehicles, he said.

Heraeus Nexensos makes premium platinum thin-film temperature sensors for high-precision measurements, and has operated for more than 100 years in the high-end industrial and automotive segments.

In aerospace, Yageo’s revenue has grown several-fold through its subsidies Kemet Corp and Pulse Electronics Corp, Chen said.

Yageo said its passive components are also used in artificial intelligence (AI) devices such as AI servers from Quanta Computer Inc (廣達) and Wistron Corp (緯創).

“We will not be absent from the AI industry,” Chen said.

Yageo’s components are used in a wide range of electronics and it works with customers in designing new products such as 6G-enabled devices and low Earth orbit satellites, it said.

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

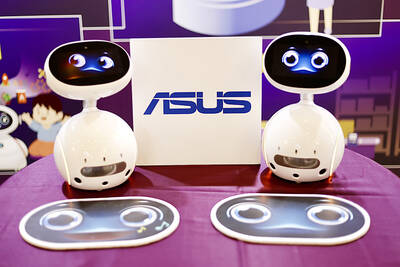

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would