South Korea has asked Washington to review its criteria for new semiconductor subsidies, concerned over the impact of rules to limit chip investment in countries such as China, a US public filing showed.

In March, the US Department of Commerce proposed rules to prevent China and other countries it deems to be of concern from tapping funds of US$52 billion earmarked for semiconductor manufacturing and research under the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act.

A leading chipmaker and major investor in the US chip sector, South Korea asked the US to review the rule that prevents recipients of US funding from building new facilities in such countries, beyond 5 percent of existing capacity.

Photo: Reuters

“The Republic of Korea believes ‘guardrail provisions’ should not be implemented in a manner that imposes an unreasonable burden on companies investing in the United States,” South Korea said, using its official name.

The filing gave no further details, but the South’s Yonhap news agency said Seoul had asked to raise the limit to 10 percent.

The South Korean Ministry of Trade, Industry and Energy declined to comment.

Washington has said the incentives aim to help restore the US’ leadership in semiconductor manufacturing, boost employment, and ensure economic and national security.

South Korea’s Samsung Electronics Co and SK Hynix Inc, the world’s top two makers of memory chips, have invested billions of dollars in chip factories in China.

Samsung is building a chip plant in Texas that could cost more than US$25 billion.

In its comments, Samsung sought clarification of the proposed rule to ensure that investments in the US chipmaking sector were “not unduly and unintentionally restricted,” a filing showed.

SK Hynix also made comments, but the public version gave no details.

Its parent, SK Group, which plans to invest US$15 billion in the US chip sector, some for an advanced chip packaging factory, has said it is considering applying for funding.

“Potential CHIPS Act funding recipients have numerous existing legacy facilities in China,” an industry group, the Semiconductor Industry Association, said.

“It is critical for these companies to be able to protect their past investments in these facilities by ensuring they remain commercially viable,” it said.

SK Hynix and Samsung Electronics did not immediately provide comments to Reuters.

The United Auto Workers union has said funding applicants should be ruled ineligible if they did not agree to allow union organizing.

“The US government should not be in the business of funding union-busting employers,” it said in a filing on Tuesday.

The commerce department began accepting subsidy applications for leading-edge chip facilities in March. On June 26, it is to open applications for “current-generation, mature-node and back-end” production facilities.

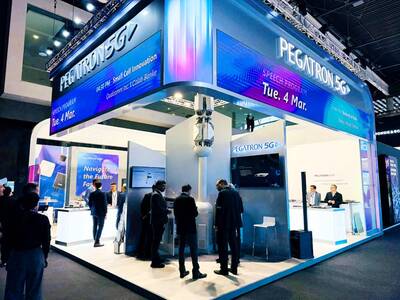

‘DECENT RESULTS’: The company said it is confident thanks to an improving world economy and uptakes in new wireless and AI technologies, despite US uncertainty Pegatron Corp (和碩) yesterday said it plans to build a new server manufacturing factory in the US this year to address US President Donald Trump’s new tariff policy. That would be the second server production base for Pegatron in addition to the existing facilities in Taoyuan, the iPhone assembler said. Servers are one of the new businesses Pegatron has explored in recent years to develop a more balanced product lineup. “We aim to provide our services from a location in the vicinity of our customers,” Pegatron president and chief executive officer Gary Cheng (鄭光治) told an online earnings conference yesterday. “We

It was late morning and steam was rising from water tanks atop the colorful, but opaque-windowed, “soapland” sex parlors in a historic Tokyo red-light district. Walking through the narrow streets, camera in hand, was Beniko — a former sex worker who is trying to capture the spirit of the area once known as Yoshiwara through photography. “People often talk about this neighborhood having a ‘bad history,’” said Beniko, who goes by her nickname. “But the truth is that through the years people have lived here, made a life here, sometimes struggled to survive. I want to share that reality.” In its mid-17th to

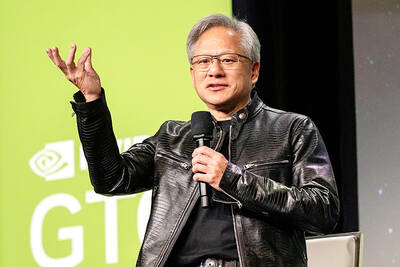

‘MAKE OR BREAK’: Nvidia shares remain down more than 9 percent, but investors are hoping CEO Jensen Huang’s speech can stave off fears that the sales boom is peaking Shares in Nvidia Corp’s Taiwanese suppliers mostly closed higher yesterday on hopes that the US artificial intelligence (AI) chip designer would showcase next-generation technologies at its annual AI conference slated to open later in the day. The GPU Technology Conference (GTC) in California is to feature developers, engineers, researchers, inventors and information technology professionals, and would focus on AI, computer graphics, data science, machine learning and autonomous machines. The event comes at a make-or-break moment for the firm, as it heads into the next few quarters, with Nvidia CEO Jensen Huang’s (黃仁勳) keynote speech today seen as having the ability to

The battle for artificial intelligence supremacy hinges on microchips, but the semiconductor sector that produces them has a dirty secret: It is a major source of chemicals linked to cancer and other health problems. Global chip sales surged more than 19 percent to about US$628 billion last year, according to the Semiconductor Industry Association, which forecasts double-digit growth again this year. That is adding urgency to reducing the effects of “forever chemicals” — which are also used to make firefighting foam, nonstick pans, raincoats and other everyday items — as are regulators in the US and Europe who are beginning to