Qisda Group (佳世達集團) on Thursday said it would invest NT$320 million (US$10.44 million) in Rapidtek Technologies Inc (鐳洋科技) as the companies aim to explore global business opportunities for low Earth orbit (LEO) satellites.

The group, led by electronics maker Qisda Corp (佳世達), has been developing its network communications business over the past few years, with a bullish outlook on the LEO satellite market in particular.

“Satellite signal coverage is not restricted by terrain constraints and represents a key battlefield for next-generation network communications,” the group said in a statement.

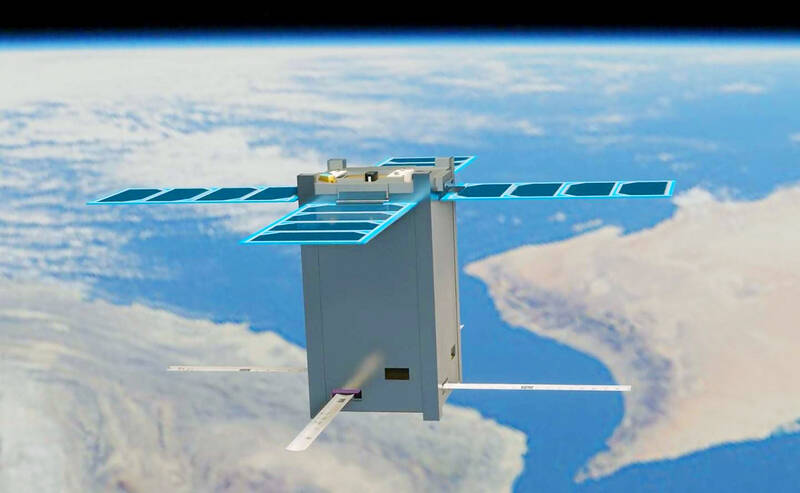

Photo courtesy of the National Applied Research Laboratories

Rapidtek, a New Taipei City-based company established in 2015, is mainly focused on antenna design and radio frequency testing.

“As Rapidtek is specialized in the design and research of key components of LEO satellites, Qisda Group’s investment in the company is expected to create strong synergy in product development and channel layout, as well as accelerate the mass production of satellite-related products and jointly develop the market,” the statement said.

LEO satellites operate at an altitude of 200km to 2,000km above the Earth’s surface.

According to Yuanta Securities Investment Consulting Co (元大投顧), the global market value of LEO satellites is expected to grow at a compound annual growth rate of 24 percent to US$11.3 billion by 2026, from US$3.11 billion in 2020, with ground-based equipment making up the lion’s share of the market at 50 percent, followed by satellite services at 44 percent.

Rapidtek said it is honored to have such a strong partner on board, and is looking forward to leveraging the strengths of both parties to explore global business opportunities in the LEO market.

The company in February launched a space industry research-and-development center in Taoyuan’s Cingpu District (青埔) in cooperation with National Central University. It was selected last year by the Taiwan Space Agency to implement several satellite and space components projects.

Meanwhile, Qisda Corp on Friday released its financial results for the first quarter, with operating margin hitting 15.8 percent, the highest in 10 years, the company said in a separate statement.

First-quarter revenue decreased 17.15 percent year-on-year to NT$50.45 billion and net profit dropped 39.4 percent to NT$324.04 million, due to non-operating expenses of NT$120.7 million, compared with non-operating gains of NT$241.49 million the previous year, it said.

Earnings per share were NT$0.16 in the January-to-March period, down from NT$0.27 a year earlier, Qisda said.

Qisda is scheduled to hold an online earnings conference today to further elaborate on the financial results of the first quarter and shed light on the outlook for the second quarter. The company is to hold its annual general meeting on May 29 and shareholders are to vote on the company's proposal of distributing a cash dividend of NT$2 per share this year.

In addition to Qisda Corp, which is focused on the information technology business, the Qisda Group also runs some value-added businesses in the medical, business solutions, and networking and communication sectors through its subsidiaries including BenQ Medical Technology Corp (明基三豐醫療器材), Metaage Corp (邁達特數位), DFI Inc (友通資訊), Aewin Technologies Co (其陽科技), Ace Pillar Co (羅昇企業) and Alpha Networks Inc (明泰科技).

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) would not produce its most advanced technologies in the US next year, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. Kuo made the comment during an appearance at the legislature, hours after the chipmaker announced that it would invest an additional US$100 billion to expand its manufacturing operations in the US. Asked by Taiwan People’s Party Legislator-at-large Chang Chi-kai (張啟楷) if TSMC would allow its most advanced technologies, the yet-to-be-released 2-nanometer and 1.6-nanometer processes, to go to the US in the near term, Kuo denied it. TSMC recently opened its first US factory, which produces 4-nanometer

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

REACTIONS: While most analysts were positive about TSMC’s investment, one said the US expansion could disrupt the company’s supply-demand balance Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) new US$100 billion investment in the US would exert a positive effect on the chipmaker’s revenue in the medium term on the back of booming artificial intelligence (AI) chip demand from US chip designers, an International Data Corp (IDC) analyst said yesterday. “This is good for TSMC in terms of business expansion, as its major clients for advanced chips are US chip designers,” IDC senior semiconductor research manager Galen Zeng (曾冠瑋) said by telephone yesterday. “Besides, those US companies all consider supply chain resilience a business imperative,” Zeng said. That meant local supply would

Servers that might contain artificial intelligence (AI)-powering Nvidia Corp chips shipped from the US to Singapore ended up in Malaysia, but their actual final destination remains a mystery, Singaporean Minister for Home Affairs and Law K Shanmugam said yesterday. The US is cracking down on exports of advanced semiconductors to China, seeking to retain a competitive edge over the technology. However, Bloomberg News reported in late January that US officials were probing whether Chinese AI firm DeepSeek (深度求索) bought advanced Nvidia semiconductors through third parties in Singapore, skirting Washington’s restrictions. Shanmugam said the route of the chips emerged in the course of an