Core consumer prices would top the list of concerns when the central bank revisits its monetary policy next month, as headline inflation has held steady while core readings continue to rise, Governor Yang Chin-long (楊金龍) said yesterday.

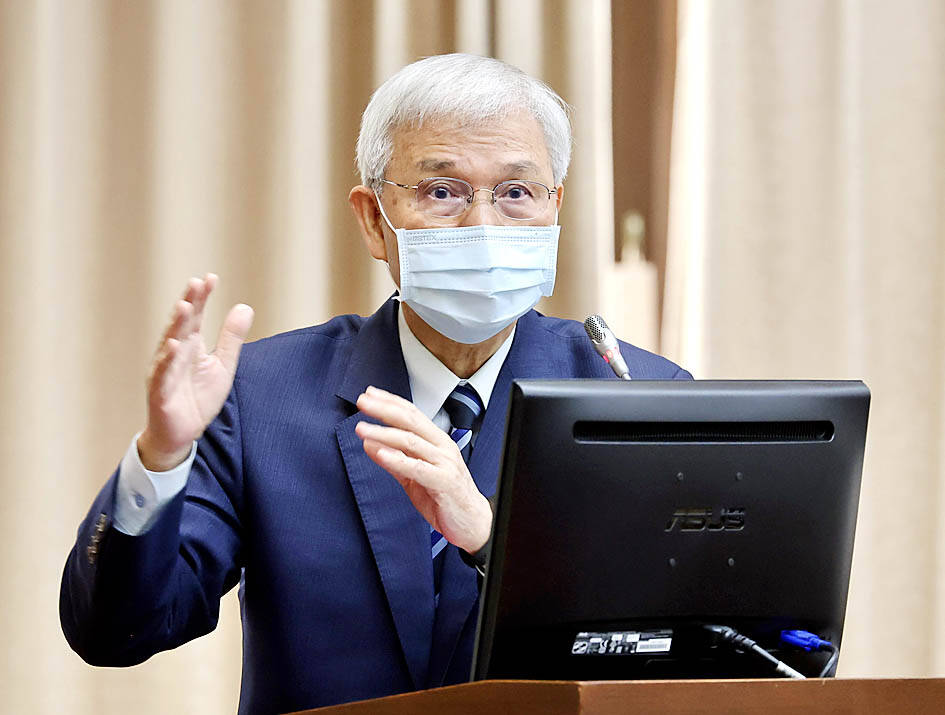

Yang shared his views on inflation and other economic issues while taking questions from lawmakers during a legislative hearing in Taipei, ahead of the central bank’s next board meeting on June 15.

Yang said his biggest concern is the core consumer price index (CPI), which advanced 2.72 percent last month, although headline inflation stayed unchanged at 2.35 percent.

Photo: CNA

Higher core CPI readings suggest sticky inflationary pressures ahead, Yang said, as the measure excludes volatile items such as fuel and vegetable prices.

If core CPI climbs higher, the central bank could raise interest rates again to tame inflation, although it would also take the nation’s economic health into consideration, he said.

Taiwan’s export-oriented economy contracted 3.02 percent during the January-to-March period and is expected to remain soft this and next quarter, as global inflation and monetary tightening slows demand for electronic components, the nation’s main export driver.

Taiwan has felt the pinch of economic uncertainty induced by aggressive interest rate hikes in the US and Europe, Yang said, adding that a recovery would take place in the fourth quarter, if not next quarter.

“Much depends on when inventory adjustments will end,” Yang said.

National Development Council Minister Kung Ming-hsin (龔明鑫) on Tuesday said that exports continue to disappoint, in line with conservative guidance from major tech firms that inventory corrections would persist into next quarter.

The Directorate-General of Budget Accounting and Statistics is on Friday expected to trim its forecast for Taiwan’s GDP growth this year, after exports and private investment fared weaker than expected.

Yang attributed Taiwan’s inflationary pressures to conspicuous rises in food, entertainment and travel charges in the wake of the government’s removal of border controls and other COVID-19 restrictions.

Dining costs, once risen, have little chance of falling before the year-on-year comparison effect fades, Yang said, responding to comments the central bank has failed to rein in inflation.

Taiwan’s inflation is moderate when compared with other countries, he said.

Yang said the US Federal Reserve is widely expected to end its rate hike cycle next month after inflation in the US fell below 5 percent and is expected to drop to the Fed’s 2 percent target by 2025.

The chance of further rate hikes is small against that backdrop, he said.

CHIP WAR: Tariffs on Taiwanese chips would prompt companies to move their factories, but not necessarily to the US, unleashing a ‘global cross-sector tariff war’ US President Donald Trump would “shoot himself in the foot” if he follows through on his recent pledge to impose higher tariffs on Taiwanese and other foreign semiconductors entering the US, analysts said. Trump’s plans to raise tariffs on chips manufactured in Taiwan to as high as 100 percent would backfire, macroeconomist Henry Wu (吳嘉隆) said. He would “shoot himself in the foot,” Wu said on Saturday, as such economic measures would lead Taiwanese chip suppliers to pass on additional costs to their US clients and consumers, and ultimately cause another wave of inflation. Trump has claimed that Taiwan took up to

A start-up in Mexico is trying to help get a handle on one coastal city’s plastic waste problem by converting it into gasoline, diesel and other fuels. With less than 10 percent of the world’s plastics being recycled, Petgas’ idea is that rather than letting discarded plastic become waste, it can become productive again as fuel. Petgas developed a machine in the port city of Boca del Rio that uses pyrolysis, a thermodynamic process that heats plastics in the absence of oxygen, breaking it down to produce gasoline, diesel, kerosene, paraffin and coke. Petgas chief technology officer Carlos Parraguirre Diaz said that in

Japan intends to closely monitor the impact on its currency of US President Donald Trump’s new tariffs and is worried about the international fallout from the trade imposts, Japanese Minister of Finance Katsunobu Kato said. “We need to carefully see how the exchange rate and other factors will be affected and what form US monetary policy will take in the future,” Kato said yesterday in an interview with Fuji Television. Japan is very concerned about how the tariffs might impact the global economy, he added. Kato spoke as nations and firms brace for potential repercussions after Trump unleashed the first salvo of

SUPPORT: The government said it would help firms deal with supply disruptions, after Trump signed orders imposing tariffs of 25 percent on imports from Canada and Mexico The government pledged to help companies with operations in Mexico, such as iPhone assembler Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), shift production lines and investment if needed to deal with higher US tariffs. The Ministry of Economic Affairs yesterday announced measures to help local firms cope with the US tariff increases on Canada, Mexico, China and other potential areas. The ministry said that it would establish an investment and trade service center in the US to help Taiwanese firms assess the investment environment in different US states, plan supply chain relocation strategies and