Qualcomm Inc is betting the future of artificial intelligence (AI) will require more computing power than what the cloud alone can provide.

The world’s largest maker of smartphone processors is transitioning from a communications company into an “intelligent edge computing” firm, Qualcomm senior vice president Alex Katouzian said.

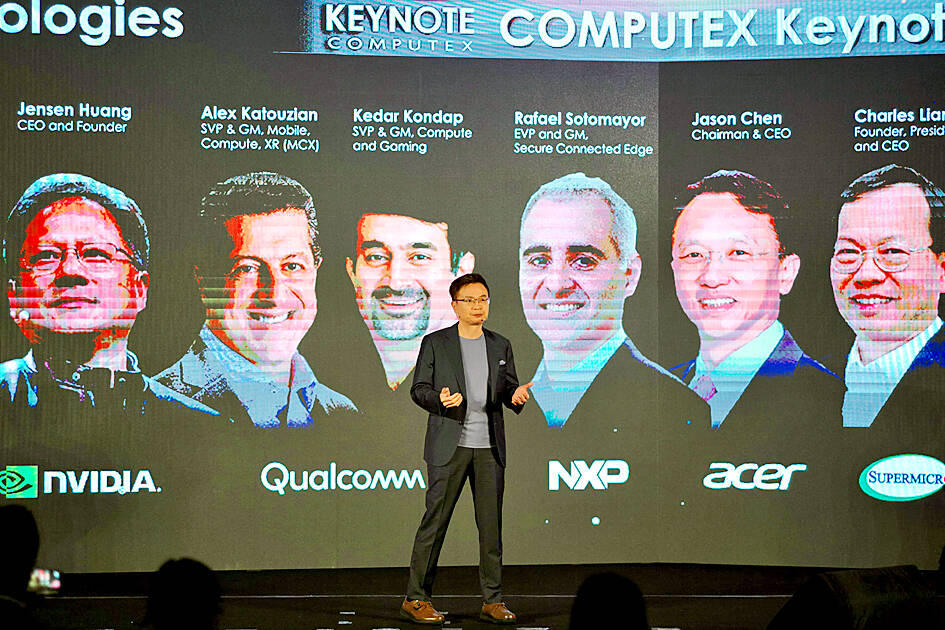

The edge in question is the mobile device that a user taps to access a network or service, and Katouzian used his time headlining one of the major keynote events at the Computex show in Taipei to make the case for how big a market that would be.

Photo: Sam Yeh, AFP

The US company’s chips help smartphones harness AI for everything from processing photographs to detecting malware. In emphasizing the “AI-capable” aspects of their products, Katouzian and his colleagues joined a flurry of companies positioning themselves as beneficiaries of a spike in demand for AI.

The company has shipped 2 billion AI-capable products to date, he said.

“As growth in the number of connected devices and data traffic continues to accelerate and data center costs climb, it simply won’t be possible to send everything to the cloud,” Katouzian said.

Nor will people want to do so when personal information is involved, he added.

Rocketing demand for chips behind AI tools such as Open AI’s ChatGPT is driving shares of chipmaking peer Nvidia Corp to record highs.

In contrast to Nvidia, Qualcomm’s outlook fell well short of estimates on sluggish global demand for mobile devices.

Katouzian sees the inventory glut depleting in the third or fourth quarter of this year.

Some customers have begun increasing orders for smaller components, a leading indicator for an uptick in demand, he said.

The wider enthusiasm for AI has prompted many companies to focus attention on their AI-related services, with more than one executive declaring a new computing era had dawned.

Arm Ltd, for instance, said its technology is enabling many AI applications already taken for granted and it would be fundamental to building the next wave of AI innovations, Arm chief executive officer Rene Haa said in a keynote address at Computex on Monday.

Citing examples from Amazon.com Inc’s Alexa voice assistant and Alphabet Inc’s Google Pixel phones to smart traffic light management and robotic beehive maintenance, Haas made the argument that on-device and small-scale AI processors would all run Arm technology.

He also pointed to Nvidia’s Grace Hopper next-generation architecture for accelerating AI as another example of Arm technology in the AI supply chain.

The company still intends to go public by the end of the year, a spokesperson confirmed on Monday. Arm, in search of a lofty valuation to satisfy parent Softbank Group Corp, is looking to present itself as another avenue for investors to tap into this vein of technology optimism.

“Given the chase for ‘AI stocks’, we think SBG [Softbank Group] may like to present Arm as an ‘AI play,’ although most of its current business is based on designing and licensing semiconductor IP [intellectual property], particularly for mobile devices,” Jefferies analyst Atul Goyal said.

CHIP WAR: Tariffs on Taiwanese chips would prompt companies to move their factories, but not necessarily to the US, unleashing a ‘global cross-sector tariff war’ US President Donald Trump would “shoot himself in the foot” if he follows through on his recent pledge to impose higher tariffs on Taiwanese and other foreign semiconductors entering the US, analysts said. Trump’s plans to raise tariffs on chips manufactured in Taiwan to as high as 100 percent would backfire, macroeconomist Henry Wu (吳嘉隆) said. He would “shoot himself in the foot,” Wu said on Saturday, as such economic measures would lead Taiwanese chip suppliers to pass on additional costs to their US clients and consumers, and ultimately cause another wave of inflation. Trump has claimed that Taiwan took up to

A start-up in Mexico is trying to help get a handle on one coastal city’s plastic waste problem by converting it into gasoline, diesel and other fuels. With less than 10 percent of the world’s plastics being recycled, Petgas’ idea is that rather than letting discarded plastic become waste, it can become productive again as fuel. Petgas developed a machine in the port city of Boca del Rio that uses pyrolysis, a thermodynamic process that heats plastics in the absence of oxygen, breaking it down to produce gasoline, diesel, kerosene, paraffin and coke. Petgas chief technology officer Carlos Parraguirre Diaz said that in

Japan intends to closely monitor the impact on its currency of US President Donald Trump’s new tariffs and is worried about the international fallout from the trade imposts, Japanese Minister of Finance Katsunobu Kato said. “We need to carefully see how the exchange rate and other factors will be affected and what form US monetary policy will take in the future,” Kato said yesterday in an interview with Fuji Television. Japan is very concerned about how the tariffs might impact the global economy, he added. Kato spoke as nations and firms brace for potential repercussions after Trump unleashed the first salvo of

SUPPORT: The government said it would help firms deal with supply disruptions, after Trump signed orders imposing tariffs of 25 percent on imports from Canada and Mexico The government pledged to help companies with operations in Mexico, such as iPhone assembler Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), shift production lines and investment if needed to deal with higher US tariffs. The Ministry of Economic Affairs yesterday announced measures to help local firms cope with the US tariff increases on Canada, Mexico, China and other potential areas. The ministry said that it would establish an investment and trade service center in the US to help Taiwanese firms assess the investment environment in different US states, plan supply chain relocation strategies and