France beat out competition from Germany and the Netherlands for ProLogium Technology Co’s (輝能科技) first overseas vehicle-battery plant with lobbying from French President Emmanuel Macron, deal sweeteners and competitive power prices, executives from the Taiwanese company said.

After narrowing a list of countries down from 13 to three, ProLogium said it this week settled on the northern French port city of Dunkirk for its second gigafactory and first outside Taiwan.

With production slated to begin in 2026, the factory would be the fourth battery plant in northern France, adding to an emerging specialized cluster central to Europe’s electric-vehicle industry.

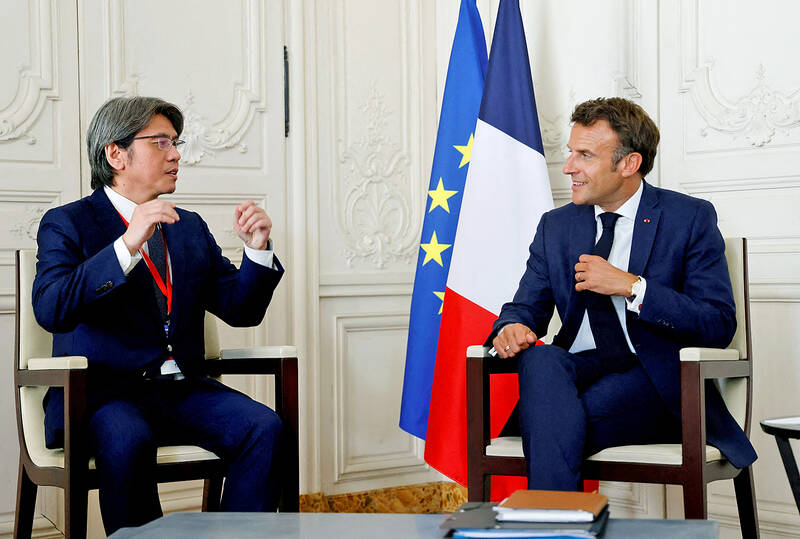

Photo: REUTERS

Europe largely depends on batteries made in Asia for electric vehicles, and national leaders are offering incentives to kickstart the industry.

That has become more urgent since the US last year passed its US$430 billion Inflation Reduction Act, which includes major tax subsidies to cut carbon emissions while boosting domestic production and manufacturing.

Macron, who met with ProLogium chief executive officer Vincent Yang (楊思枬) at the start of the vetting process, was yesterday due to officially announce the 5.2 billion euros (US$5.7 billion) investment in Dunkirk.

ProLogium executive vice president Gilles Normand said that after Macron, a former investment banker, pitched Yang more than a year ago, French Minister of Finance Bruno Le Maire followed up and helped make the company’s case with the European Commission for EU financial incentives.

“There was then the realization that there might be some interesting possibilities, which was maybe a little bit different from the cliches about France,” Normand told reporters.

ProLogium expects the project to create 3,000 jobs directly, and four times as many indirectly.

The emergence of an industrial cluster around the three battery plants already in the works was in itself an attraction, offering a critical mass of material suppliers and skilled workers, Normand said.

Also playing in France’s favor was its competitively priced zero-carbon electricity, produced by one of the biggest fleets of nuclear plants in the world, but also increasingly by offshore wind farms and solar.

Normand added that the government sweetened the deal with an incentives package, but could not give details while further subsidies were under review at the European Commission.

Macron’s government is eager to use the recent relaxation of EU state aid rules to offer tax breaks and other subsidies to encourage investment in green technologies.

He on Thursday announced that the government would offer a tax credit worth up to 40 percent of a company’s capital investment in wind, solar, heat-pump and battery projects.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors