For all the gloom around the impact of Brexit on the City of London, the latest survey of Europe’s top destinations for foreign direct investment (FDI) in financial services is a reminder of the UK’s continuing heft in the sector.

Britain landed 76 financial service projects last year, up 17 percent from the previous year, despite the economic downturn and political instability in Westminster, an Ernst & Young analysis said.

It means the UK secured 26 percent of all European financial services FDI projects.

The rise was thanks to an increase in US investment, with the UK home to 21 US-backed projects — up a quarter year-on-year.

Even in challenging times, investors see the UK “as the most attractive European financial services market,” said Anna Anthony, UK financial services managing partner at Ernst & Young.

The industry needs to work with the government to continue to boost the UK’s appeals through investment in programs such as boosting social mobility and upskilling local talent.

France, which recorded a 25 percent fall in the number of projects last year, came in second at 45. Germany and Spain followed with 31 each.

The Ernst & Young results come even as a growing chorus of executives criticize the UK’s business environment. Last month, Revolut’s cofounders launched a blistering attack on the UK as a place to run a business, saying they would not consider listing in London.

By contrast, an accompanying survey of executives across banking, insurance, wealth and asset management, and fintech found they expected the UK to retain or improve its level of financial services attractiveness over the next three years, according to Ernst & Young.

State-run CPC Corp, Taiwan (CPC, 台灣中油) yesterday signed a letter of intent with Alaska Gasline Development Corp (AGDC), expressing an interest to buy liquefied natural gas (LNG) and invest in the latter’s Alaska LNG project, the Ministry of Economic Affairs said in a statement. Under the agreement, CPC is to participate in the project’s upstream gas investment to secure stable energy resources for Taiwan, the ministry said. The Alaska LNG project is jointly promoted by AGDC and major developer Glenfarne Group LLC, as Alaska plans to export up to 20 million tonnes of LNG annually from 2031. It involves constructing an 1,290km

NEXT GENERATION: The company also showcased automated machines, including a nursing robot called Nurabot, which is to enter service at a Taichung hospital this year Hon Hai Precision Industry Co (鴻海精密) expects server revenue to exceed its iPhone revenue within two years, with the possibility of achieving this goal as early as this year, chairman Young Liu (劉揚偉) said on Tuesday at Nvidia Corp’s annual technology conference in San Jose, California. AI would be the primary focus this year for the company, also known as Foxconn Technology Group (富士康科技集團), as rapidly advancing AI applications are driving up demand for AI servers, Liu said. The production and shipment of Nvidia’s GB200 chips and the anticipated launch of GB300 chips in the second half of the year would propel

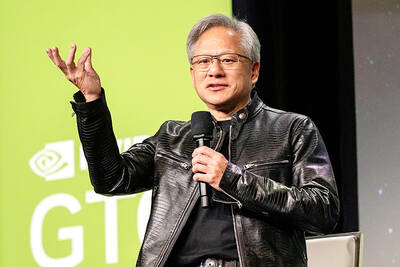

‘MAKE OR BREAK’: Nvidia shares remain down more than 9 percent, but investors are hoping CEO Jensen Huang’s speech can stave off fears that the sales boom is peaking Shares in Nvidia Corp’s Taiwanese suppliers mostly closed higher yesterday on hopes that the US artificial intelligence (AI) chip designer would showcase next-generation technologies at its annual AI conference slated to open later in the day. The GPU Technology Conference (GTC) in California is to feature developers, engineers, researchers, inventors and information technology professionals, and would focus on AI, computer graphics, data science, machine learning and autonomous machines. The event comes at a make-or-break moment for the firm, as it heads into the next few quarters, with Nvidia CEO Jensen Huang’s (黃仁勳) keynote speech today seen as having the ability to

WAIT-AND-SEE: Last month’s consumer price index came in at 2.8%, which boosts expectations that the Fed would proceed cautiously to lower inflation sustainably The US Federal Reserve is widely expected to keep interest rates unchanged at its policy meeting this week, treading carefully amid uncertainty over US President Donald Trump’s economic policies, which include spending cuts and sweeping tariffs. Since January, Trump has imposed levies on major trading partners Canada, Mexico and China, and on steel and aluminum imports, roiling financial markets and fanning fears that his plans could tip the world’s biggest economy into a recession. The Trump administration has also embarked on unprecedented cost-cutting efforts that target staff and spending, while the US president has promised tax reductions and deregulation down the road. However,