US businesses might be able to secure bank deposit insurance for accounts holding more than US$250,000 if the US Congress agrees with Federal Deposit Insurance Corp’s (FDIC) proposal to ease the industry turmoil that has sparked three bank failures in the past two months.

The FDIC recommended the change on Monday, rethinking the decades-old limit and seeking more flexibility to cover higher deposits on a “targeted” basis.

Raising the insurance limit for business accounts that pay for company operations such as payroll would shore up accounts that pose the most risk to financial stability, the FDIC said.

The proposed change appears to openly acknowledge that the FDIC is looking for ways to calm depositors and markets as the agency contends with the third bank run this year.

First Republic Bank became the second largest failure in history on Monday when regulators seized it and JPMorgan Chase & Co stepped up as a buyer.

“The recent failures of Silicon Valley Bank and Signature Bank, and the decision to approve Systemic Risk Exceptions to protect the uninsured depositors at those institutions, raised fundamental questions about the role of deposit insurance in the United States banking system,” FDIC Chairman Martin J. Gruenberg wrote in a statement accompanying the regulator’s recommendations.

As of December last year, more than 99 percent of US deposit accounts held less than US$250,000, and so were automatically covered by existing FDIC insurance, Gruenberg said.

However, the system remains subject to the sort of bank runs that brought down First Republic, despite a consortium of big lenders having pooled US$30 billion in cash to stabilize the bank as recently as March.

US Representative Patrick McHenry, who leads the US House of Representatives Financial Services Committee, issued a statement on Monday saying that the FDIC “used its available tools to resolve First Republic Bank,” but he did not immediately address the agency’s recommendations for change.

In seeking additional powers to insure business accounts, the FDIC said technological advances hasten the speed of information and let depositors quickly take their money elsewhere at the first sign of trouble.

Both factors can spur “faster, and more costly, bank runs,” the agency said.

However, insuring more deposits doesn’t come without a downside. Deposit insurance can encourage banks to take on greater risk if they know their deposits are covered.

Targeted coverage to protect businesses would be the most cost effective way for regulators to meet their stability objectives, Gruenberg said.

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

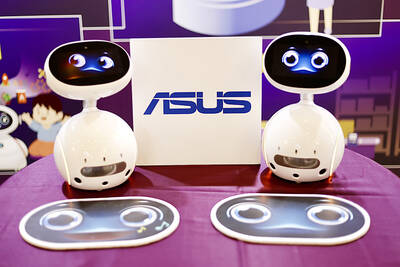

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would