JPMorgan Chase Bank NA is to take over all deposits and most of the assets of troubled First Republic Bank, the US Federal Deposit Insurance Corp (FDIC) said early yesterday.

California regulators closed First Republic and appointed the FDIC as receiver, it said in a statement.

JPMorgan Chase is to assume “all of the deposits and substantially all of the assets of First Republic Bank,” it said.

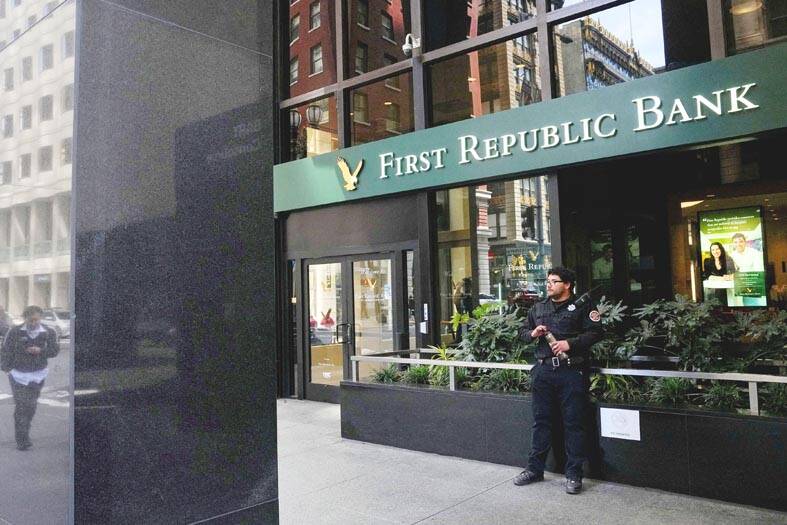

Photo: Reuters

First Republic Bank’s 84 branches in eight states were yesterday to reopen as branches of JPMorgan Chase Bank.

Regulators had been working to find a way forward before US stock markets opened yesterday.

San Francisco-based First Republic has struggled since the collapses of Silicon Valley Bank and Signature Bank in early March. They added to worries that the bank might not survive as an independent entity for much longer.

Shares in First Republic closed at US$3.51 on Friday, a fraction of the about US$170 a share it traded for a year earlier. It fell further in afterhours trading.

The bank reported total assets of US$233 billion as of March 31. At the end of last year, the US Federal Reserve ranked First Republic 14th in size among US commercial banks.

Before Silicon Valley Bank failed, First Republic had a banking franchise that was the envy of most of the industry.

Its clients — mostly the rich and powerful — rarely defaulted on their loans. The bank has made much of its money making low-cost loans to the rich, which reportedly included Meta Platforms Inc CEO Mark Zuckerberg.

Flush with deposits from the well-heeled, First Republic saw total assets more than double from US$102 billion at the end of first quarter in 2019, when its full-time workforce was 4,600.

The vast majority of First Republic’s deposits, like those in Silicon Valley and Signature Bank, were uninsured — that is, above the US$250,000 limit set by the FDIC.

That made analysts and investors worried. If First Republic were to fail, its depositors might not get all their money back.

Those fears were crystalized in the bank’s recent quarterly results.

It said that depositors pulled more than US$100 billion out of the bank during last month’s crisis.

First Republic said that it was only able to stanch the bleeding after a group of large banks stepped in to save it with US$30 billion in uninsured deposits.

Now First Republic is in need of a bigger fix.

“Getting the bank in the hands of a larger one is the best possible economic outcome,” said Steven Kelly, a researcher at the Yale School of Management Program on Financial Stability. “First Republic has lots of knowledge about its customers and has been a profitable bank for its entire history — but its business model is not stable. It needs a big bank balance sheet behind it.”

Kelly said that other options, such as government control or continuing to try to survive on its own, would see its value continue to disappear, along with credit and economic growth.

“A successful absorption into a big bank would provide a proper, stable home for the firm to continue to provide its value proposition to the economy,” Kelly said.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

WARNING SHOT: The US president has threatened to impose 25 percent tariffs on all imported vehicles, and similar or higher duties on pharmaceuticals and semiconductors US President Donald Trump on Wednesday suggested that a trade deal with China was “possible” — a key target in the US leader’s tariffs policy. The US in 2020 had already agreed to “a great trade deal with China” and a new deal was “possible,” Trump said. Trump said he expected Chinese President Xi Jinping (習近平) to visit the US, without giving a timeline for his trip. Trump also said that he was talking to China about TikTok, as the US seeks to broker a sale of the popular app owned by Chinese firm ByteDance Ltd (字節跳動). Trump last week said that he had

STRUGGLING TO SURVIVE: The group is proposing a consortium of investors, with Tesla as the largest backer, and possibly a minority investment by Hon Hai Precision Nissan Motor Co shares jumped after the Financial Times reported that a high-level Japanese group has drawn up plans to seek investment from Elon Musk’s Tesla Inc to aid the struggling automaker. The group believes the electric vehicle (EV) maker is interested in acquiring Nissan’s plants in the US, the newspaper reported, citing people it did not identify. The proposal envisions a consortium of investors, with Tesla as the largest backer, but also includes the possibility of a minority investment by Hon Hai Precision Industry Co (鴻海精密) to prevent a full takeover by the Apple supplier, the report said. The group is