The US Department of Commerce should put trade curbs on Chinese memorychip maker Changxin Memory Technologies (CXMT, 長鑫存儲) after Beijing earlier this week banned the sale of some chips by US-based Micron Technology Inc, the chair of the US House of Representatives’ Select Committee on Strategic Competition Between the US and the Chinese Communist Party said on Tuesday.

The restrictions by China’s cyberspace regulator against Micron are the latest in a widening trade dispute between the world’s two largest economies.

The move by China sparked tough language from key lawmakers and the White House.

Photo: REUTERS

White House press secretary Karine Jean-Pierre told reporters on Tuesday that the Chinese announcement on Micron was “not based in fact.”

The White House said the commerce department was “engaged directly” with China over Micron, a maker of memory chips that are essential for products from cell phones to data center servers.

US Senate Majority Leader Chuck Schumer, the top Senate Democrat, also said he is talking to the broader business community and allies about the issue.

US Representative Mike Gallagher, an influential lawmaker whose select committee has pressed the administration of US President Joe Biden to take tougher stances on China, is the only lawmaker so far to call for retaliatory action.

The US “must make clear to the PRC [People’s Republic of China] that it will not tolerate economic coercion against its companies or its allies,” Gallagher said.

“The commerce department should immediately add Changxin Memory Technologies to the entity list and ensure no US technology, regardless of specifications, goes to CXMT, YMTC, or other PRC firms operating in this industry,” he said, referring to Yangtze Memory Technology Corp (長江存儲).

CXMT is China’s leading maker of DRAM memory chips and the domestic competitor most likely to benefit if Micron is barred from China’s massive chip market.

YMTC is a Chinese chipmaker put on the entity list in December last year.

Gallagher also said the commerce department must ensure “no US-export licenses granted to foreign semiconductor memory firms operating in [China] are used to backfill Micron, and our South Korean allies, who have experienced exactly this kind of CCP [Chinese Communist Party] economic coercion firsthand in recent years, should likewise act to prevent backfilling.”

South Korea’s Samsung Electronics Co Ltd and SK Hynix Inc, which both operate memorychip factories in China, and other non-Chinese firms were spared the brunt of US export controls on chip manufacturing gear imposed in October last year, but they are operating under exemptions from the US rules that can expire or be revoked.

Analysts believe CXMT’s chips are two to three generations behind industry leaders Micron, Samsung and SK Hynix.

Gallagher’s call came weeks after US makers of chip manufacturing equipment said they received a clarification from US export control authorities that would allow them to ship more tools to China than initially anticipated.

Lam Research Corp, the leading maker of tools for manufacturing memory chips, told investors the clarification could result in hundreds of millions of dollars in additional sales from China. The clarification from the commerce department concerned how memorychip features are measured for the purposes of applying export control rules.

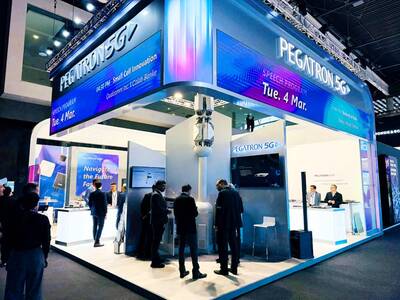

‘DECENT RESULTS’: The company said it is confident thanks to an improving world economy and uptakes in new wireless and AI technologies, despite US uncertainty Pegatron Corp (和碩) yesterday said it plans to build a new server manufacturing factory in the US this year to address US President Donald Trump’s new tariff policy. That would be the second server production base for Pegatron in addition to the existing facilities in Taoyuan, the iPhone assembler said. Servers are one of the new businesses Pegatron has explored in recent years to develop a more balanced product lineup. “We aim to provide our services from a location in the vicinity of our customers,” Pegatron president and chief executive officer Gary Cheng (鄭光治) told an online earnings conference yesterday. “We

It was late morning and steam was rising from water tanks atop the colorful, but opaque-windowed, “soapland” sex parlors in a historic Tokyo red-light district. Walking through the narrow streets, camera in hand, was Beniko — a former sex worker who is trying to capture the spirit of the area once known as Yoshiwara through photography. “People often talk about this neighborhood having a ‘bad history,’” said Beniko, who goes by her nickname. “But the truth is that through the years people have lived here, made a life here, sometimes struggled to survive. I want to share that reality.” In its mid-17th to

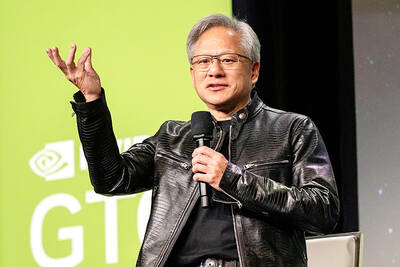

‘MAKE OR BREAK’: Nvidia shares remain down more than 9 percent, but investors are hoping CEO Jensen Huang’s speech can stave off fears that the sales boom is peaking Shares in Nvidia Corp’s Taiwanese suppliers mostly closed higher yesterday on hopes that the US artificial intelligence (AI) chip designer would showcase next-generation technologies at its annual AI conference slated to open later in the day. The GPU Technology Conference (GTC) in California is to feature developers, engineers, researchers, inventors and information technology professionals, and would focus on AI, computer graphics, data science, machine learning and autonomous machines. The event comes at a make-or-break moment for the firm, as it heads into the next few quarters, with Nvidia CEO Jensen Huang’s (黃仁勳) keynote speech today seen as having the ability to

The battle for artificial intelligence supremacy hinges on microchips, but the semiconductor sector that produces them has a dirty secret: It is a major source of chemicals linked to cancer and other health problems. Global chip sales surged more than 19 percent to about US$628 billion last year, according to the Semiconductor Industry Association, which forecasts double-digit growth again this year. That is adding urgency to reducing the effects of “forever chemicals” — which are also used to make firefighting foam, nonstick pans, raincoats and other everyday items — as are regulators in the US and Europe who are beginning to